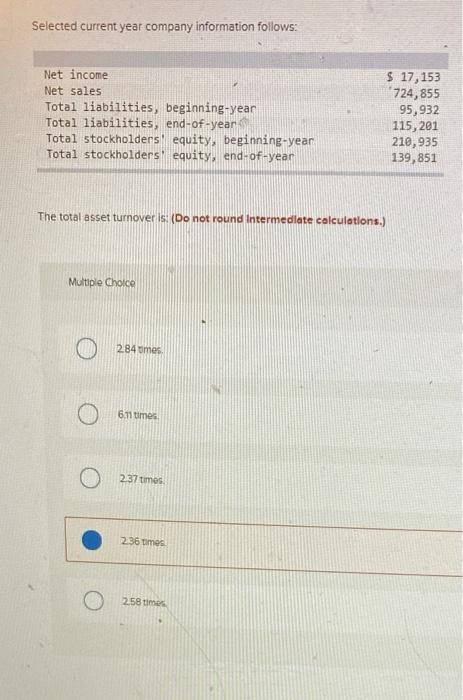

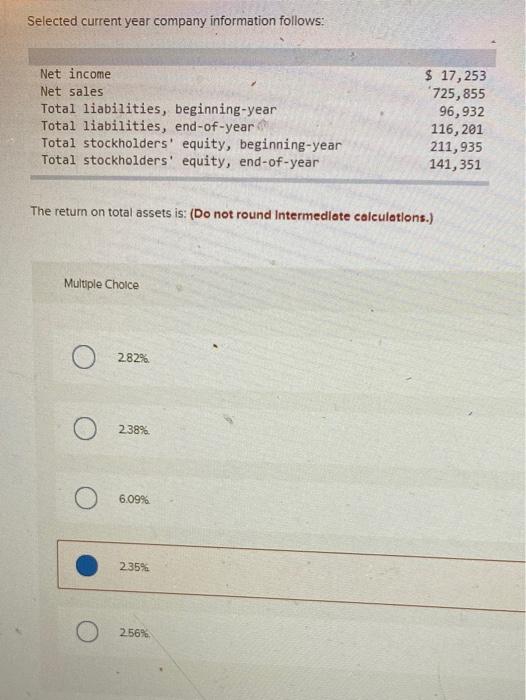

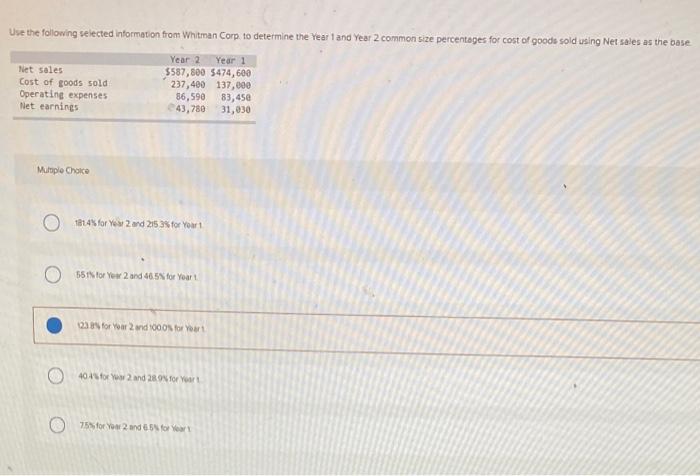

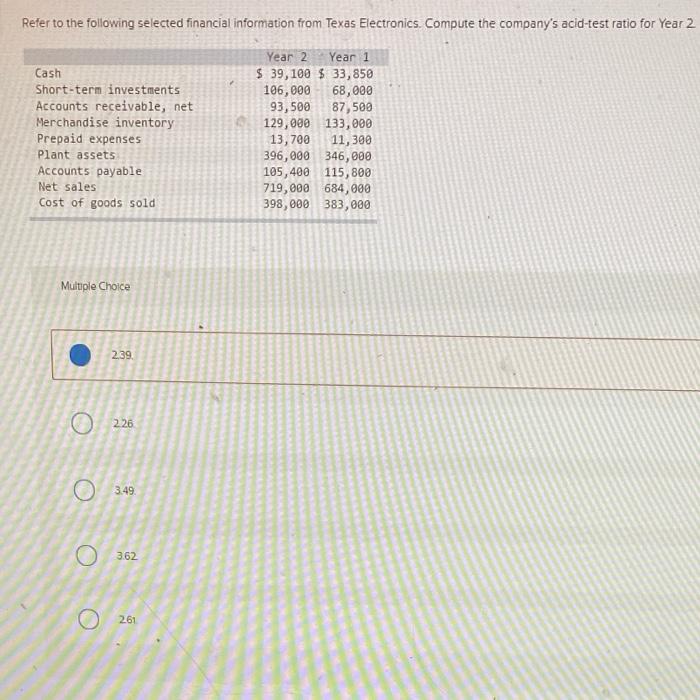

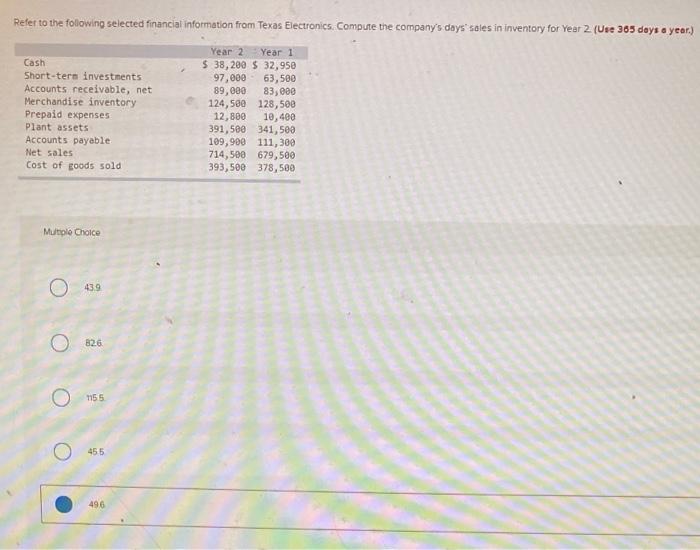

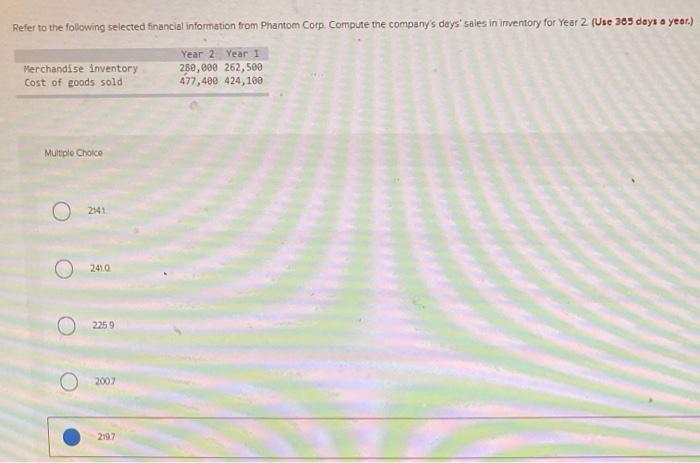

Selected current year company information follows: Net income Net sales Total liabilities, beginning-year Total liabilities, end-of-year Total stockholders' equity, beginning-year Total stockholders' equity end-of-year $ 17,153 "724,855 95,932 115,201 210,935 139,851 The total asset turnover is: (Do not round Intermediate calculations.) Multiple Choice 2.84 mes 6.11 times 2.37 times 236 timer 2.58 times Selected current year company information follows: Net income Net sales Total liabilities, beginning-year Total liabilities, end-of-year Total stockholders' equity, beginning-year Total stockholders' equity, end-of-year $ 17, 253 *725,855 96,932 116, 201 211,935 141, 351 The return on total assets is: (Do not round Intermediate calculations.) Multiple Choice 2.82% O 238% 6.09% 2359 256% Use the following selected information from Whitman Corp. to determine the Year 1 and Year 2 common size percentages for cost of goods sold using Net sales as the base Net soles Cost of goods sold Operating expenses Net earnings Year 2 Year 