Answered step by step

Verified Expert Solution

Question

1 Approved Answer

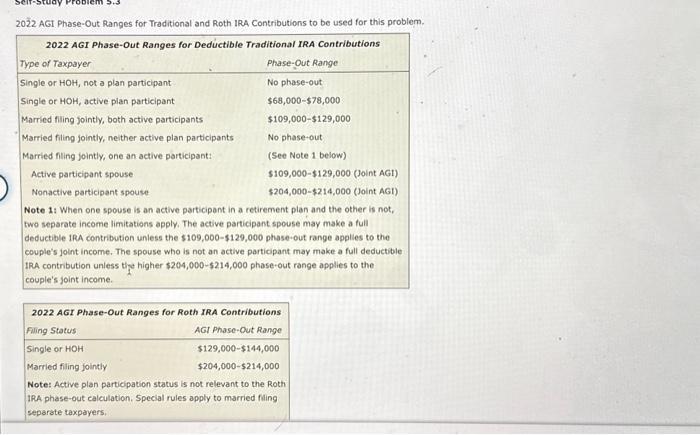

Self-Study Problem 5.3 2022 AGI Phase-Out Ranges for Traditional and Roth IRA Contributions to be used for this problem. 2022 AGI Phase-Out Ranges for

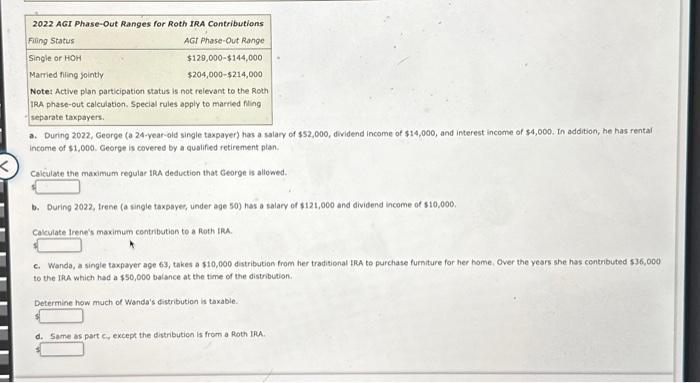

Self-Study Problem 5.3 2022 AGI Phase-Out Ranges for Traditional and Roth IRA Contributions to be used for this problem. 2022 AGI Phase-Out Ranges for Deductible Traditional IRA Contributions Type of Taxpayer Phase-Out Range Single or HOH, not a plan participant Single or HOH, active plan participant Married filing jointly, both active participants Married filing jointly, neither active plan participants Married filing jointly, one an active participant: Active participant spouse Nonactive participant spouse No phase-out $68,000-$78,000 $109,000-$129,000 No phase-out (See Note 1 below) $109,000-$129,000 (Joint AGI) $204,000-$214,000 (Joint AGI) Note 1: When one spouse is an active participant in a retirement plan and the other is not, two separate income limitations apply. The active participant spouse may make a full deductible IRA contribution unless the $109,000-$129,000 phase-out range applies to the couple's joint income. The spouse who is not an active participant may make a full deductible IRA contribution unless the higher $204,000-$214,000 phase-out range applies to the couple's joint income. 2022 AGI Phase-Out Ranges for Roth IRA Contributions Filling Status Single or HOH Married filing jointly AGI Phase-Out Range $129,000-$144,000 $204,000-$214,000 Note: Active plan participation status is not relevant to the Roth IRA phase-out calculation. Special rules apply to married filing separate taxpayers. 2022 AGI Phase-Out Ranges for Roth IRA Contributions Filling Status Single or HOH Married filing jointly AGI Phase-Out Range $129,000-$144,000. $204,000-$214,000 Note: Active plan participation status is not relevant to the Roth IRA phase-out calculation. Special rules apply to married filing separate taxpayers. a. During 2022, George (a 24-year-old single taxpayer) has a salary of $52,000, dividend income of $14,000, and interest income of $4,000. In addition, he has rental Income of $1,000. George is covered by a qualified retirement plan. Calculate the maximum regular IRA deduction that George is allowed. b. During 2022, Irene (a single taxpayer, under age 50) has a salary of $121,000 and dividend income of $10,000. Calculate Irene's maximum contribution to a Roth IRA c. Wanda, a single taxpayer age 63, takes a $10,000 distribution from her traditional IRA to purchase furniture for her home. Over the years she has contributed $36,000 to the IRA which had a $50,000 balance at the time of the distribution. Determine how much of Wanda's distribution is taxable. d. Same as part c, except the distribution is from a Roth IRA.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the maximum regular IRA deduction for George we need to consider his salary dividend income interest income rental income and his cover...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started