Question

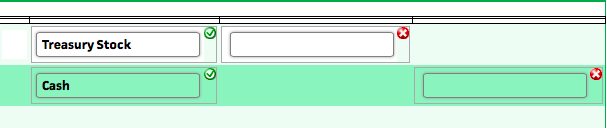

Selected Stock Transactions The following selected accounts appear in the ledger of Orion Inc. on February 1, 2014, the beginning of the current fiscal year:

Selected Stock Transactions

The following selected accounts appear in the ledger of Orion Inc. on February 1, 2014, the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: Journalize the entries to record the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank.

During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows:

Journalize the entries to record the transactions.

For a compound transaction, if an amount box does not require an entry, leave it blank.

Required:

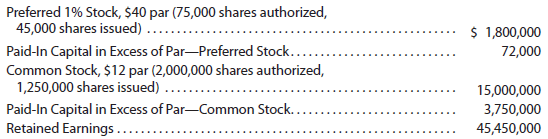

a. Issued 360,000 shares of common stock at $22, receiving cash.

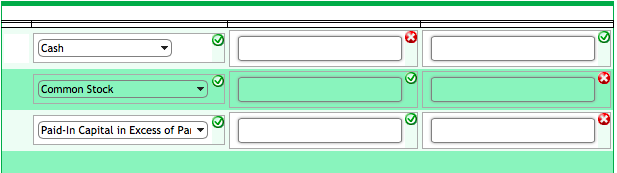

b. Issued 14,000 shares of preferred 1% stock at $43.

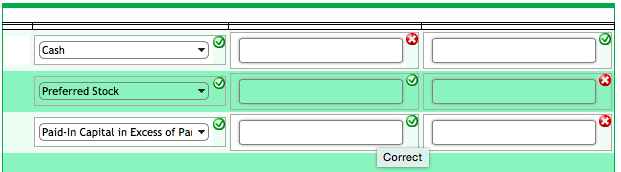

c. Purchased 66,000 shares of treasury common for $18 per share.

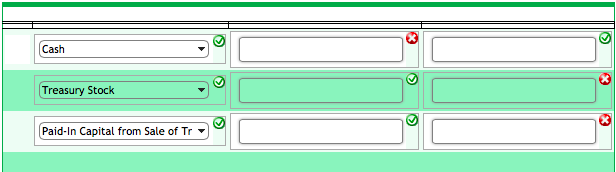

d. Sold 51,000 shares of treasury common for $21 per share.

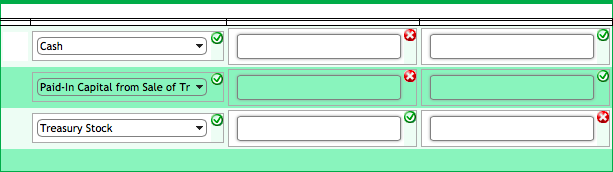

e. Sold 10,000 shares of treasury common for $16 per share.

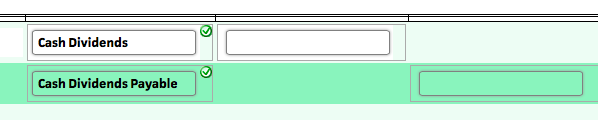

f. Declared cash dividends of $0.40 per share on preferred stock and $0.03 per share on common stock.

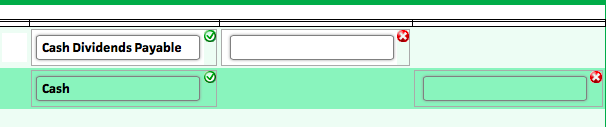

g. Paid the cash dividends.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started