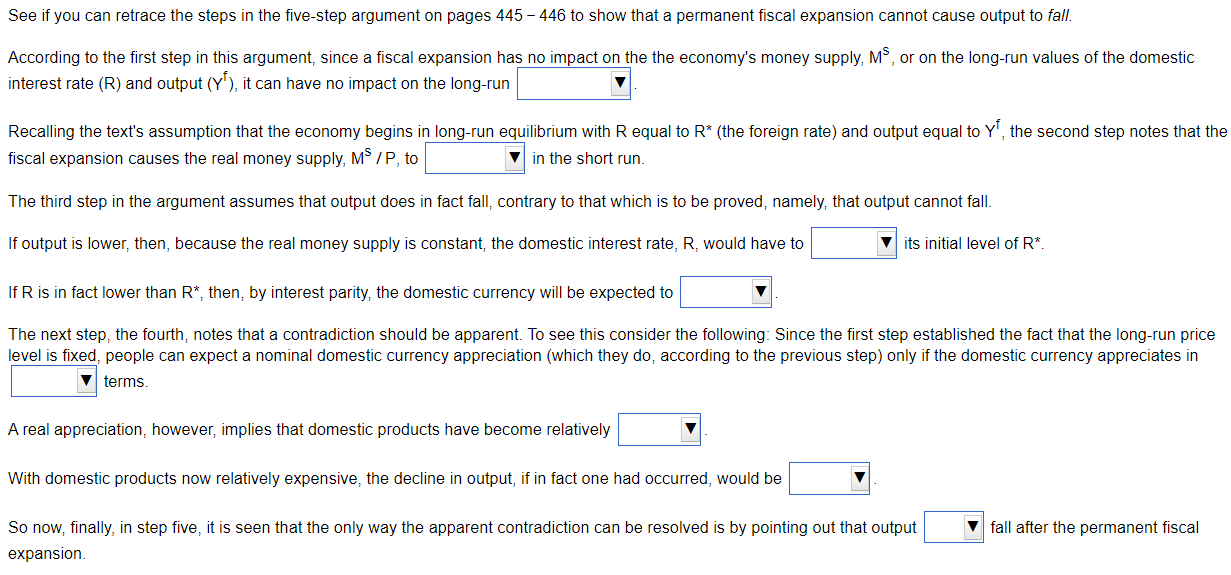

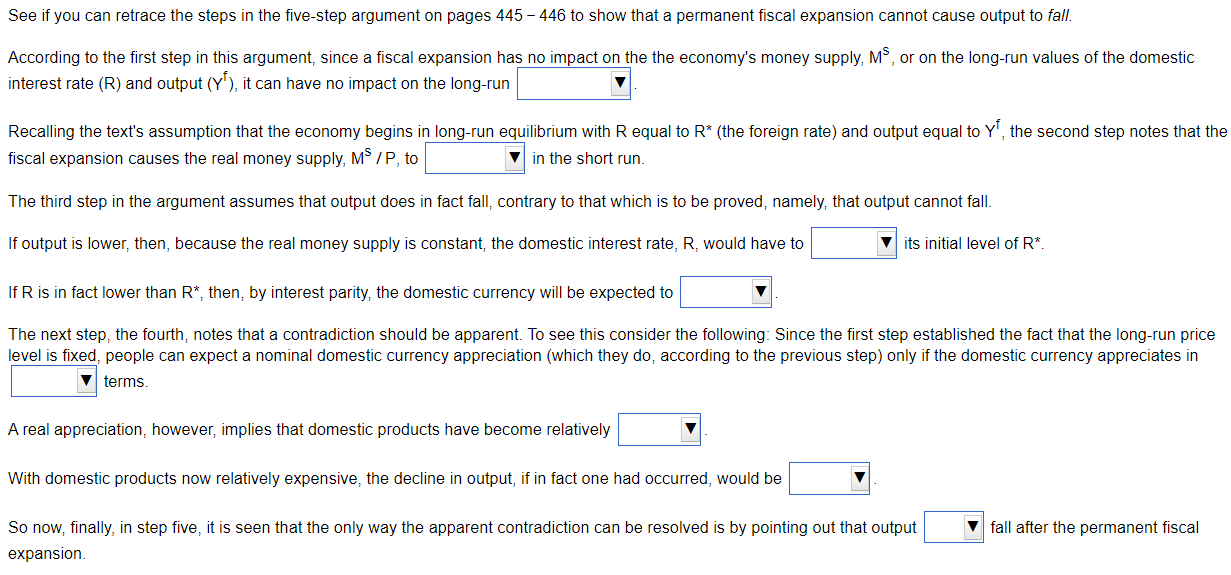

See if you can retrace the steps in the five-step argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fall. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, MS, or on the long-run values of the domestic interest rate (R) and output (YP), it can have no impact on the long-run Recalling the text's assumption that the economy begins in long-run equilibrium with R equal to R* (the foreign rate) and output equal to Yf, the second step notes that the fiscal expansion causes the real money supply, MS/P, to in the short run The third step in the argument assumes that output does in fact fall, contrary to that which is to be proved, namely, that output cannot fall. If output is lower, then, because the real money supply is constant, the domestic interest rate, R, would have to its initial level of R*. 7 If R is in fact lower than R*, then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency appreciates in terms. A real appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, if in fact one had occurred, would be So now, finally, in step five, it is seen that the only way the apparent contradiction can be resolved is by pointing out that output expansion vfall after the permanent fiscal See if you can retrace the steps in the five-step argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fall. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, MS, or on the long-run values of the domestic interest rate (R) and output (YP), it can have no impact on the long-run Recalling the text's assumption that the economy begins in long-run equilibrium with R equal to R* (the foreign rate) and output equal to Yf, the second step notes that the fiscal expansion causes the real money supply, MS/P, to in the short run The third step in the argument assumes that output does in fact fall, contrary to that which is to be proved, namely, that output cannot fall. If output is lower, then, because the real money supply is constant, the domestic interest rate, R, would have to its initial level of R*. 7 If R is in fact lower than R*, then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency appreciates in terms. A real appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, if in fact one had occurred, would be So now, finally, in step five, it is seen that the only way the apparent contradiction can be resolved is by pointing out that output expansion vfall after the permanent fiscal