Question

Seng Pte Ltd is a company incorporated in Singapore and adopts the Singapore FRSs. The comparative statements of financial position and extract of its final

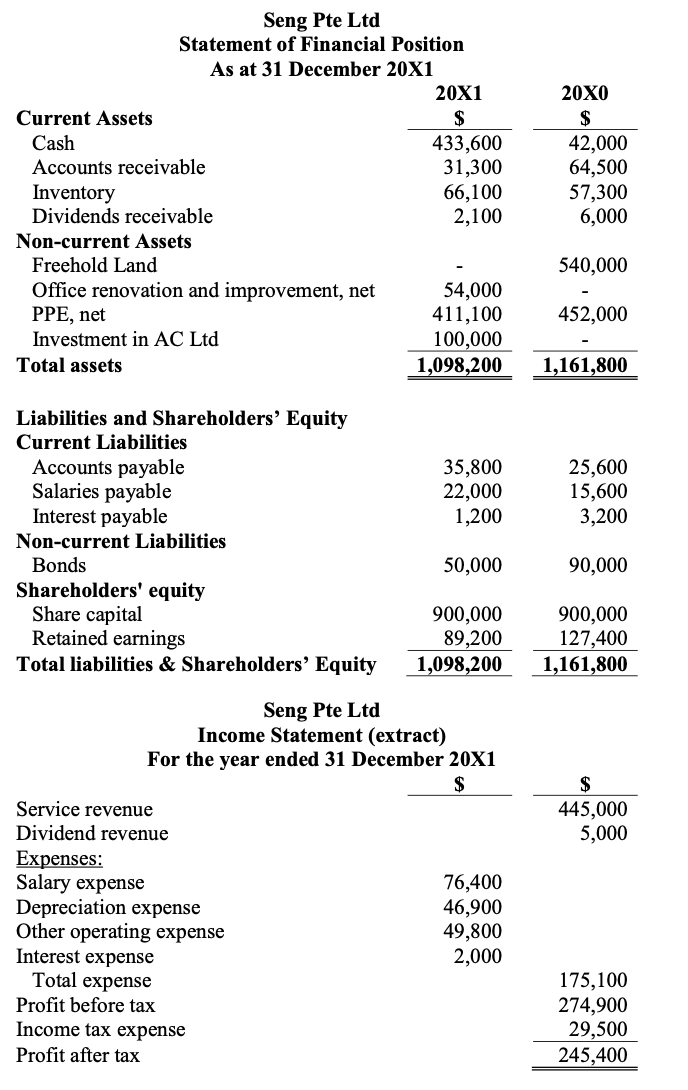

Seng Pte Ltd is a company incorporated in Singapore and adopts the Singapore FRSs. The comparative statements of financial position and extract of its final income statement for Seng Pte Ltd are given as follow:

Additional information:

(1) In December 20X1, Seng Pte Ltd sold its freehold land at cost for cash. There is no other disposal of fixed assets.

(2) During the year, the company renovated its office and capitalised the cost (incurred in cash) accordingly. Depreciation on this cost has also been accounted for

(3) The investments in other companies were also made in cash.

(4) The companys practice is to classify interest receipts and dividend receipts and interest payments as under operating cash flows and dividend payments as under financing cash flows on the Statement of Cash Flows.

(5) When preparing the Statement of Cash Flows, the companys practice is to present the section on cash flows from operating activities using the indirect method.

Prepare Seng Pte Ltds Statement of Cash Flows for the year ended 31 December 20X1.

Please show all workings clearly.

Seng Pte Ltd Statement of Financial Position As at 31 December 20X1 20X1 Current Assets $ Cash 433,600 Accounts receivable 31,300 Inventory 66,100 Dividends receivable 2,100 Non-current Assets Freehold Land Office renovation and improvement, net 54,000 PPE, net 411,100 Investment in AC Ltd 100,000 Total assets 1,098,200 20X0 $ 42,000 64,500 57,300 6,000 540,000 452,000 1,161,800 35,800 22,000 1,200 25,600 15,600 3,200 Liabilities and Shareholders' Equity Current Liabilities Accounts payable Salaries payable Interest payable Non-current Liabilities Bonds Shareholders' equity Share capital Retained earnings Total liabilities & Shareholders' Equity 50,000 90,000 900,000 89,200 1,098,200 900,000 127,400 1,161,800 $ 445,000 5,000 Seng Pte Ltd Income Statement (extract) For the year ended 31 December 20X1 $ Service revenue Dividend revenue Expenses: Salary expense 76,400 Depreciation expense 46,900 Other operating expense 49,800 Interest expense 2,000 Total expense Profit before tax Income tax expense Profit after tax 175,100 274,900 29,500 245,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started