Answered step by step

Verified Expert Solution

Question

1 Approved Answer

see q 1-6 below Oil and gas taxation - may need to google revenue rulings or tax cases to solve operating interest to be reduced

see q 1-6 below Oil and gas taxation - may need to google revenue rulings or tax cases to solve

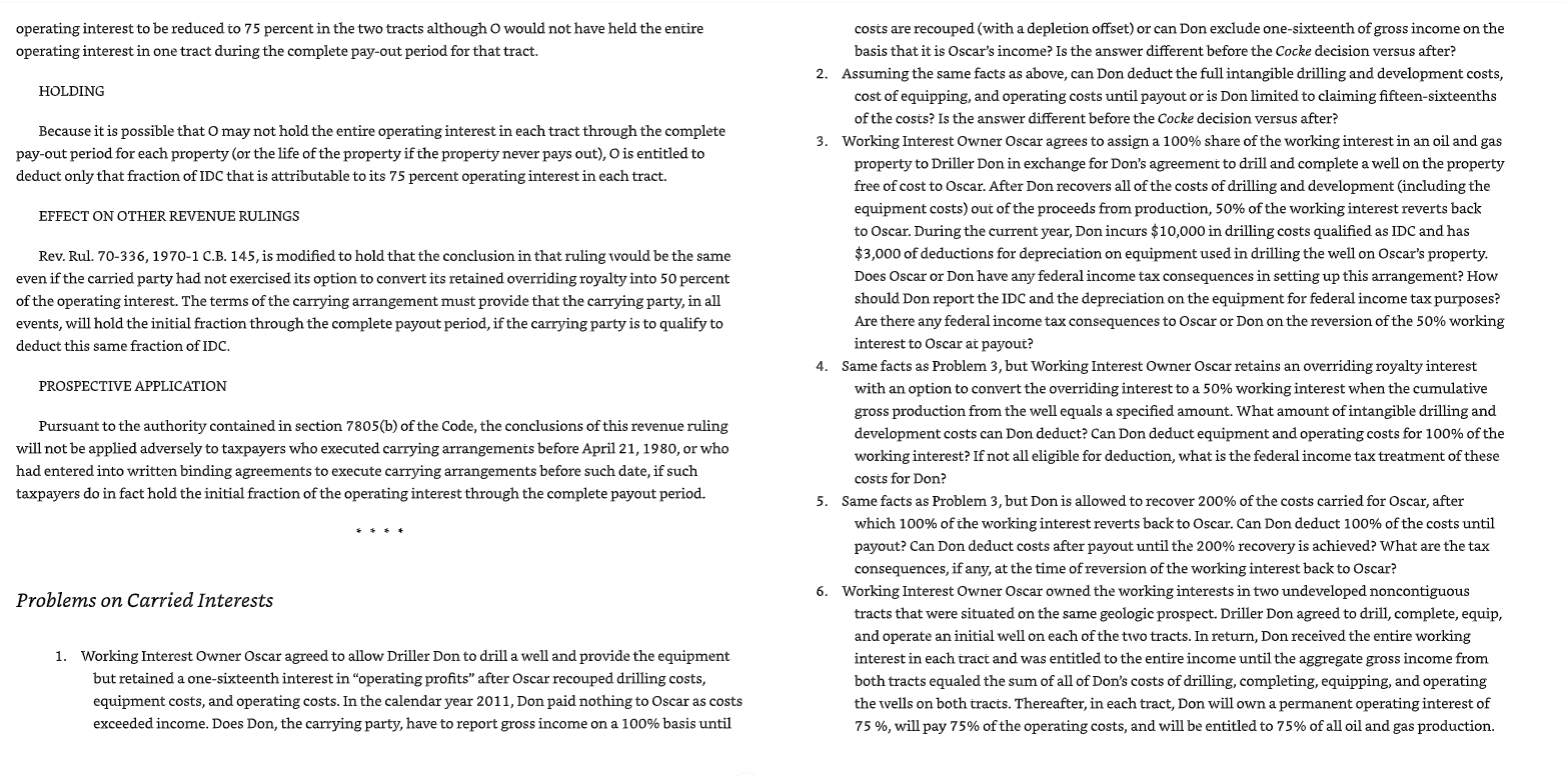

operating interest to be reduced to 75 percent in the two tracts although O would not have held the entire operating interest in one tract during the complete pay-out period for that tract. HOLDING Because it is possible that O may not hold the entire operating interest in each tract through the complete pay-out period for each property (or the life of the property if the property never pays out), O is entitled to deduct only that fraction of IDC that is attributable to its 75 percent operating interest in each tract. EFFECT ON OTHER REVENUE RULINGS Rev. Rul. 70-336, 1970-1 C.B. 145 , is modified to hold that the conclusion in that ruling vould be the same even if the carried party had not exercised its option to convert its retained overriding royalty into 50 percent of the operating interest. The terms of the carrying arrangement must provide that the carrying party, in all events, will hold the initial fraction through the complete payout period, if the carrying party is to qualify to deduct this same fraction of IDC. PROSPECTIVE APPLICATION Pursuant to the authority contained in section 7805 (b) of the Code, the conclusions of this revenue ruling will not be applied adversely to taxpayers who executed carrying arrangements before April 21, 1980, or who had entered into written binding agreements to execute carrying arrangements before such date, if such taxpayers do in fact hold the initial fraction of the operating interest through the complete payout period. Problems on Carried Interests 1. Working Interest Owner Oscar agreed to allow Driller Don to drill a well and provide the equipment but retained a one-sixteenth interest in "operating profits" after Oscar recouped drilling costs, equipment costs, and operating costs. In the calendar year 2011, Don paid nothing to Oscar as costs exceeded income. Does Don, the carrying party, have to report gross income on a 100% basis until costs are recouped (with a depletion offset) or can Don exclude one-sixteenth of gross income on the basis that it is Oscar's income? Is the answer different before the Cocke decision versus after? 2. Assuming the same facts as above, can Don deduct the full intangible drilling and development costs, cost of equipping, and operating costs until payout or is Don limited to claiming fifteen-sixteenths of the costs? Is the answer different before the Cocke decision versus after? 