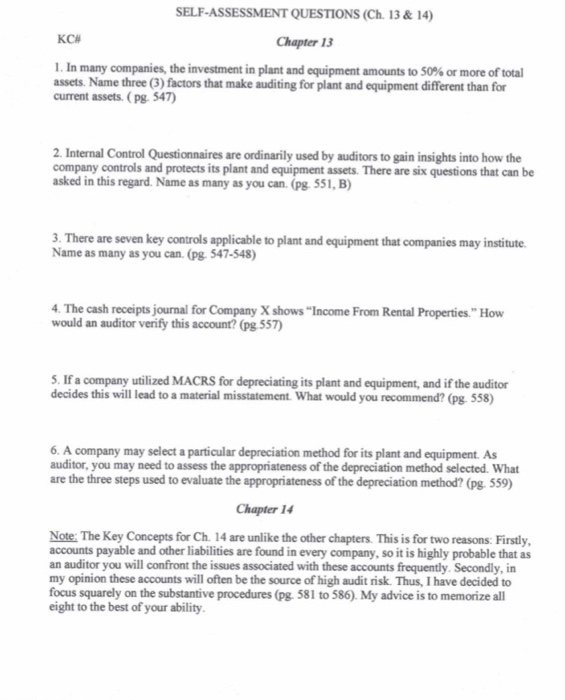

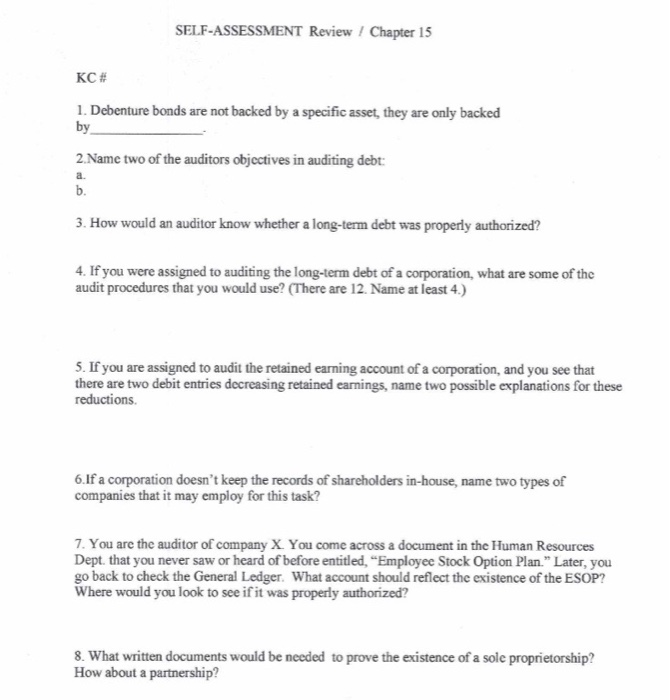

SELF-ASSESSMENT QUESTIONS (Ch. 13 & 14) KC# Chapter 13 1. In many companies, the investment in plant and equipment amounts to 50% or more of total assets. Name three (3) factors that make auditing for plant and equipment different than for current assets. (Pg. 547) 2. Internal Control Questionnaires are ordinarily used by auditors to gain insights into how the company controls and protects its plant and equipment assets. There are six questions that can be asked in this regard. Name as many as you can. (Pg. 551,B) 3. There are seven key controls applicable to plant and equipment that companies may institute Name as many as you can. (pg. 547-548) 4. The cash receipts journal for Company X shows "Income From Rental Properties." How would an auditor verify this account? (pg 557) 5. If a company utilized MACRS for depreciating its plant and equipment, and if the auditor decides this will lead to a material misstatement. What would you recommend? (pg. 558) 6. A company may select a particular depreciation method for its plant and equipment. As auditor, you may need to assess the appropriateness of the depreciation method selected. What are the three steps used to evaluate the appropriateness of the depreciation method? (pg. 559) Chapter 14 Note: The Key Concepts for Ch. 14 are unlike the other chapters. This is for two reasons. Firstly, accounts payable and other liabilities are found in every company, so it is highly probable that as an auditor you will confront the issues associated with these accounts frequently. Secondly, in my opinion these accounts will often be the source of high audit risk. Thus, I have decided to focus squarely on the substantive procedures (pg. 581 to 586). My advice is to memorize all eight to the best of your ability SELF-ASSESSMENT Review / Chapter 15 KC# 1. Debenture bonds are not backed by a specific asset, they are only backed by 2.Name two of the auditors objectives in auditing debt: b. a. 3. How would an auditor know whether a long-term debt was properly authorized? 4. If you were assigned to auditing the long-term debt of a corporation, what are some of the audit procedures that you would use? (There are 12. Name at least 4.) 5. If you are assigned to audit the retained earning account of a corporation, and you see that there are two debit entries decreasing retained earnings, name two possible explanations for these reductions 6.If a corporation doesn't keep the records of shareholders in-house, name two types of companies that it may employ for this task? 7. You are the auditor of company X. You come across a document in the Human Resources Dept. that you never saw or heard of before entitled, Employee Stock Option Plan." Later, you go back to check the General Ledger. What account should reflect the existence of the ESOP? Where would you look to see if it was properly authorized? 8. What written documents would be needed to prove the existence of a sole proprietorship? How about a partnership