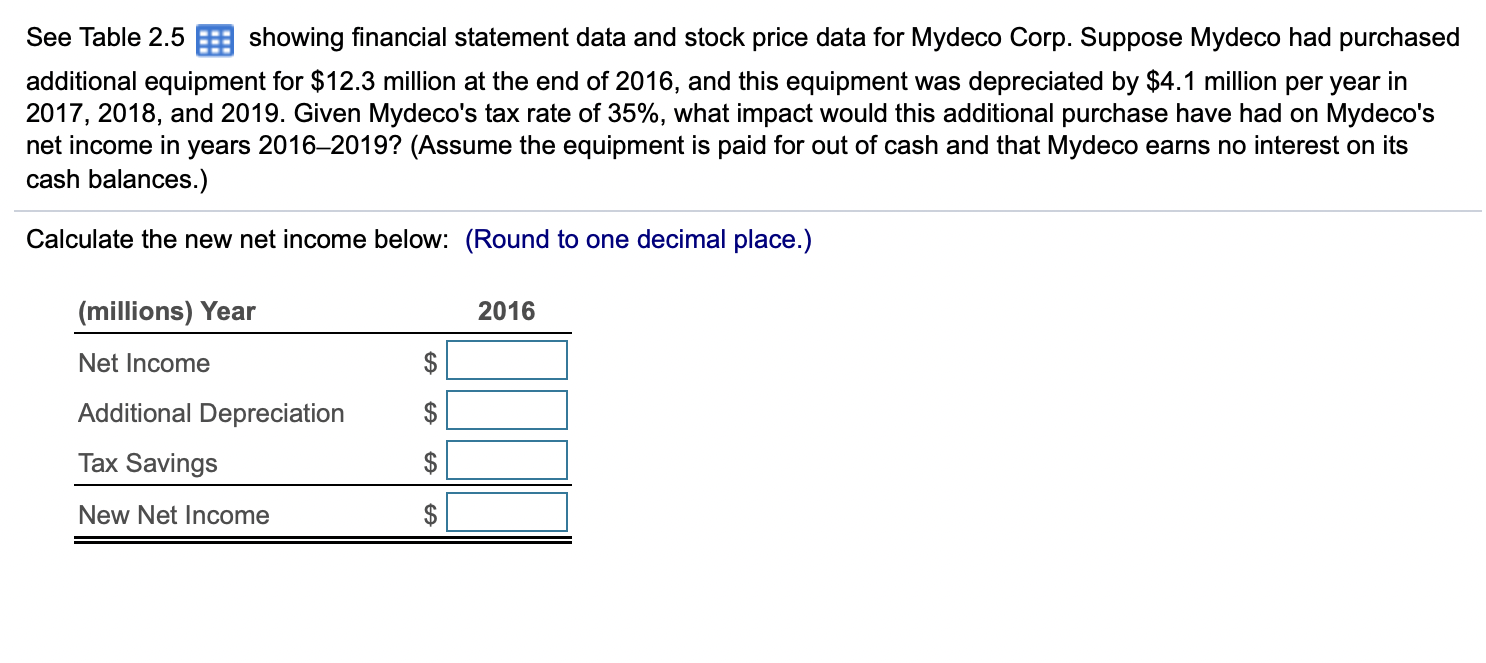

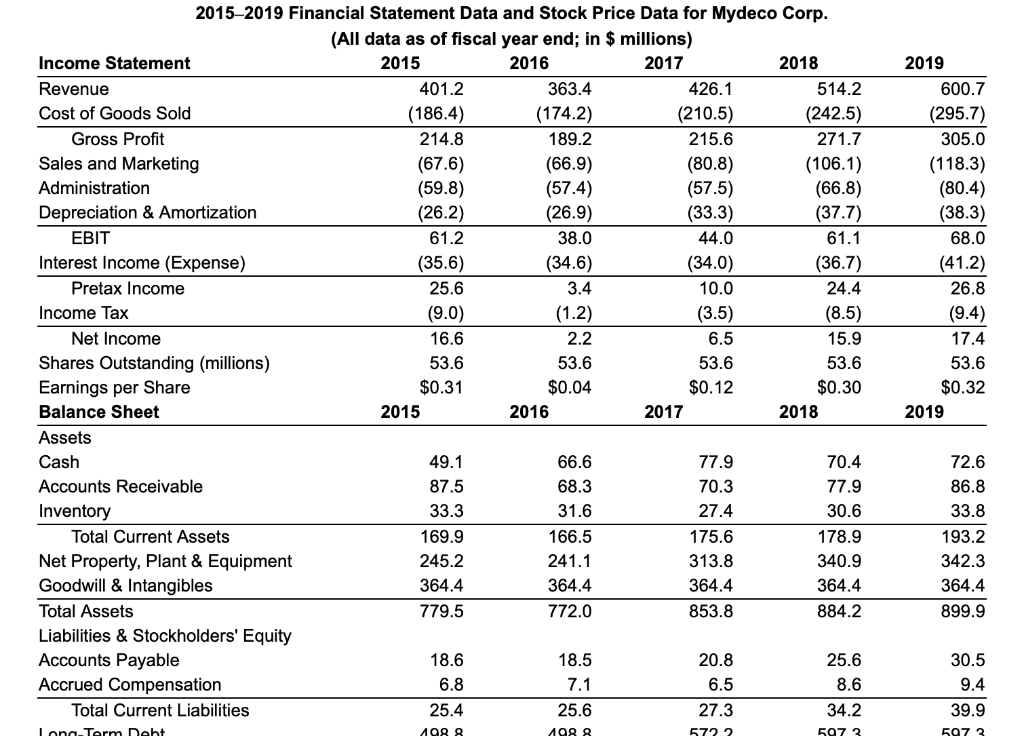

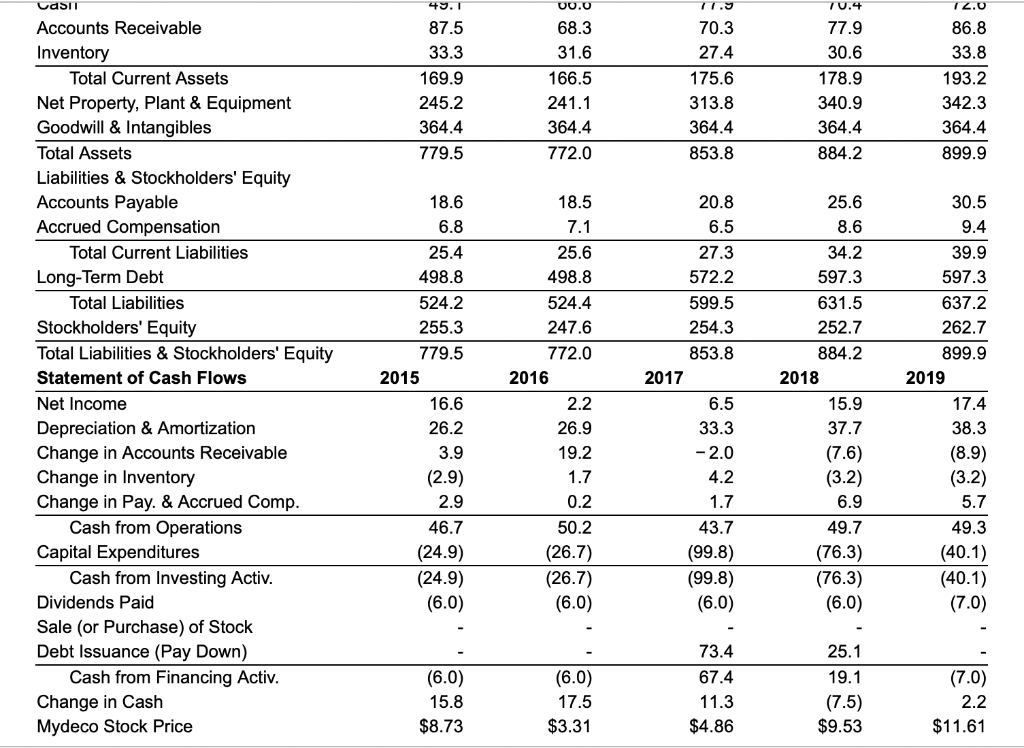

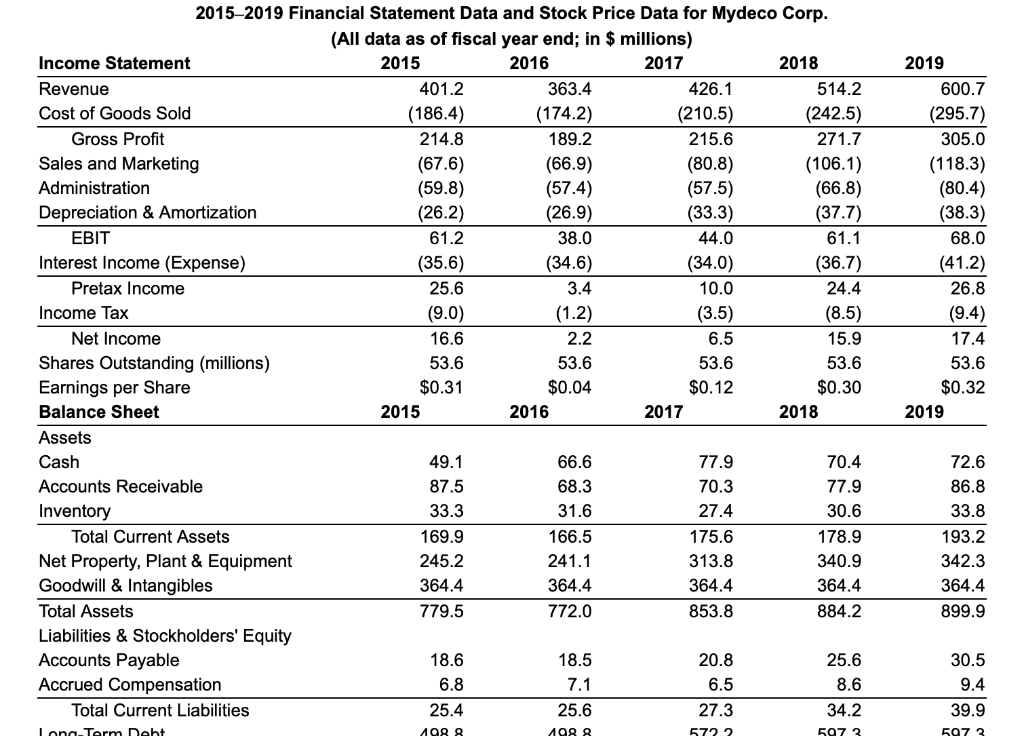

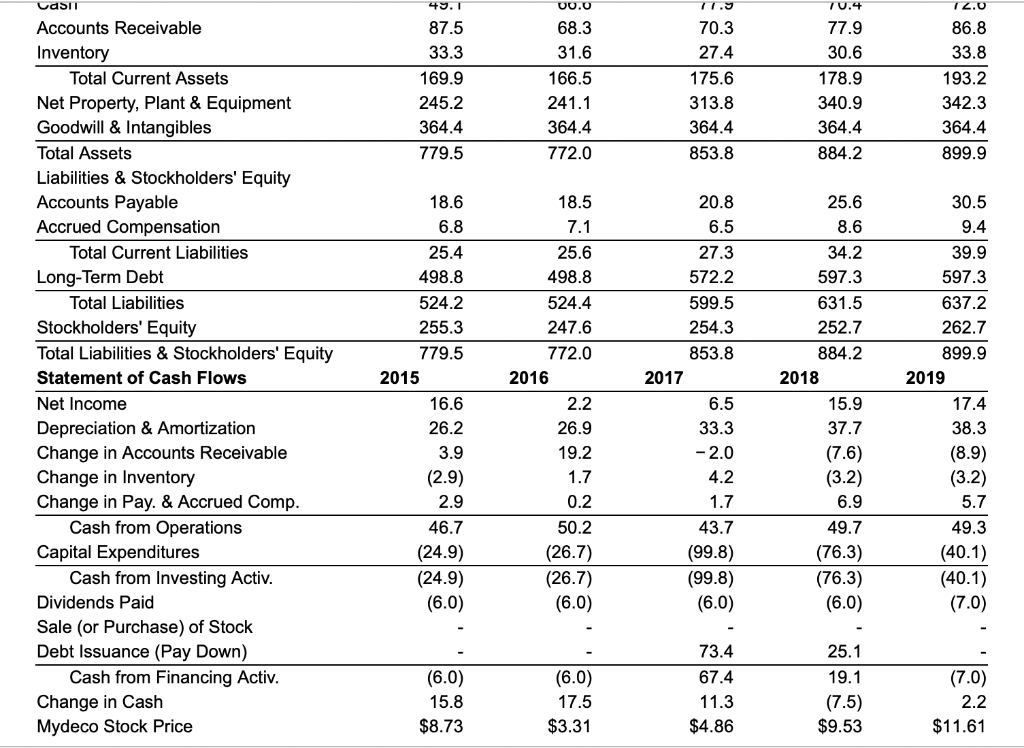

See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco had purchased additional equipment for $12.3 million at the end of 2016, and this equipment was depreciated by $4.1 million per year in 2017, 2018, and 2019. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydeco's net income in years 2016-2019? (Assume the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances.) Calculate the new net income below: (Round to one decimal place.) (millions) Year 2016 Net Income $ Additional Depreciation $ Savings $ New Net Income $ 2015-2019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) Income Statement 2015 2016 