3. Working Interest Owner Oscar agrees to assign a 100\% share of the working interest in an oil and gas property to Driller Don in exchange for Don's agreement to drill and complete a well on the property free of cost to Oscar. After Don recovers all of the costs of drilling and development (including the equipment costs) out of the proceeds from production, 50% of the working interest reverts back to Oscar. During the current year, Don incurs $10,000 in drilling costs qualified as IDC and has $3,000 of deductions for depreciation on equipment used in drilling the well on Oscar's property. Does Oscar or Don have any federal income tax consequences in setting up this arrangement? How should Don report the IDC and the depreciation on the equipment for federal income tax purposes? Are there any federal income tax consequences to Oscar or Don on the reversion of the 50% working interest to Oscar at payout? 4. Same facts as Problem 3, but Working Interest Owner Oscar retains an overriding royalty interest with an option to convert the overriding interest to a 50% working interest when the cumulative gross production from the well equals a specified amount. What amount of intangible drilling and development costs can Don deduct? Can Don deduct equipment and operating costs for 100% of the working interest? If not all eligible for deduction, what is the federal income tax treatment of these costs for Don? 5. Same facts as Problem 3, but Don is allowed to recover 200% of the costs carried for Oscar, after which 100% of the working interest reverts back to Oscar. Can Don deduct 100% of the costs until payout? Can Don deduct costs after payout until the 200% recovery is achieved? What are the tax consequences, if any, at the time of reversion of the working interest back to Oscar? 6. Working Interest Owner Oscar owned the working interests in two undeveloped noncontiguous tracts that were situated on the same geologic prospect. Driller Don agreed to drill, complete, equip, and operate an initial well on each of the trvo tracts. In return, Don received the entire working interest in each tract and was entitled to the entire income until the aggregate gross income from both tracts equaled the sum of all of Don's costs of drilling, completing, equipping, and operating the ivells on both tracts. Thereafter, in each tract, Don will own a permanent operating interest of 75%, will pay 75% of the operating costs, and will be entitled to 75% of all oil and gas production

