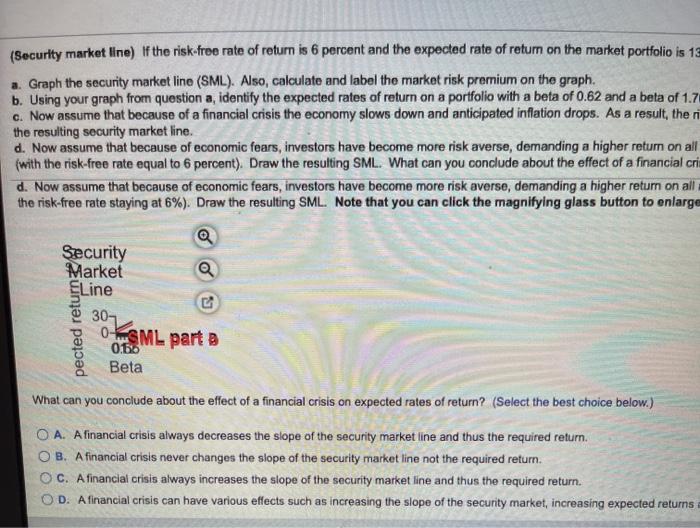

(Security market line) If the risk-free rate of return is 6 percent and the expected rate of return on the market portfolio is 13 percent. a. Graph the security market line (SML). Also, calculate and label the market risk premium on the graph. b. Using your graph from question a, identify the expected rates of return on a portfolio with a beta of 0.62 and a beta of 1.70, respectively. c. Now assume that because of a financial crisis the economy slows down and anticipated inflation drops. As a result, the risk-free rate of return drops to 1 percent and the expected rate of return on the market portfolio drops to 8 percent. Draw the resulting security market line. d. Now assume that because of economic fears, investors have become more risk averse, demanding a higher return on all assets that have any risk. This results in an increase in the expected rate of return on the market portfolio to 16 percent (with the risk-free rate equal to 6 percent). Draw the resulting SML. What can you conclude about the effect of a financial crisis on expected rates of retur? a. Assume the risk-free rate is 6 percent and the expected return on the market portfolio is 13 percent. The market risk premium is 0% (Round to the nearest percent.) Draw the security market line on the graph below. Note that you can click the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the palette to draw the line Commenti Click the graph, choose a tool in the palette and follow the instructions to create your graph. 23 28 W P (Security market line) if the risk-free rate of return is 6 percent and the expected rate of return on the market portfolio is 13 percent. a. Graph the security market line (SML). Also, calculate and label the market risk premium on the graph. b. Using your graph from question a, identify the expected rates of return on a portfolio with a beta of 0.62 and a beta of 1.70, respectively, c. Now assume that because of a financial crisis the economy slows down and anticipated inflation drops. As a result, the risk-free rate of return drops to 1 percent and the expected rate of return on the market portfolio drops to 8 percent. Draw the resulting security market line. d. Now assume that because of economic fears, investors have become more risk averse, demanding a higher return on all assets that have any risk. This results in an increase in the expected rate of return on the market portfolio to 16 percent (with the risk-free rate equal to 6 percent). Draw the resulting SML. What can you conclude about the effect of a financial crisis on expected rates of return? b. Using your graph from question a, the expected rates of return on a portfolio with a beta of 0.62 is (1%. (Round to the nearest whole number.) Using your graph from question a, the expected rates of return on a portfolio with a beta of 1.70 is %. (Round to the nearest whole number.) c. Now assume that because of a financial crisis the economy slows down and anticipated inflation drops. As a result, the risk-free rate of return drops to 1% and the expected rate of return on the market portfolio drops to 8% Draw the resulting security market fine. Note that you can click Click the graph, choose a tool in the palette and follow the instructions to create your graph. 21 28 W A MacBook esc 20 Doa FI F2 F3 F4 GA % (Security market line) If the risk-free rate of return is 6 percent and the expected rate of return on the market portfolio is 15 a. Graph the security market line (SML). Also, calculate and label the market risk premium on the graph. b. Using your graph from question a, identify the expected rates of return on a portfolio with a beta of 0.62 and a beta of 1.7 c. Now assume that because of a financial crisis the economy slows down and anticipated inflation drops. As a result, then the resulting security market line. d. Now assume that because of economic fears, investors have become more risk averse, demanding a higher return on all (with the risk-free rate equal to 6 percent). Draw the resulting SML. What can you conclude about the effect of a financial crin d. Now assume that because of economic fears, investors have become more risk averse, demanding a higher return on all the risk-free rate staying at 6%). Draw the resulting SML. Note that you can click the magnifying glass button to enlarge a Security Market Line 30 pected return 0 ML parte 0.16 Beta What can you conclude about the effect of a financial crisis on expected rates of return? (Select the best choice below.) OA. A financial crisis always decreases the slope of the security market line and thus the required return. OB. A financial crisis never changes the slope of the security market line not the required return. C. A financial crisis always increases the slope of the security market line and thus the required return. D. A financial crisis can have various effects such as increasing the slope of the security market, increasing expected returns