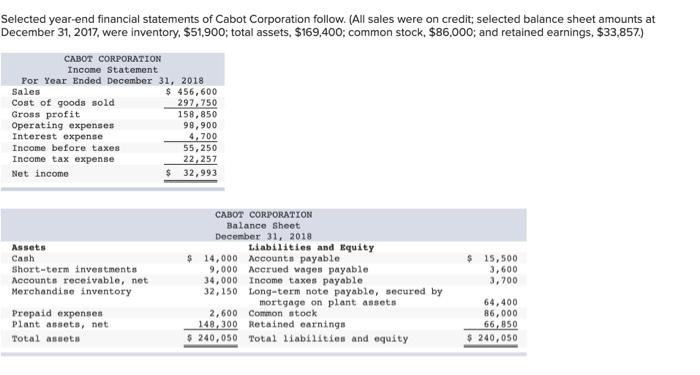

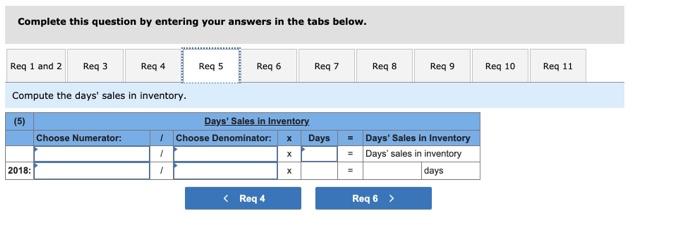

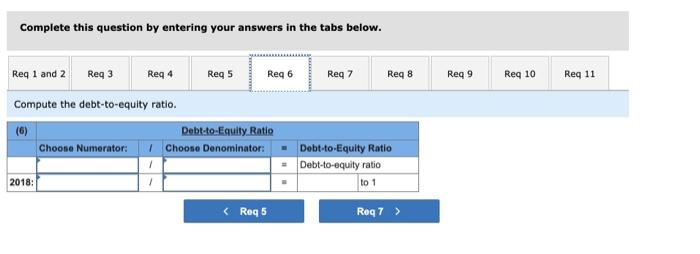

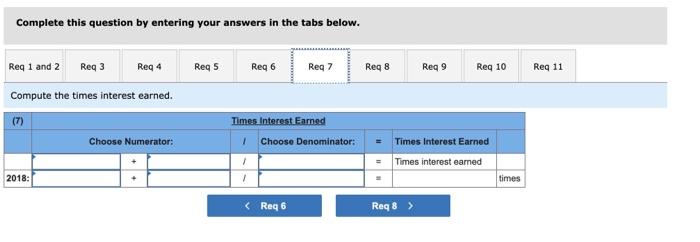

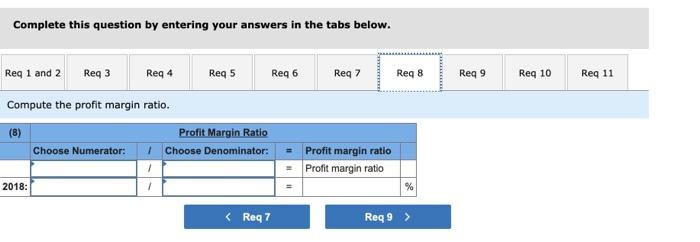

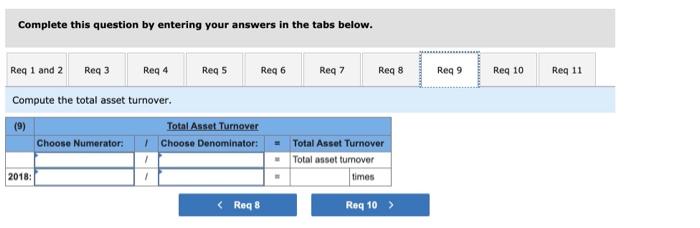

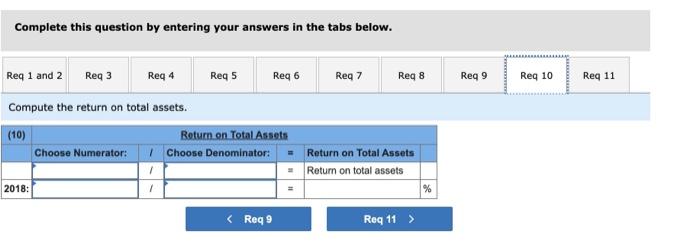

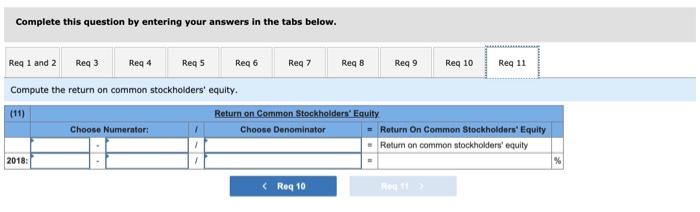

Selected year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31, 2017, were inventory, $51,900; total assets, $169,400: common stock, $86,000; and retained earnings, $33,857.) CABOT CORPORATION Income Statement For Year Ended December 31, 2018 Sales $ 456,600 Cost of goods sold 297,750 Gross profit 158,850 Operating expenses 98,900 Interest expense 4,700 Income before taxes 55,250 Income tax expense 22,257 Net income $ 32,993 Assets Cash Short-term investments Accounts receivable, net Merchandise inventory CABOT CORPORATION Balance Sheet December 31, 2018 Liabilities and Equity $ 14,000 Accounts payable 9,000 Accrued wages payable 34,000 Income taxes payable 32,150 Long-term note payable, secured by mortgage on plant assets 2,600 Common stock 148,300 Retained earnings $ 240,050 Total liabilities and equity $ 15,500 3,600 3,700 Prepaid expenses Plant assets, net Total assets 64,400 86,000 66,850 $ 240,050 Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Req 4 Req5 Reg 6 Req 7 Req8 Reg 9 Reg 10 Reg 11 Compute the days' sales in inventory. (5) Days' Sales in Inventory Choose Numerator: Choose Denominator: * Days Days' Sales In Inventory Days' sales in inventory days 2018: 1 Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Req 4 Reqs Req 6 Req 7 Req8 Reg 9 Reg 10 Req 11 Compute the debt-to-equity ratio. Debt-to-Equity Ratio Choose Numerator: Choose Denominator: 2018: 1 Debt-to-Equity Ratio Debt-to-equity ratio to 1 Roq?> Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 Req 4 Req5 Reg 6 Reg 7 Req 8 Req9 Req 10 Reg 11 Compute the profit margin ratio. (8) Profit Margin Ratio Choose Numerator: | Choose Denominator: = Profit margin ratio = Profit margin ratio 1 2018: 1 % Complete this question by entering your answers in the tabs below. Reg 7 Reg 8 Reg 9 Reg 10 Reg 11 Req 1 and 2 Reg 3 Reg 4 Reg 5 Reg 6 Compute the total asset turnover. (9) Total Asset Turnover Choose Numerator. Choose Denominator: 1 2018: Total Asset Turnover Total asset turnover times 1 Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Reg 5 Reg 6 Req 7 Reg 8 Req 9 Reg 10 Reg 11 Compute the return on total assets. (10) Return on Total Assets Choose Numerator: 1 Choose Denominator: Return on Total Assets Return on total assets 2018: 1 Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Reqs Reg 6 Reg 7 Req8 Req9 Reg 10 Reg 11 Compute the return on common stockholders' equity. (11) Return on Common Stockholders' Equity Choose Numerator: Choose Denominator = Return On Common Stockholders' Equity - Return on common stockholders' equity 2018: %