operating interest to be reduced to 75 percent in the two tracts although O would not have held the entire operating interest in one tract during the complete pay-out period for that tract. HOLDING Because it is possible that O may not hold the entire operating interest in each tract through the complete pay-out period for each property (or the life of the property if the property never pays out), O is entitled to deduct only that fraction of IDC that is attributable to its 75 percent operating interest in each tract. EFFECT ON OTHER REVENUE RULINGS Rev. Rul. 70-336, 1970-1 C.B. 145 , is modified to hold that the conclusion in that ruling vould be the same even if the carried party had not exercised its option to convert its retained overriding royalty into 50 percent of the operating interest. The terms of the carrying arrangement must provide that the carrying party, in all events, will hold the initial fraction through the complete payout period, if the carrying party is to qualify to deduct this same fraction of IDC. PROSPECTIVE APPLICATION Pursuant to the authority contained in section 7805 (b) of the Code, the conclusions of this revenue ruling will not be applied adversely to taxpayers who executed carrying arrangements before April 21, 1980, or who had entered into written binding agreements to execute carrying arrangements before such date, if such taxpayers do in fact hold the initial fraction of the operating interest through the complete payout period. Problems on Carried Interests 1. Working Interest Owner Oscar agreed to allow Driller Don to drill a well and provide the equipment but retained a one-sixteenth interest in "operating profits" after Oscar recouped drilling costs, equipment costs, and operating costs. In the calendar year 2011, Don paid nothing to Oscar as costs exceeded income. Does Don, the carrying party, have to report gross income on a 100% basis until costs are recouped (with a depletion offset) or can Don exclude one-sixteenth of gross income on the basis that it is Oscar's income? Is the answer different before the Cocke decision versus after? 2. Assuming the same facts as above, can Don deduct the full intangible drilling and development costs, cost of equipping, and operating costs until payout or is Don limited to claiming fifteen-sixteenths of the costs? Is the answer different before the Cocke decision versus after? 3. Working Interest Owner Oscar agrees to assign a 100\% share of the working interest in an oil and gas property to Driller Don in exchange for Don's agreement to drill and complete a well on the property free of cost to Oscar. After Don recovers all of the costs of drilling and development (including the equipment costs) out of the proceeds from production, 50% of the working interest reverts back to Oscar. During the current year, Don incurs $10,000 in drilling costs qualified as IDC and has $3,000 of deductions for depreciation on equipment used in drilling the well on Oscar's property. Does Oscar or Don have any federal income tax consequences in setting up this arrangement? How should Don report the IDC and the depreciation on the equipment for federal income tax purposes? Are there any federal income tax consequences to Oscar or Don on the reversion of the 50% working interest to Oscar at payout? 4. Same facts as Problem 3, but Working Interest Owner Oscar retains an overriding royalty interest with an option to convert the overriding interest to a 50% working interest when the cumulative gross production from the well equals a specified amount. What amount of intangible drilling and development costs can Don deduct? Can Don deduct equipment and operating costs for 100% of the working interest? If not all eligible for deduction, what is the federal income tax treatment of these costs for Don? 5. Same facts as Problem 3, but Don is allowed to recover 200% of the costs carried for Oscar, after which 100% of the working interest reverts back to Oscar. Can Don deduct 100% of the costs until payout? Can Don deduct costs after payout until the 200% recovery is achieved? What are the tax consequences, if any, at the time of reversion of the working interest back to Oscar? 6. Working Interest Owner Oscar owned the working interests in two undeveloped noncontiguous tracts that were situated on the same geologic prospect. Driller Don agreed to drill, complete, equip, and operate an initial well on each of the trvo tracts. In return, Don received the entire working interest in each tract and was entitled to the entire income until the aggregate gross income from both tracts equaled the sum of all of Don's costs of drilling, completing, equipping, and operating the ivells on both tracts. Thereafter, in each tract, Don will own a permanent operating interest of 75%, will pay 75% of the operating costs, and will be entitled to 75% of all oil and gas production Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started