Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select a research topic and develop a research proposal Question 4 James is aspiring to become an MP (Member of Parliament) in Ghana and he

Select a research topic and develop a research proposal

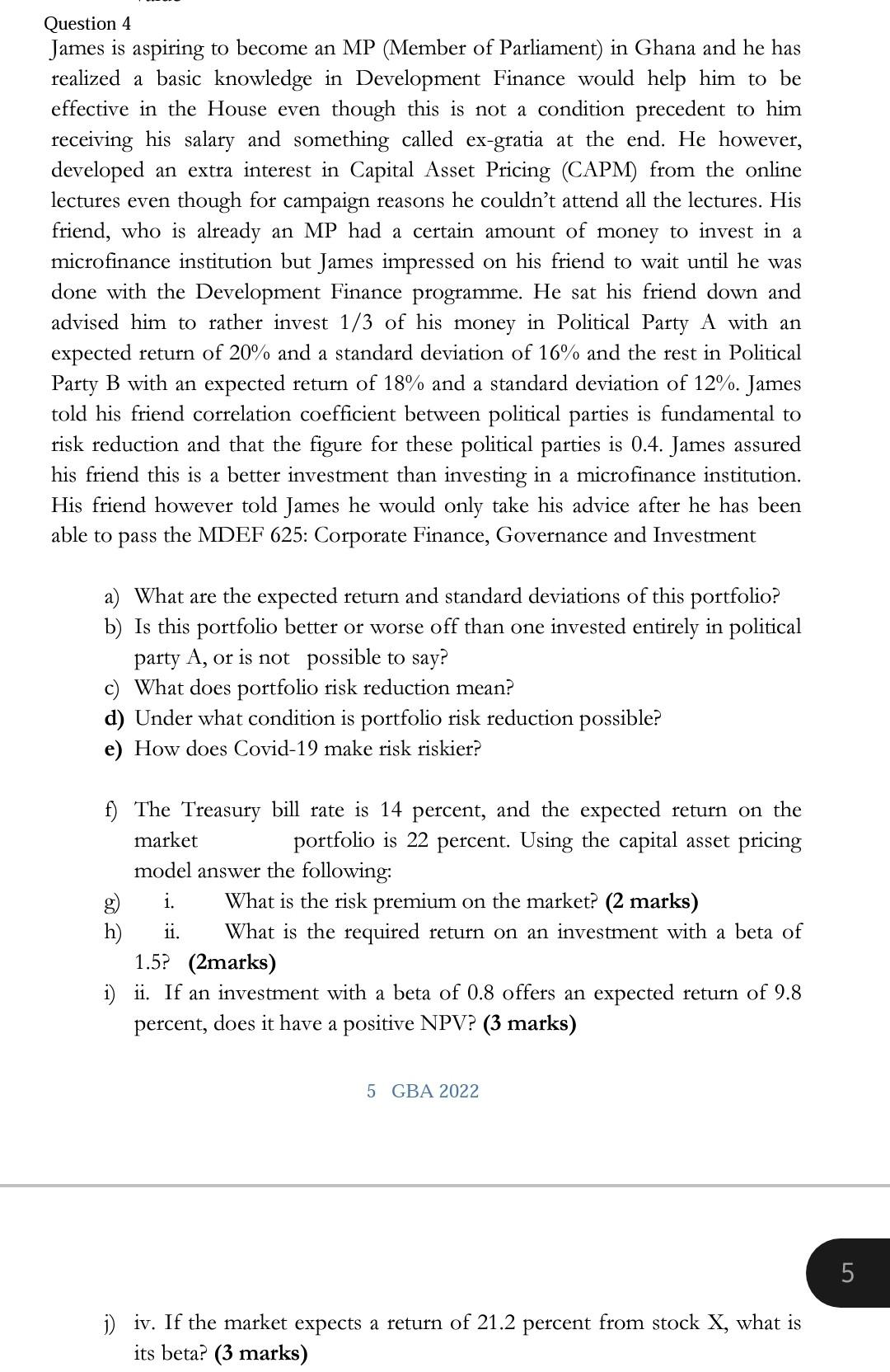

Question 4 James is aspiring to become an MP (Member of Parliament) in Ghana and he has realized a basic knowledge in Development Finance would help him to be effective in the House even though this is not a condition precedent to him receiving his salary and something called ex-gratia at the end. He however, developed an extra interest in Capital Asset Pricing (CAPM) from the online lectures even though for campaign reasons he couldn't attend all the lectures. His friend, who is already an MP had a certain amount of money to invest in a microfinance institution but James impressed on his friend to wait until he was done with the Development Finance programme. He sat his friend down and advised him to rather invest 1/3 of his money in Political Party A with an expected return of 20% and a standard deviation of 16% and the rest in Political Party B with an expected return of 18% and a standard deviation of 12%. James told his friend correlation coefficient between political parties is fundamental to risk reduction and that the figure for these political parties is 0.4. James assured his friend this is a better investment than investing in a microfinance institution. His friend however told James he would only take his advice after he has been able to pass the MDEF 625: Corporate Finance, Governance and Investment a) What are the expected return and standard deviations of this portfolio? b) Is this portfolio better or worse off than one invested entirely in political party A, or is not possible to say? What does portfolio risk reduction mean? d) Under what condition is portfolio risk reduction possible? e) How does Covid-19 make risk riskier? f) The Treasury bill rate is 14 percent, and the expected return on the market portfolio is 22 percent. Using the capital asset pricing model answer the following: i. What is the risk premium on the market? (2 marks) h) ii. What is the required return on an investment with a beta of 1.5? (2marks) i) ii. If an investment with a beta of 0.8 offers an expected return of 9.8 percent, does it have a positive NPV? (3 marks) 5 GBA 2022 5 07 j) iv. If the market expects a return of 21.2 percent from stock X, what is its betaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started