Answered step by step

Verified Expert Solution

Question

1 Approved Answer

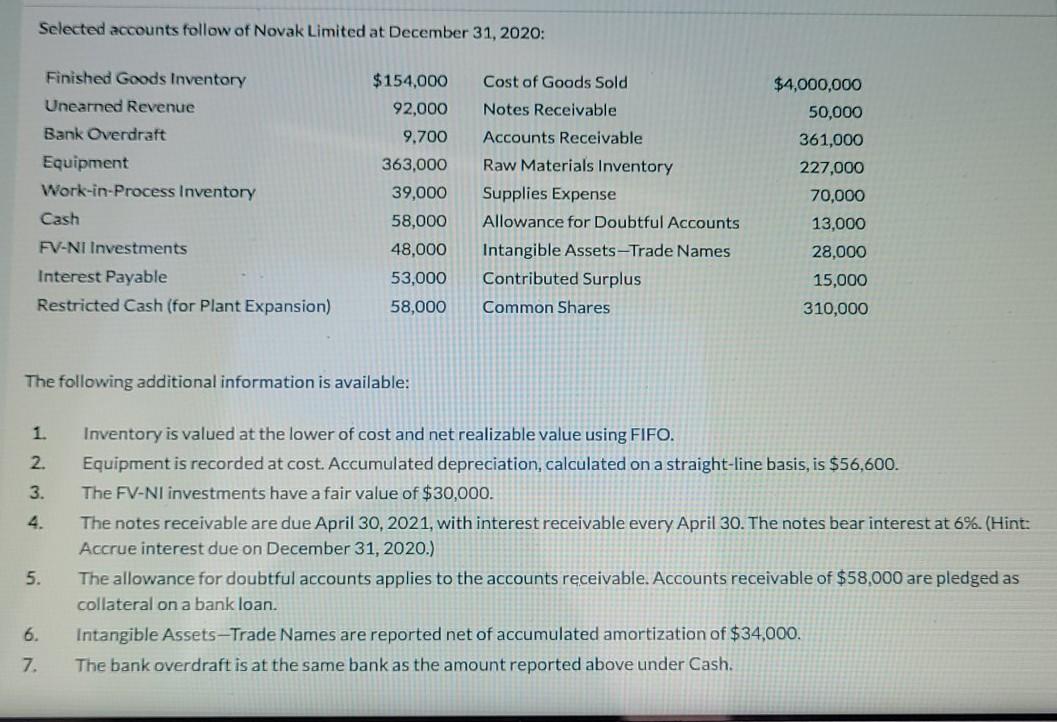

Selected accounts follow of Novak Limited at December 31, 2020: Finished Goods Inventory Unearned Revenue Bank Overdraft Equipment Work-in-Process Inventory Cash FV-NI Investments Interest Payable

Selected accounts follow of Novak Limited at December 31, 2020: Finished Goods Inventory Unearned Revenue Bank Overdraft Equipment Work-in-Process Inventory Cash FV-NI Investments Interest Payable Restricted Cash (for Plant Expansion) $154,000 92,000 9.700 363,000 39,000 Cost of Goods Sold Notes Receivable Accounts Receivable Raw Materials Inventory Supplies Expense Allowance for Doubtful Accounts Intangible Assets-Trade Names Contributed Surplus Common Shares $4,000,000 50,000 361,000 227,000 70,000 13,000 28,000 15,000 310,000 58,000 48,000 53,000 58,000 The following additional information is available: 1 2. 3. Inventory is valued at the lower of cost and net realizable value using FIFO. Equipment is recorded at cost. Accumulated depreciation, calculated on a straight-line basis, is $56,600. The FV-NI investments have a fair value of $30,000. The notes receivable are due April 30, 2021, with interest receivable every April 30. The notes bear interest at 6%. (Hint: Accrue interest due on December 31, 2020.) The allowance for doubtful accounts applies to the accounts receivable. Accounts receivable of $58,000 are pledged as collateral on a bank loan. Intangible Assets-Trade Names are reported net of accumulated amortization of $34,000. The bank overdraft is at the same bank as the amount reported above under Cash. 5. 6. 7. Novak Limited Statement of Financial Position Current Assets $ > > Total Current Assets $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started