Answered step by step

Verified Expert Solution

Question

1 Approved Answer

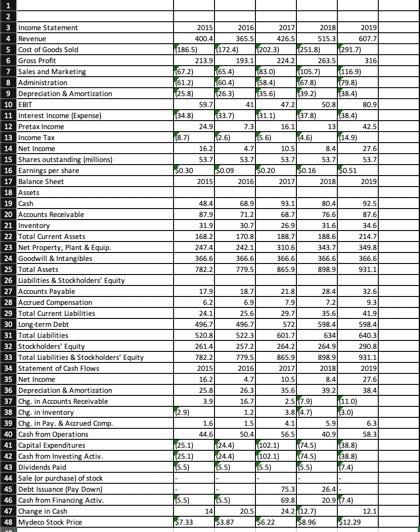

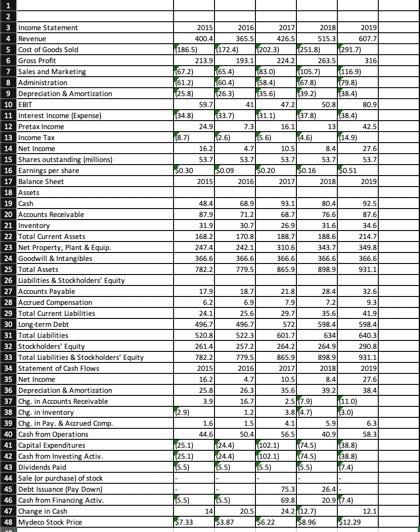

See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco had purchased additional equipment for $11.2 million at the

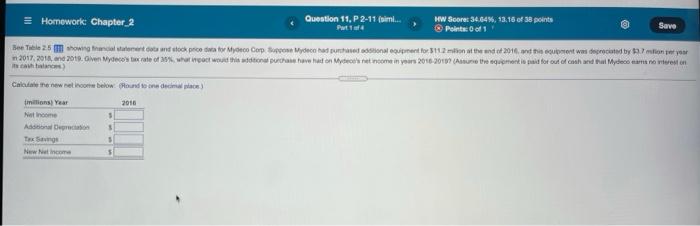

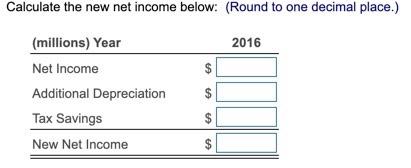

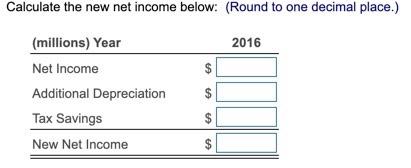

See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco had purchased additional equipment for $11.2 million at the end of 2016, and this equipment was depreciated by $3.7 million per year in 2017,2018,and 2019. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydeco's net income in yers 2016-2019? (Assume the equipment is paid for out cash and that Mydeco earns no interest on its cash balances.)

Homework: Chapter 2 Question 11, P2-11 (dim. Put WW Score 34.64% 13.15 of 38 points Point of Save Bee Tele 25 showing online and stock pricewat My Corpose Mydeco had purchasing out for 12 months and of 2016 at was declared by one year 2017. 2018, and 2010. Oliver ydeco rate of what hot would this edition purchase what on Mythes et come in yours 2016-2017 Curso te qene i pod for out of hand a Mydeco antro ton ht) Cele me now ret hom below and te onderwe) milions) Year 2016 Niet Income $ AD $ New income $ 723 2015 2016 2017 2018 2019 400.41 365.51 426.5 5153 6077 186.51 172.4) 12023) 251.8) (291.77 2139 193.11 2242 263.5 316 183.0) 1057) 0169) 1612] 60.4) 58.4) 167.8) 179.8) 25.8) 1263) 856) 39.2) (38.4) 59.7 411 47.2 50.8 80.9 348) 33.7) 31.3) 137.8 138.4) 24.9 73 16.1 13 42.5 8.7) 2.6) 5.6) 4.6) (14.9) 162 4.7 105 8.4 27.6 53.7 53.71 $3.7 53.7 53.7 30 30 s0.09 $0.20 $0.16 $0.51 2015 20161 2017 2018 2019) 48.4 87.9 31.9 1682 247.4 3666 7822 689 712 30.7 1708 2421 3666 779.5 931 68.7 26.9 1997 3106 366.6 865.9 80.4 76.6 31.6 1986 343.7 366.6 898.91 92.5 87.6 34.6 214.7 349.8 366.6 9313 3 Income Statement 4 Revenue 5 Cost of Goods Sold 6 Gross Profit 7 Sales and Marketing 8 Administration 9 Depreciation & Amortization 10 ERIT 11 Interest Income Expense 12 Pretax income 13 Income Tax 14 Net Income 15 Shares outstanding millions 16 Earnings per share 17 Balance Sheet 18 Assets 19 Cash 20 Accounts Receivable 21 Inventory 22 Total Current Assets 23 Net Property. Plant & Equip. 24 Goodwill & intangibles 25 Total Assets 25 Liabilities & Stockholders' Equity 27 Accounts Payable 28 Accrued Compensation 29 Total Current Liabilities 30 long-term Debt 31 Total abilities 32 Stockholders' Equity 33 Total abilities & Stockholders' Equity 34 Statement of Cash Flows 35 Net Income 36 Depreciation & Amortization 37 Che. in Accounts Receivable 38 Chy. In inventory 39 che, in Pay. & Accrued Comp. 40 Cash from Operations 41 Capital Expenditures 42 Cash from Investing Activ. 43 Dividends Paid 44 Sale for purchase of stock 45 Debt Issuance (Pay Down 46 Cash from Financing Activ 47 Change in Cash 48 Mydeco Stock Price 17.9 18.7 21.8 28.4 32.6 621 691 7.9 7.2 9.3 24.1 25.61 29.7 35.6 41.9 496.7 496.7 572 598.4 5984 5208 5223 601.7 634 640.3 2614 2572 264.2 264.9 290.8 7822 779.5 865.9 8989 931.1 2015 2016 2017 2018 2019 16.2 4.7 10.5 84 27.6 25.8 26.3 35.6 39.2 38.4 3.9 16.7 2519) (110) 291 12 3.8 4.7 13.0) 16 15 41 5.9 6.3 50.41 56S 409 58.3 25.1) 24.4) 102.1) 174.5) 38.8) 25.1) 102.1) 1045 198.8) S. $5) ISS) 5.5) 17.4) 446 24.4 75.3 26.41 20.92.4) 12.1 $12.29 14 $3.87 205 $6.22 24 2 12.7) $8.96 $7.33 Calculate the new net income below: (Round to one decimal place.) 2016 (millions) Year Net Income Additional Depreciation Tax Savings New Net Income $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started