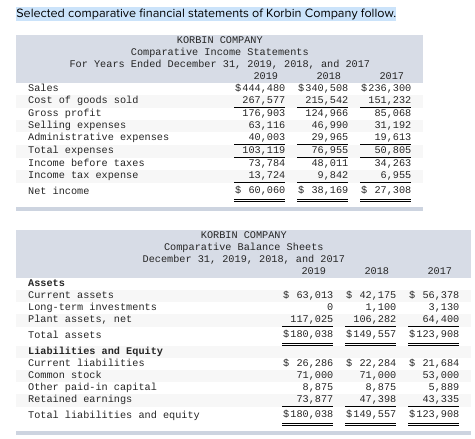

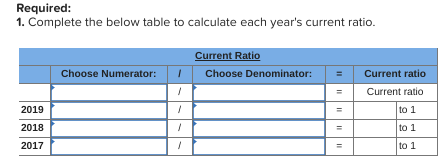

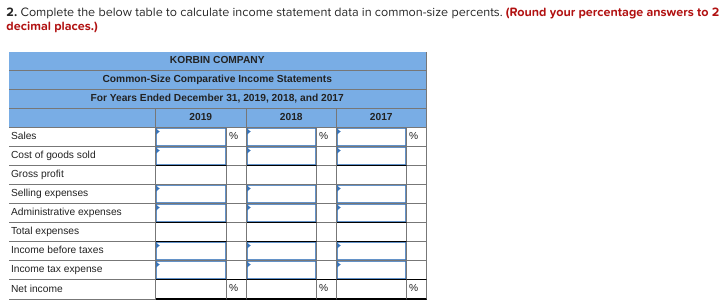

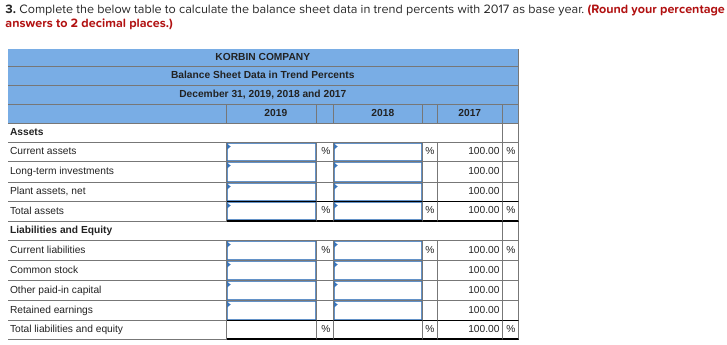

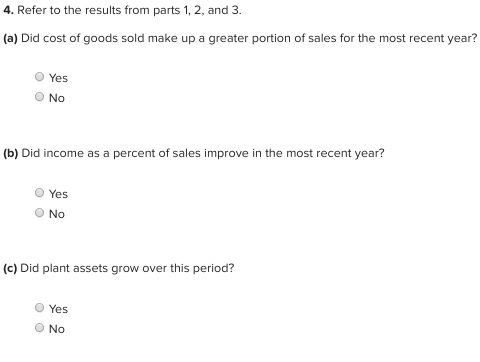

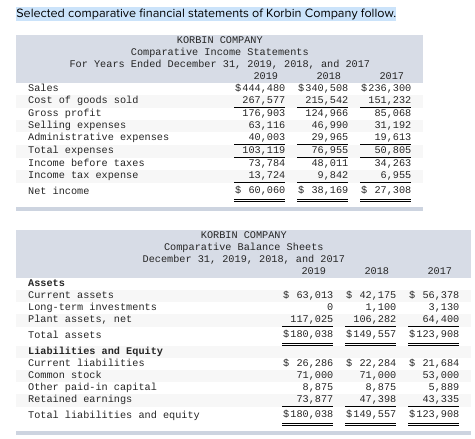

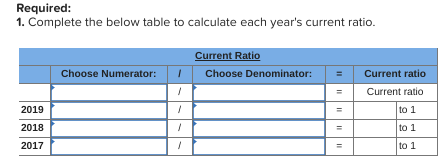

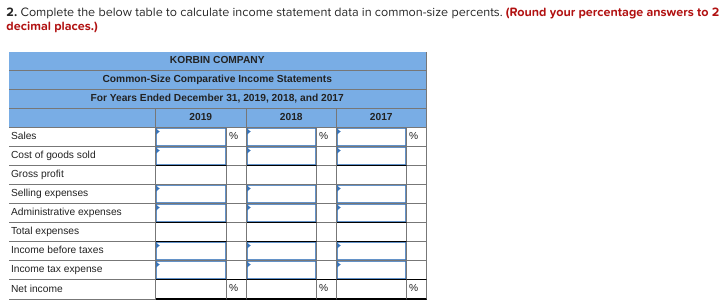

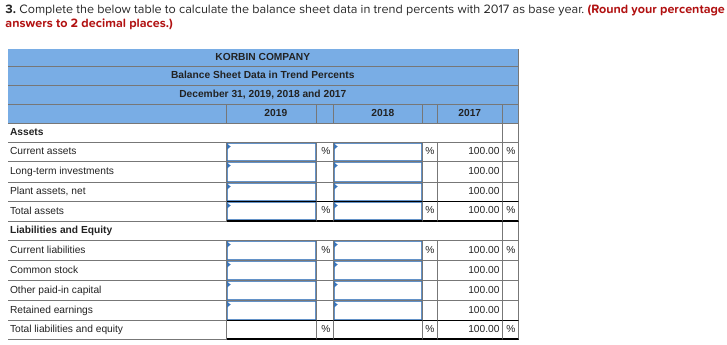

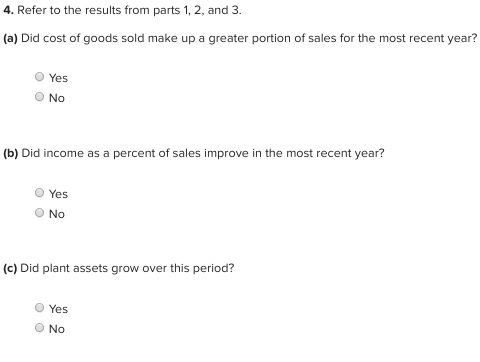

Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales $444, 480 $340, 508 $236, 300 Cost of goods sold 267,577 215, 542 151,232 Gross profit 176,983 124, 966 85, 068 Selling expenses 63, 116 46,990 31, 192 Administrative expenses 40,003 29,965 19,613 Total expenses 103, 119 76, 955 50, 805 Income before taxes 73, 784 48,011 34,263 Income tax expense 13,724 9,842 6,955 Net income $ 60,060 $ 38, 169 $ 27, 308 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 2017 Assets Current assets $ 63, 013 $ 42,175 $ 56, 378 Long-term investments 0 1 , 100 3, 130 Plant assets, net 117, 025 106,282 64,400 Total assets $180, e38 $149,557 $123, 908 Liabilities and Equity Current liabilities $ 26, 286 $ 22,284 $ 21,684 Common stock 71, 90071, 0053,000 Other paid-in capital 8,8758 ,875 5,889 Retained earnings 73,877 47,398 43, 335 Total liabilities and equity $180, e38 $149,557 $123, 908 Required: 1. Complete the below table to calculate each year's current ratio. Current Ratio Choose Denominator: Choose Numerator: = Current ratio Current ratio 2019 2018 2017 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2017 KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income 3. Complete the below table to calculate the balance sheet data in trend percents with 2017 as base year. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2019, 2018 and 2017 2019 2018 2017 Assets Current assets Long-term investments Plant assets, net 100.00 100.00 100.00 100.00% Total assets Liabilities and Equity Current liabilities Common stock Other paid in capital 100.00 % 100.00 100.00 100.00 100.00 % Retained earnings Total liabilities and equity 4. Refer to the results from parts 1, 2, and 3. (a) Did cost of goods sold make up a greater portion of sales for the most recent year? Yes No (b) Did income as a percent of sales improve in the most recent year? Yes No (c) Did plant assets grow over this period? Yes No