2017 2018 Revenue 401.2 363.4 426.1 514.2 Cost of Goods Sold (186.4) (174.2) (210.5) (242.5) Gross Profit 214.8 189.2 215.6 271.7 Sales and Marketing (67.6) (66.9) (80.8) (106.1) Administration (59.8) (57.4) (57.5) (66.8) Depreciation & Amortization (26.2) (26.9) (33.3) (37.7) EBIT 61.2 38.0 44.0 61.1 Interest Income (Expense) (35.6) (34.6) (34.0) (36.7) Pretax Income 25.6 3.4 10.0 24.4 Income Tax (9.0) (1.2) (3.5) (8.5) Net Income 16.6 2.2 6.5 15.9 Shares Outstanding (millions) 53.6 53.6 53.6 53.6 Earnings per Share $0.31 $0.04 $0.12 $0.30 Balance Sheet 2015 2016 2017 2018 Assets Cash 49.1 66.6 77.9 70.4 Accounts Receivable 87.5 68.3 70.3 77.9 Inventory 33.3 31.6 27.4 30.6 Total Current Assets 169.9 166.5 175.6 178.9 Net Property, Plant & Equipment 245.2 241.1 313.8 340.9 Goodwill & Intangibles 364.4 364.4 364.4 364.4 Total Assets 779.5 772.0 853.8 884.2 Liabilities & Stockholders' Equity Accounts Payable 18.6 18.5 20.8 25.6 Accrued Compensation 6.8 7.1 6.5 8.6 Total Current Liabilities 25.4 25.6 27.3 34.2 Long-Term Debt 1988 5722 5973 2019 600.7 (295.7) 305.0 (118.3) (80.4) (38.3) 68.0 (41.2) 26.8 (9.4) 17.4 53.6 $0.32 2019 72.6 86.8 33.8 193.2 342.3 364.4 899.9 30.5 9.4 39.9 597 3 dag g 49.1 70.4 12.0 87.5 33.3 169.9 245.2 364.4 779.5 UU. 68.3 31.6 166.5 241.1 364.4 772.0 70.3 27.4 175.6 313.8 364.4 853.8 77.9 30.6 178.9 340.9 364.4 884.2 86.8 33.8 193.2 342.3 364.4 899.9 Udsi Accounts Receivable Inventory Total Current Assets Net Property, Plant & Equipment Goodwill & Intangibles Total Assets Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation Total Current Liabilities Long-Term Debt Total Liabilities Stockholders' Equity Total Liabilities & Stockholders' Equity Statement of Cash Flows Net Income Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay. & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activ. Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ. Change in Cash Mydeco Stock Price 18.6 6.8 25.4 498.8 524.2 255.3 779.5 2015 16.6 26.2 3.9 (2.9) 2.9 46.7 (24.9) (24.9) (6.0) 18.5 7.1 25.6 498.8 524.4 247.6 772.0 2016 2.2 26.9 19.2 1.7 0.2 50.2 (26.7) (26.7) (6.0) 20.8 6.5 27.3 572.2 599.5 254.3 853.8 2017 6.5 33.3 - 2.0 4.2 1.7 43.7 (99.8) (99.8) (6.0) 25.6 8.6 34.2 597.3 631.5 252.7 884.2 2018 15.9 37.7 (7.6) (3.2) 6.9 49.7 (76.3) (76.3) (6.0) 30.5 9.4 39.9 597.3 637.2 262.7 899.9 2019 17.4 38.3 (8.9) (3.2) 5.7 49.3 (40.1) (40.1) (7.0) (6.0) 15.8 $8.73 (6.0) 17.5 $3.31 73.4 67.4 11.3 $4.86 25.1 19.1 (7.5) $9.53 (7.0) 2.2 $11.61