Answered step by step

Verified Expert Solution

Question

1 Approved Answer

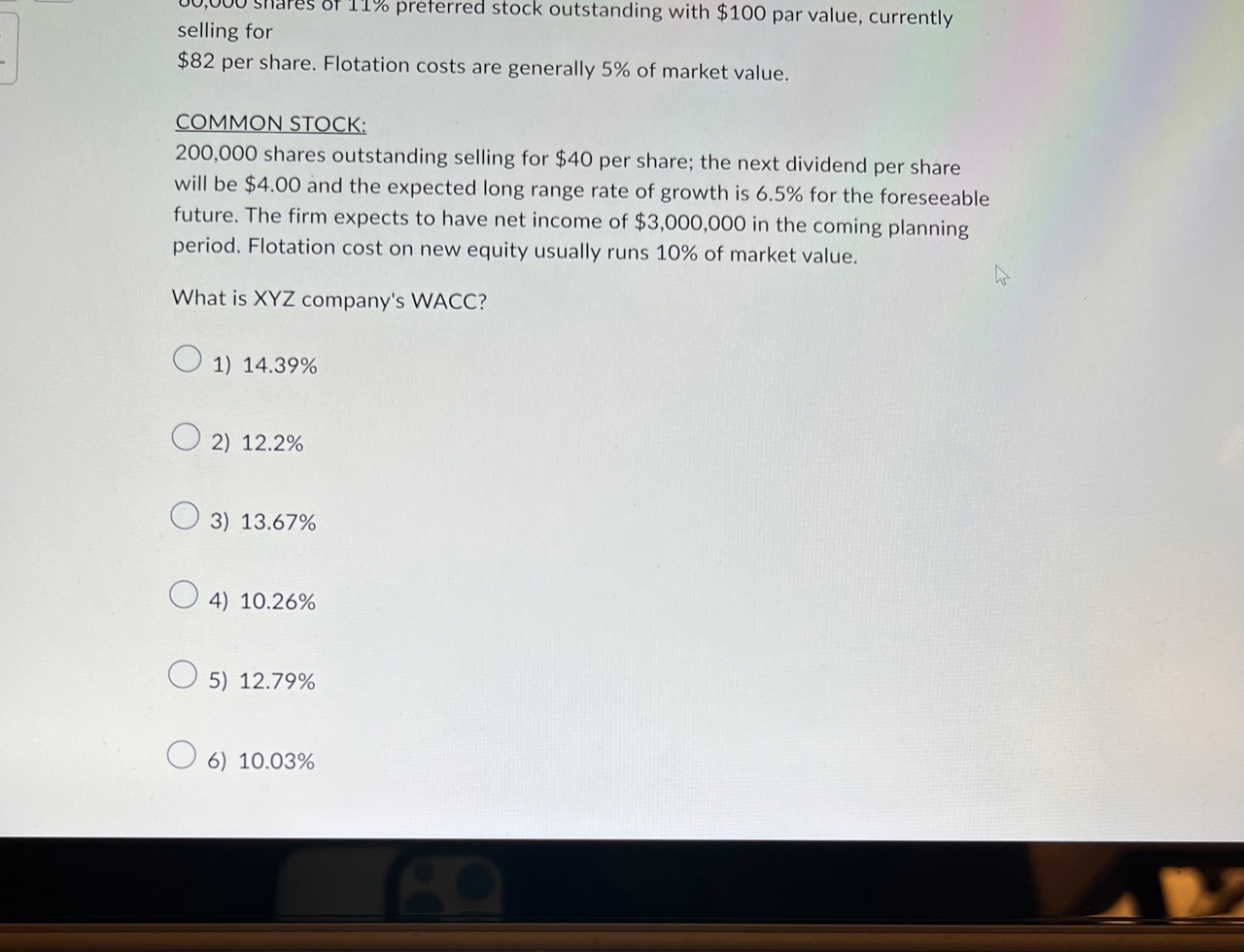

selling for $82 per share. Flotation costs are generally 5% of market value. COMMON STOCK: 200,000 shares outstanding selling for $40 per share; the next

