Answered step by step

Verified Expert Solution

Question

1 Approved Answer

See Q 1-4 below Oil and Gas Taxation- may need to google revenue rulings or tax law cases - of the oil and gas on

See Q 1-4 below Oil and Gas Taxation- may need to google revenue rulings or tax law cases -

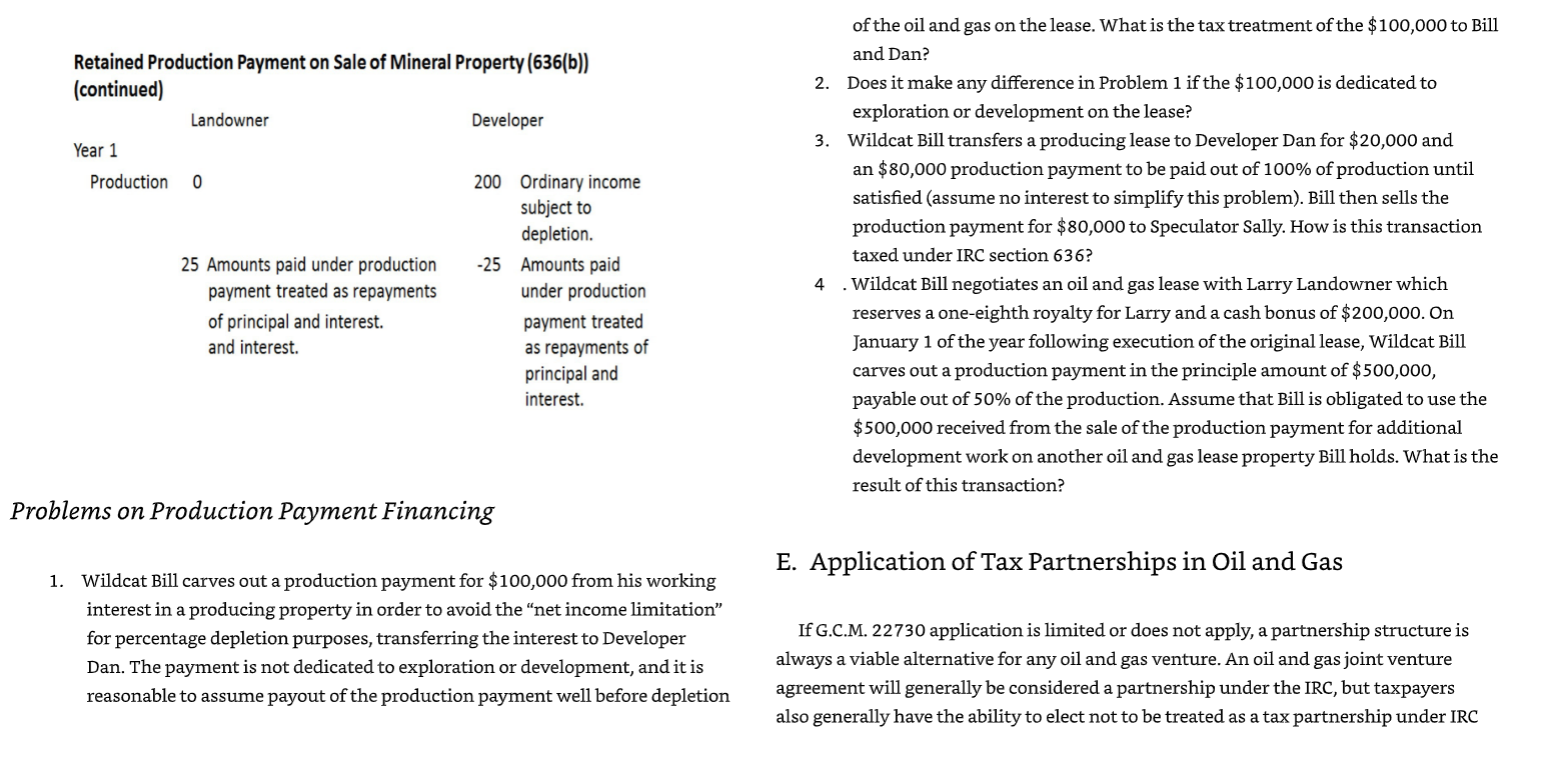

of the oil and gas on the lease. What is the tax treatment of the $100,000 to Bill and Dan? 2. Does it make any difference in Problem 1 if the $100,000 is dedicated to exploration or development on the lease? 3. Wildcat Bill transfers a producing lease to Developer Dan for $20,000 and an $80,000 production payment to be paid out of 100% of production until satisfied (assume no interest to simplify this problem). Bill then sells the production payment for $80,000 to Speculator Sally. How is this transaction taxed under IRC section 636 ? 4 . Wildcat Bill negotiates an oil and gas lease with Larry Landowner which reserves a one-eighth royalty for Larry and a cash bonus of $200,000. On January 1 of the year following execution of the original lease, Wildcat Bill carves out a production payment in the principle amount of $500,000, payable out of 50% of the production. Assume that Bill is obligated to use the $500,000 received from the sale of the production payment for additional development work on another oil and gas lease property Bill holds. What is the result of this transaction? roblems on Production Payment Financing 1. Wildcat Bill carves out a production payment for $100,000 from his working interest in a producing property in order to avoid the "net income limitation" for percentage depletion purposes, transferring the interest to Developer Dan. The payment is not dedicated to exploration or development, and it is reasonable to assume payout of the production payment well before depletion E. Application of Tax Partnerships in Oil and Gas If G.C.M. 22730 application is limited or does not apply, a partnership structure is always a viable alternative for any oil and gas venture. An oil and gas joint venture agreement will generally be considered a partnership under the IRC, but taxpayers also generally have the ability to elect not to be treated as a tax partnership under IRC

of the oil and gas on the lease. What is the tax treatment of the $100,000 to Bill and Dan? 2. Does it make any difference in Problem 1 if the $100,000 is dedicated to exploration or development on the lease? 3. Wildcat Bill transfers a producing lease to Developer Dan for $20,000 and an $80,000 production payment to be paid out of 100% of production until satisfied (assume no interest to simplify this problem). Bill then sells the production payment for $80,000 to Speculator Sally. How is this transaction taxed under IRC section 636 ? 4 . Wildcat Bill negotiates an oil and gas lease with Larry Landowner which reserves a one-eighth royalty for Larry and a cash bonus of $200,000. On January 1 of the year following execution of the original lease, Wildcat Bill carves out a production payment in the principle amount of $500,000, payable out of 50% of the production. Assume that Bill is obligated to use the $500,000 received from the sale of the production payment for additional development work on another oil and gas lease property Bill holds. What is the result of this transaction? roblems on Production Payment Financing 1. Wildcat Bill carves out a production payment for $100,000 from his working interest in a producing property in order to avoid the "net income limitation" for percentage depletion purposes, transferring the interest to Developer Dan. The payment is not dedicated to exploration or development, and it is reasonable to assume payout of the production payment well before depletion E. Application of Tax Partnerships in Oil and Gas If G.C.M. 22730 application is limited or does not apply, a partnership structure is always a viable alternative for any oil and gas venture. An oil and gas joint venture agreement will generally be considered a partnership under the IRC, but taxpayers also generally have the ability to elect not to be treated as a tax partnership under IRC Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started