Question

Selected plant and equipment asset balances on December 31, 2013 for Stake Technology Inc. are as follows: Machinery$84,900Accumulated Depreciation, Machinery72,000 Total estimated useful life on

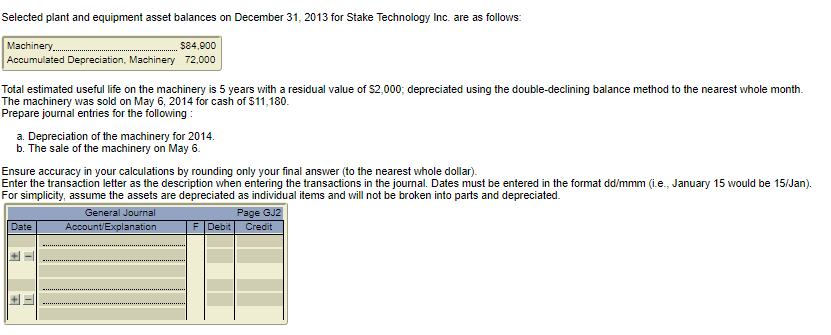

Selected plant and equipment asset balances on December 31, 2013 for Stake Technology Inc. are as follows:

Machinery$84,900Accumulated Depreciation, Machinery72,000

Total estimated useful life on the machinery is 5 years with a residual value of $2,000; depreciated using the double-declining balance method to the nearest whole month. The machinery was sold on May 6, 2014 for cash of $11,180. Prepare journal entries for the following :

- Depreciation of the machinery for 2014.

- The sale of the machinery on May 6.

Ensure accuracy in your calculations by rounding only your final answer (to the nearest whole dollar). Enter the transaction letter as the description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (i.e., January 15 would be 15/Jan). For simplicity, assume the assets are depreciated as individual items and will not be broken into parts and depreciated.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started