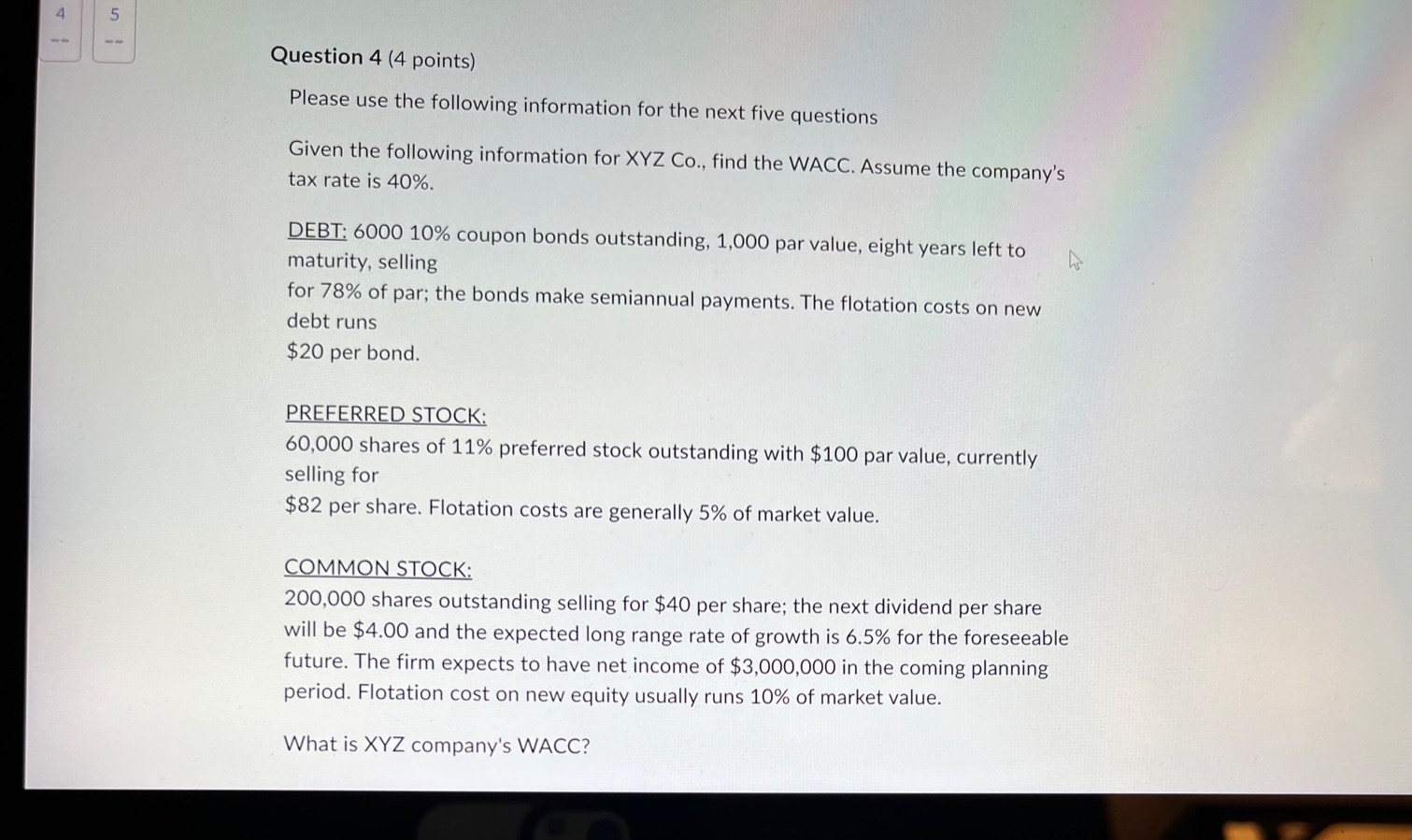

selling for $82 per share. Flotation costs are generally 5% of market value. COMMON STOCK: 200,000 shares outstanding selling for $40 per share; the next dividend per share will be $4.00 and the expected long range rate of growth is 6.5% for the foreseable future. The firm expects to have net income of $3,000,000 in the coming planning period. Flotation cost on new equity usually runs 10% of market value. What is XYZ company's WACC? 1) 14.39% 2) 12.2% 3) 13.67% 4) 10.26% 5) 12.79% 6) 10.03% Question 4 (4 points) Please use the following information for the next five questions Given the following information for XYZ Co., find the WACC. Assume the company's tax rate is 40%. DEBT: 6000 10\% coupon bonds outstanding, 1,000 par value, eight years left to maturity, selling for 78% of par; the bonds make semiannual payments. The flotation costs on new debt runs $20 per bond. PREFERRED STOCK: 60,000 shares of 11% preferred stock outstanding with $100 par value, currently selling for $82 per share. Flotation costs are generally 5% of market value. COMMON STOCK: 200,000 shares outstanding selling for $40 per share; the next dividend per share will be $4.00 and the expected long range rate of growth is 6.5% for the foreseeable future. The firm expects to have net income of $3,000,000 in the coming planning period. Flotation cost on new equity usually runs 10% of market value. What is XYZ company's WACC

selling for $82 per share. Flotation costs are generally 5% of market value. COMMON STOCK: 200,000 shares outstanding selling for $40 per share; the next dividend per share will be $4.00 and the expected long range rate of growth is 6.5% for the foreseable future. The firm expects to have net income of $3,000,000 in the coming planning period. Flotation cost on new equity usually runs 10% of market value. What is XYZ company's WACC? 1) 14.39% 2) 12.2% 3) 13.67% 4) 10.26% 5) 12.79% 6) 10.03% Question 4 (4 points) Please use the following information for the next five questions Given the following information for XYZ Co., find the WACC. Assume the company's tax rate is 40%. DEBT: 6000 10\% coupon bonds outstanding, 1,000 par value, eight years left to maturity, selling for 78% of par; the bonds make semiannual payments. The flotation costs on new debt runs $20 per bond. PREFERRED STOCK: 60,000 shares of 11% preferred stock outstanding with $100 par value, currently selling for $82 per share. Flotation costs are generally 5% of market value. COMMON STOCK: 200,000 shares outstanding selling for $40 per share; the next dividend per share will be $4.00 and the expected long range rate of growth is 6.5% for the foreseeable future. The firm expects to have net income of $3,000,000 in the coming planning period. Flotation cost on new equity usually runs 10% of market value. What is XYZ company's WACC Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started