Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(See Tung Ch. 3 for background). Suppose you take out a Y-year mortgage ( Y is almost always either 15 or 30 ) with a

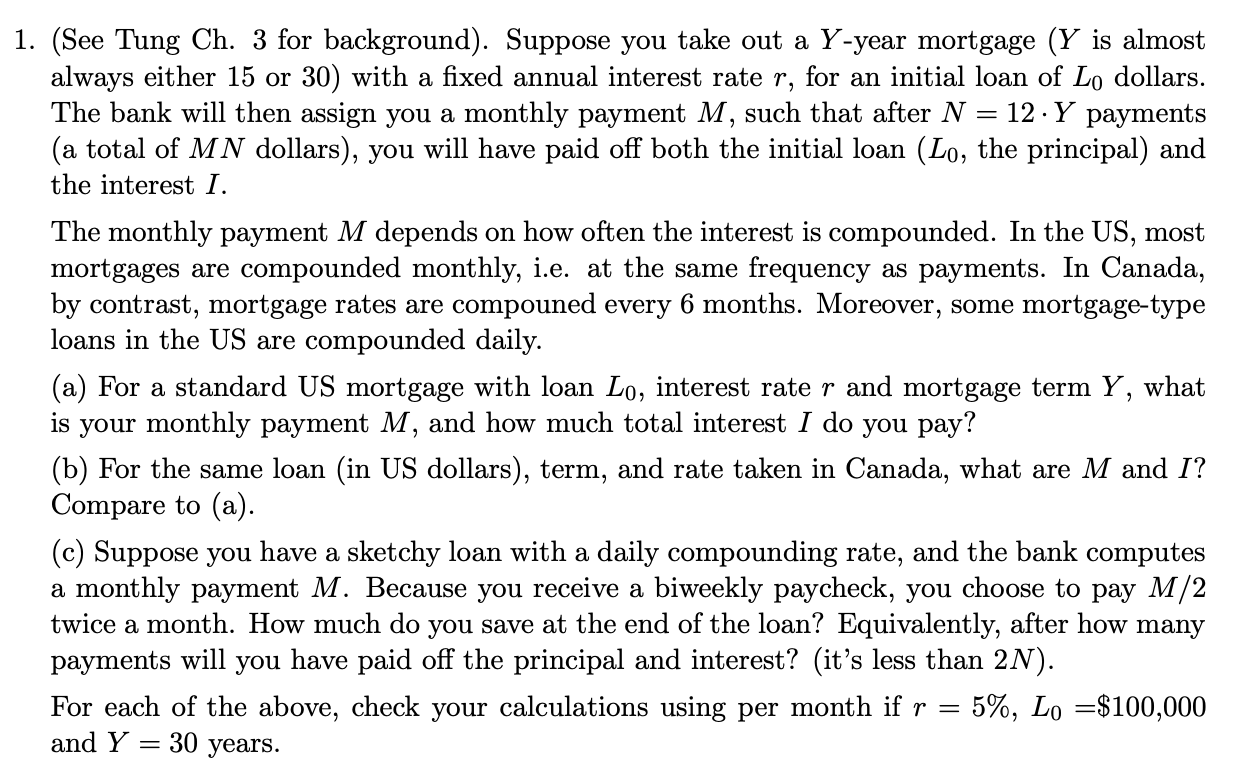

(See Tung Ch. 3 for background). Suppose you take out a Y-year mortgage ( Y is almost always either 15 or 30 ) with a fixed annual interest rate r, for an initial loan of L0 dollars. The bank will then assign you a monthly payment M, such that after N=12Y payments (a total of MN dollars), you will have paid off both the initial loan ( L0, the principal) and the interest I. The monthly payment M depends on how often the interest is compounded. In the US, most mortgages are compounded monthly, i.e. at the same frequency as payments. In Canada, by contrast, mortgage rates are compouned every 6 months. Moreover, some mortgage-type loans in the US are compounded daily. (a) For a standard US mortgage with loan L0, interest rate r and mortgage term Y, what is your monthly payment M, and how much total interest I do you pay? (b) For the same loan (in US dollars), term, and rate taken in Canada, what are M and I ? Compare to (a). (c) Suppose you have a sketchy loan with a daily compounding rate, and the bank computes a monthly payment M. Because you receive a biweekly paycheck, you choose to pay M/2 twice a month. How much do you save at the end of the loan? Equivalently, after how many payments will you have paid off the principal and interest? (it's less than 2N ). For each of the above, check your calculations using per month if r=5%,L0=$100,000 and Y=30 years

(See Tung Ch. 3 for background). Suppose you take out a Y-year mortgage ( Y is almost always either 15 or 30 ) with a fixed annual interest rate r, for an initial loan of L0 dollars. The bank will then assign you a monthly payment M, such that after N=12Y payments (a total of MN dollars), you will have paid off both the initial loan ( L0, the principal) and the interest I. The monthly payment M depends on how often the interest is compounded. In the US, most mortgages are compounded monthly, i.e. at the same frequency as payments. In Canada, by contrast, mortgage rates are compouned every 6 months. Moreover, some mortgage-type loans in the US are compounded daily. (a) For a standard US mortgage with loan L0, interest rate r and mortgage term Y, what is your monthly payment M, and how much total interest I do you pay? (b) For the same loan (in US dollars), term, and rate taken in Canada, what are M and I ? Compare to (a). (c) Suppose you have a sketchy loan with a daily compounding rate, and the bank computes a monthly payment M. Because you receive a biweekly paycheck, you choose to pay M/2 twice a month. How much do you save at the end of the loan? Equivalently, after how many payments will you have paid off the principal and interest? (it's less than 2N ). For each of the above, check your calculations using per month if r=5%,L0=$100,000 and Y=30 years Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started