Answered step by step

Verified Expert Solution

Question

1 Approved Answer

see attached image 1 . An investor, who purchased 1 1 percent of the preferred class of stock during the initial private offering, has been

see attached image

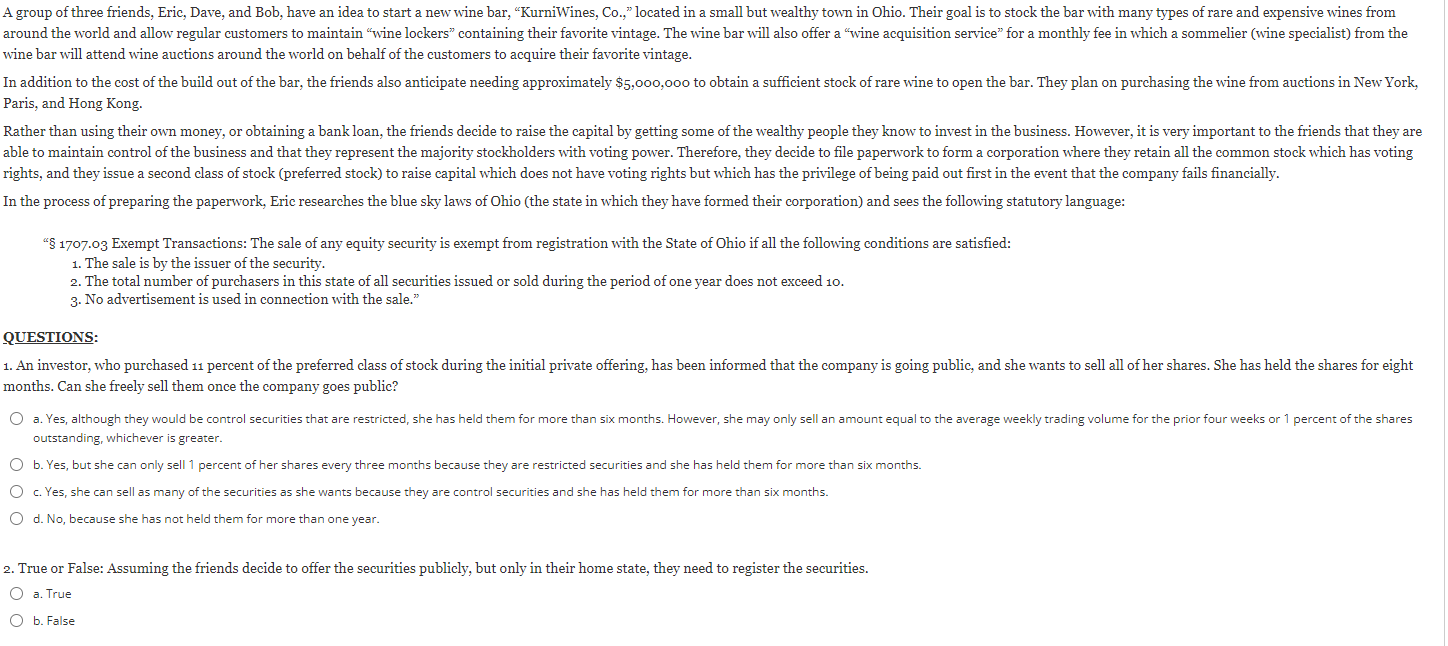

An investor, who purchased percent of the preferred class of stock during the initial private offering, has been informed that the company is going public, and she wants to sell all of her shares. She has held the shares for eight months. Can she freely sell them once the company goes public?

True or False: Assuming the friends decide to offer the securities publicly, but only in their home state, they need to register the securities

What other regulation, besides Regulation D should the friends consider to raise $ million within one year?

Assume that the wine bar is a huge success and in five years from the initial private offering the company would like to go public. As part of their public offering, one of the initial investors from the private offering decides to sell his shares. Does this stock need to be registered under the Securities Act?

Assume that in the process of making a private offering under Regulation D one of the friends sends and email to a potential investor while he is on vacation out of state. It reads, In order to address your concerns about the potential purchase of highend fake wines at auction, we will employ a forgery expert to attend all auctions with our sommelier to authenticate each bottle prior to purchase. However, the three friends had previously agreed that sending an authentication expert to all the auctions would be costly and therefore they would rather spend the money in other areas. Is the friend liable under the Act if no expert attends the auctions and the sommelier purchases fake wines?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started