Answered step by step

Verified Expert Solution

Question

1 Approved Answer

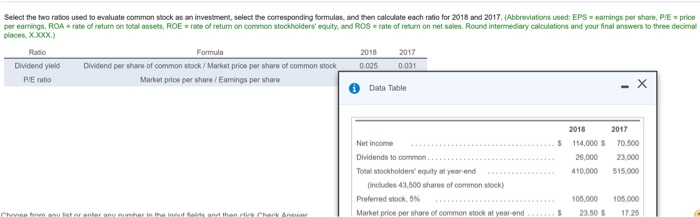

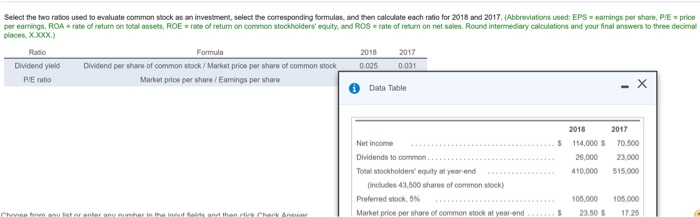

Select the two ratios used to evaluate common stock as an investment, select the corresponding formulas, and then calculate each ratio for 2018 and 2017.

Select the two ratios used to evaluate common stock as an investment, select the corresponding formulas, and then calculate each ratio for 2018 and 2017. (Abbreviations used: EPS- earmings per share, PIE price per ear ngs R Arate of return on total assets, R Erate of retum on common stockholders' equity, and R Srate or earn on net sales. Round intermediary calculations and your final answers o n re e decr ai places, X.:0xx Formula Dividend per share of common sock/Market price per share of common stock Market price per share/ Eamings per share Ratio Dividend yleild D P/E ratio Data Table 2018 2017 Net income Dividends to common Total stockholders equity at year-end 114,000 s .500 26,000 23000 10,000 515000 includes 43,500 shares of common stock) Preferred stock, 5% Market price per share of common stock at year-end w...na105,000 105,000 $ 23.50 7 25

Select the two ratios used to evaluate common stock as an investment, select the corresponding formulas, and then calculate each ratio for 2018 and 2017. (Abbreviations used: EPS- earmings per share, PIE price per ear ngs R Arate of return on total assets, R Erate of retum on common stockholders' equity, and R Srate or earn on net sales. Round intermediary calculations and your final answers o n re e decr ai places, X.:0xx Formula Dividend per share of common sock/Market price per share of common stock Market price per share/ Eamings per share Ratio Dividend yleild D P/E ratio Data Table 2018 2017 Net income Dividends to common Total stockholders equity at year-end 114,000 s .500 26,000 23000 10,000 515000 includes 43,500 shares of common stock) Preferred stock, 5% Market price per share of common stock at year-end w...na105,000 105,000 $ 23.50 7 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started