1 5587,800 5474,600 237,400 137,000 36,590 83,450 43,780 31,030 Multiple Choice 1814% for you and 215 35 for Your 551 for Yes 2 and 46.5% for Yeart 03 for Your 2000 For You 404 for 2 and 23.0x for Your O 75 for You 2 und es for Refer to the following selected financial information from Texas Electronics Compute the company's acid-test ratio for Year 2 Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 Year 1 $ 39,100 $ 33,850 106,000 68,000 93,500 87,500 129,000 133,000 13,700 11,380 396,000 346,000 105,400 115,800 719,000 684,000 398,000 383,080 Multiple Choice 239 O 226 03.49 362 261 Refer to the following selected financial information from Texas Electronics, Compute the company's days' sales in inventory for Year 2. (Use 365 days a year.) Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 Year 1 $ 38,200 $ 32,950 97,000 63,500 89,080 83,000 124,580 128,500 12,800 10,400 391,500 341,500 109,900 111,300 714,500 679,500 393,500 378,500 Multiple Choice O439 O 826 O 7155 O 45.5 496 Refer to the following selected financial information from Phantom Corp Compute the company's days' sales in inventory for Year 2 (Use 385 days a year.) Merchandise inventory Cost of goods sold Year 2 Year 1 280,000 262,500 477,400 424,100 Multiple Choice 0 2141 o 2410 O 225 9 2007 2107