Question

Sensitivity Analysis for Aria Acoustics, Inc. Use the spreadsheet for the voice-emulating implant project by Aria Acoustics, Inc in Assignment 5. You may either use

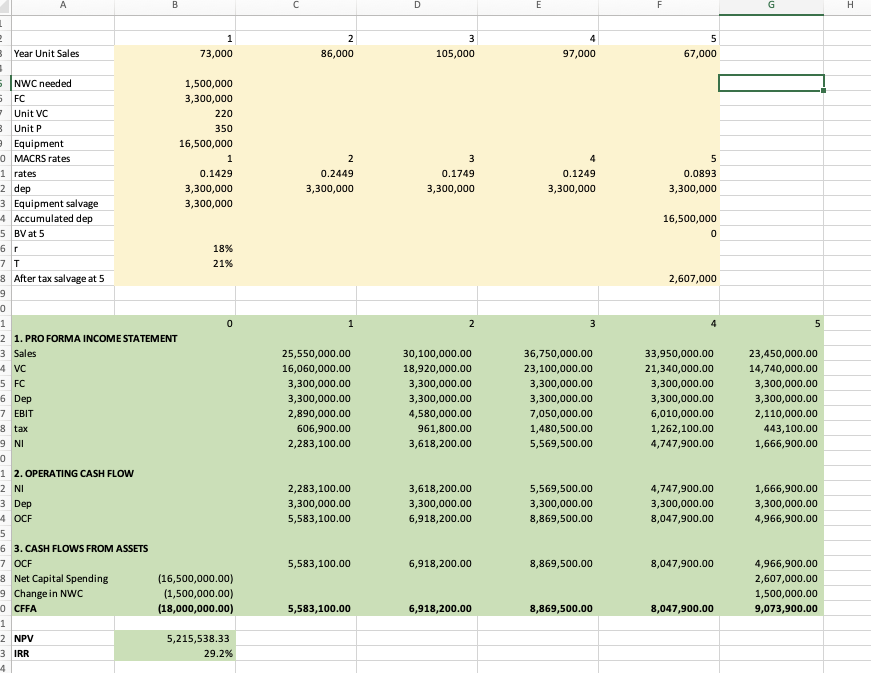

Sensitivity Analysis for Aria Acoustics, Inc. Use the spreadsheet for the voice-emulating implant project by Aria Acoustics, Inc in Assignment 5. You may either use the spreadsheet that you submitted for Assignment 5 or download the spreadsheet from Blackboard (in the tab Assignments). Perform sensitivity analysis for the following variables: 1. unit price; 2. discount rate. Use the Data Table tool in excel to perform the analysis. A. If all other assumptions remain the same, what is the unit price below which the company should not accept the project? B. Ifallotherassumptionsremainthesame,whatisthediscountrateabovewhichthe company should not accept the project?

Year Unit Sales 1 73,000 286,0003105,000 1,500,000 3,300,000 NWC needed FC 220 Unit VC 350 16,500,000 Equipment \begin{tabular}{l|lr} \hline & rates & 1 \\ 2 & dep & 0.1429 \\ 3 & Equipment salvage & 3,300,000 \\ 4 & Accumulated dep & 3,300,000 \\ 5 & BVat 5 & \\ 6 & r & 18% \\ 7 & T & 21% \\ \hline \end{tabular} 2 0.2449 3,300,000 30.17493,300,00040.12493,300,00050.08933,300,000 After tax salvage at 5 2,607,000 1. PRO FORMA INCOMESTATEMENT 0 1 2 3 16,500,000 Sales VC 25,550,000.0016,060,000.003,300,000.003,300,000.002,890,000.00606,900.002,283,100.0030,100,000.0018,920,000.003,300,000.003,300,000.004,580,000.00961,800.003,618,200.0036,750,000.0023,100,000.003,300,000.003,300,000.007,050,000.001,480,500.005,569,500.0033,950,000.0021,340,000.003,300,000.003,300,000.006,010,000.001,262,100.004,747,900.0023,450,000.0014,740,000.003,300,000.003,300,000.002,110,000.00443,100.001,666,900.00 2. OPERATING CASH FLOW 3. CASH FLOWS FROM ASSETS Year Unit Sales 1 73,000 286,0003105,000 1,500,000 3,300,000 NWC needed FC 220 Unit VC 350 16,500,000 Equipment \begin{tabular}{l|lr} \hline & rates & 1 \\ 2 & dep & 0.1429 \\ 3 & Equipment salvage & 3,300,000 \\ 4 & Accumulated dep & 3,300,000 \\ 5 & BVat 5 & \\ 6 & r & 18% \\ 7 & T & 21% \\ \hline \end{tabular} 2 0.2449 3,300,000 30.17493,300,00040.12493,300,00050.08933,300,000 After tax salvage at 5 2,607,000 1. PRO FORMA INCOMESTATEMENT 0 1 2 3 16,500,000 Sales VC 25,550,000.0016,060,000.003,300,000.003,300,000.002,890,000.00606,900.002,283,100.0030,100,000.0018,920,000.003,300,000.003,300,000.004,580,000.00961,800.003,618,200.0036,750,000.0023,100,000.003,300,000.003,300,000.007,050,000.001,480,500.005,569,500.0033,950,000.0021,340,000.003,300,000.003,300,000.006,010,000.001,262,100.004,747,900.0023,450,000.0014,740,000.003,300,000.003,300,000.002,110,000.00443,100.001,666,900.00 2. OPERATING CASH FLOW 3. CASH FLOWS FROM ASSETSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started