Answered step by step

Verified Expert Solution

Question

1 Approved Answer

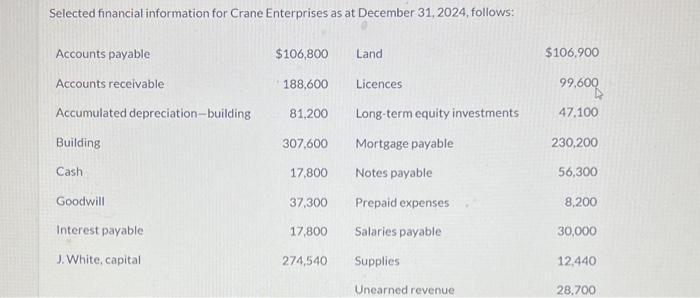

Selected financial information for Crane Enterprises as at December 31, 2024, follows: $106,900 Accounts payable $106,800 Land Accounts receivable 188,600 Licences 99,600 Accumulated depreciation-building.

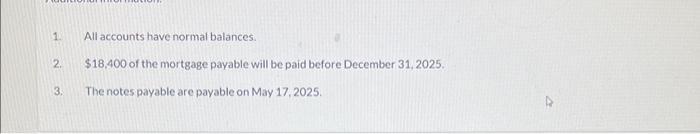

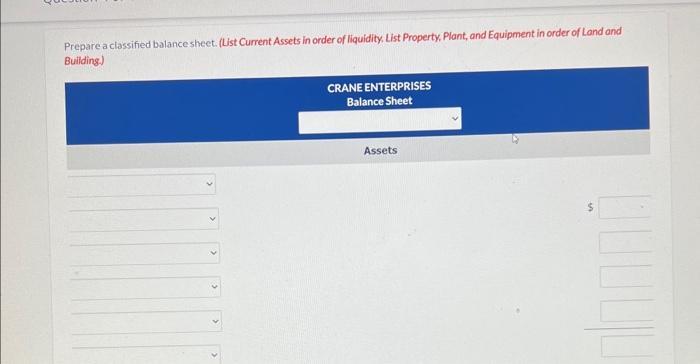

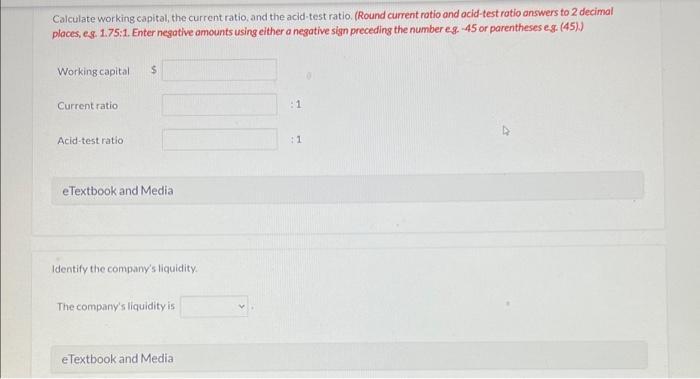

Selected financial information for Crane Enterprises as at December 31, 2024, follows: $106,900 Accounts payable $106,800 Land Accounts receivable 188,600 Licences 99,600 Accumulated depreciation-building. 81,200 Long-term equity investments 47.100 Building 307,600 Mortgage payable 230,200 Cash 17,800 Notes payable 56,300 Goodwill 37,300 Prepaid expenses 8,200 Interest payable 17,800 Salaries payable 30,000 J. White, capital 274,540 Supplies 12,440 Unearned revenue 28,700 1. All accounts have normal balances. 2. $18,400 of the mortgage payable will be paid before December 31, 2025. 3. The notes payable are payable on May 17, 2025. Prepare a classified balance sheet. (List Current Assets in order of liquidity. List Property, Plant, and Equipment in order of Land and Building.) CRANE ENTERPRISES Balance Sheet Assets Calculate working capital, the current ratio, and the acid-test ratio. (Round current ratio and acid-test ratio answers to 2 decimal places, e.g. 1.75:1. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses e.g. (45).) Working capital $ Current ratio 1 Acid-test ration eTextbook and Media Identify the company's liquidity. The company's liquidity is eTextbook and Media 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the classified balance sheet for Crane Enterprises as of December 31 2024 based on the pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started