Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Selected operating information from a firm's 20X2 financial statements is cost of goods sold = 100 gross profit margin = 60% EBIT margin= 30%

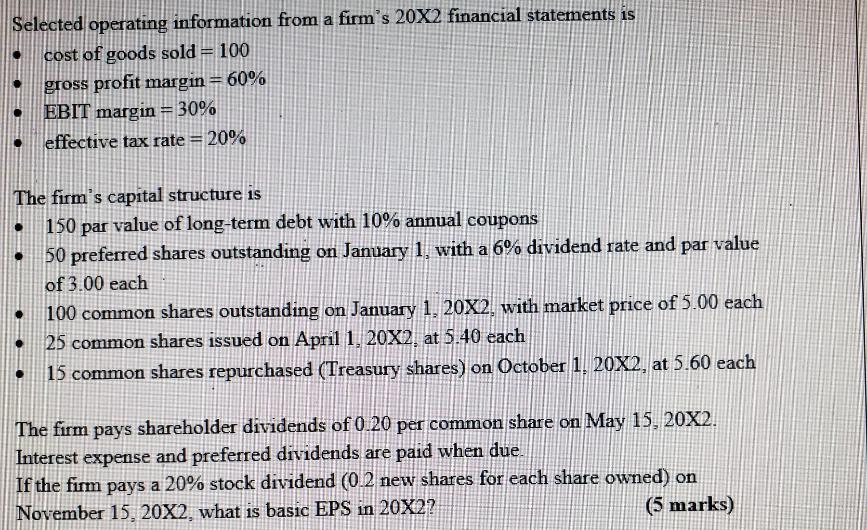

Selected operating information from a firm's 20X2 financial statements is cost of goods sold = 100 gross profit margin = 60% EBIT margin= 30% effective tax rate = 20% The firm's capital structure is 150 par value of long-term debt with 10% annual coupons 50 preferred shares outstanding on January 1, with a 6% dividend rate and par value of 3.00 each 100 common shares outstanding on January 1, 20X2, with market price of 5.00 each 25 common shares issued on April 1, 20X2, at 5.40 each 15 common shares repurchased (Treasury shares) on October 1, 20X2, at 5.60 each The firm pays shareholder dividends of 0.20 per common share on May 15, 20X2. Interest expense and preferred dividends are paid when due. If the firm pays a 20% stock dividend (0.2 new shares for each share owned) on November 15, 20X2, what is basic EPS in 20X2? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Calculating Basic EPS in 20X2 Heres how ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started