Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SensorTech makes motion sensors to detect intruders in high-security buildings. It currently has an annual revenue of approximately $3 million and has 14 employees (founder/CEO,

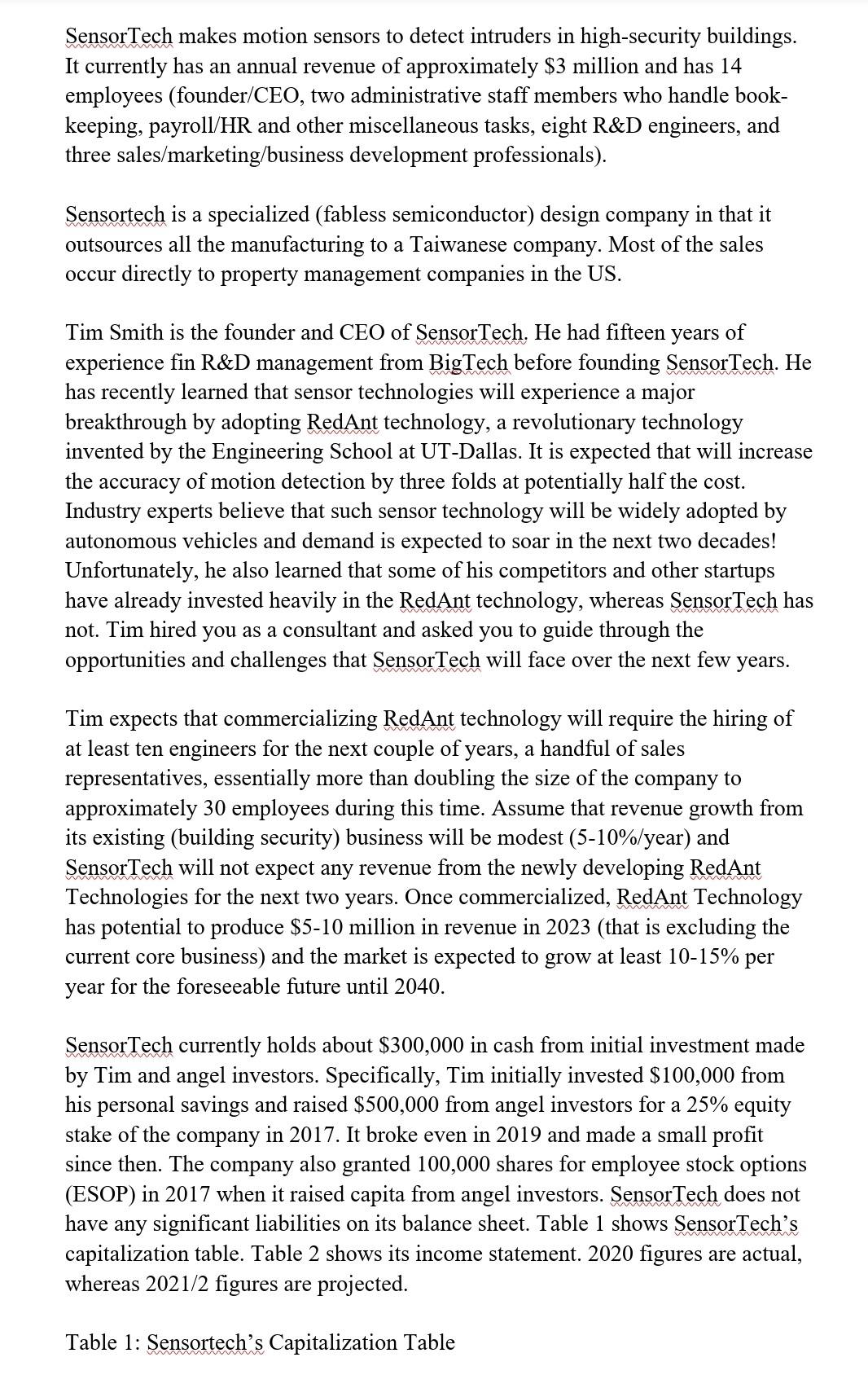

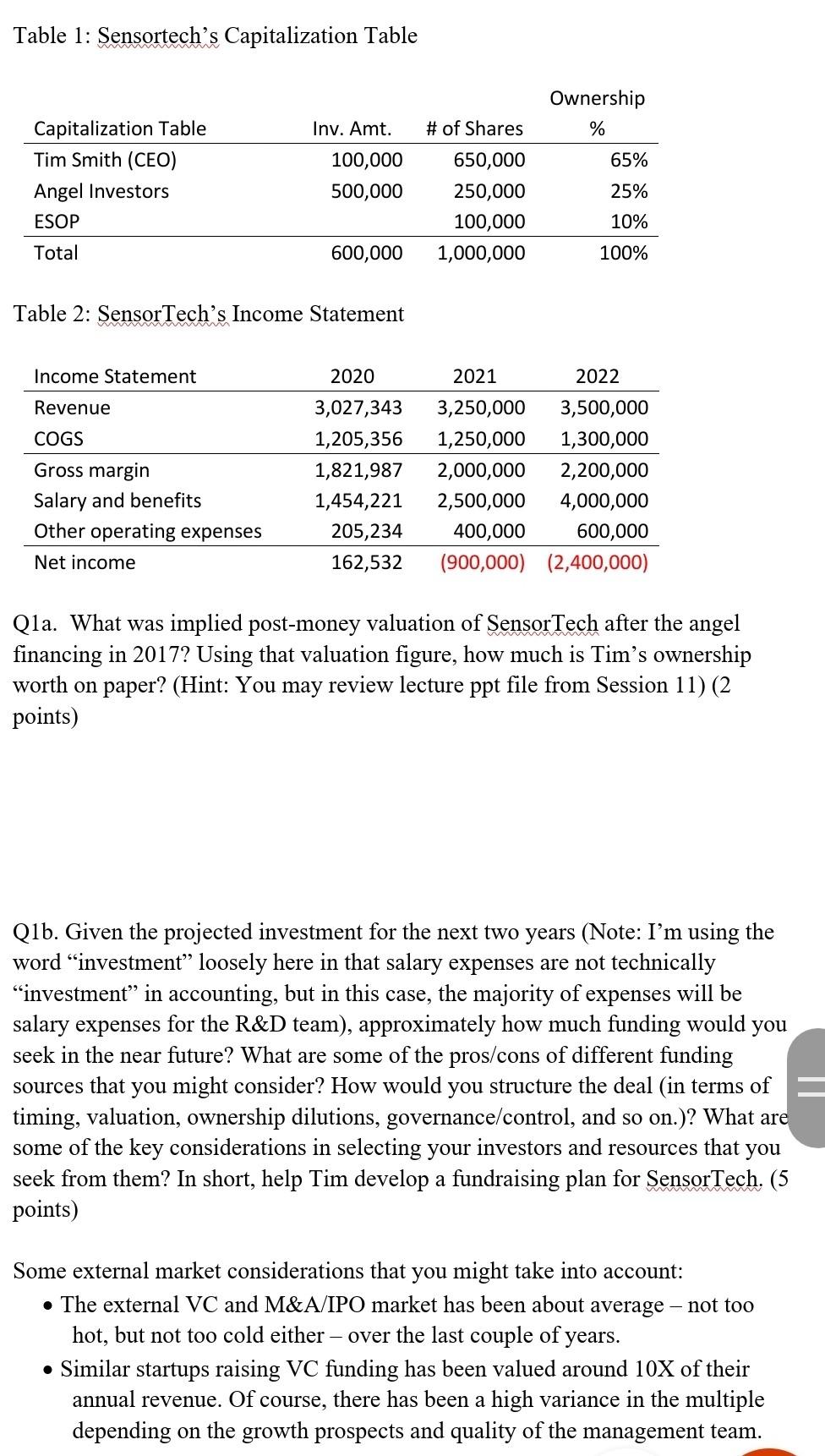

SensorTech makes motion sensors to detect intruders in high-security buildings. It currently has an annual revenue of approximately $3 million and has 14 employees (founder/CEO, two administrative staff members who handle book- keeping, payroll/HR and other miscellaneous tasks, eight R&D engineers, and three sales/marketing/business development professionals). Sensortech is a specialized (fabless semiconductor) design company in that it outsources all the manufacturing to a Taiwanese company. Most of the sales occur directly to property management companies in the US. Tim Smith is the founder and CEO of SensorTech. He had fifteen years of experience fin R&D management from BigTech before founding SensorTech. He has recently learned that sensor technologies will experience a major breakthrough by adopting RedAnt technology, a revolutionary technology invented by the Engineering School at UT-Dallas. It is expected that will increase the accuracy of motion detection by three folds at potentially half the cost. Industry experts believe that such sensor technology will be widely adopted by autonomous vehicles and demand is expected to soar in the next two decades! Unfortunately, he also learned that some of his competitors and other startups have already invested heavily in the RedAnt technology, whereas SensorTech has not. Tim hired you as a consultant and asked you to guide through the opportunities and challenges that SensorTech will face over the next few years. Tim expects that commercializing RedAnt technology will require the hiring of at least ten engineers for the next couple of years, a handful of sales representatives, essentially more than doubling the size of the company to approximately 30 employees during this time. Assume that revenue growth from its existing (building security) business will be modest (5-10%/year) and SensorTech will not expect any revenue from the newly developing RedAnt Technologies for the next two years. Once commercialized, RedAnt Technology has potential to produce $5-10 million in revenue in 2023 (that is excluding the current core business) and the market is expected to grow at least 10-15% per year for the foreseeable future until 2040. SensorTech currently holds about $300,000 in cash from initial investment made by Tim and angel investors. Specifically, Tim initially invested $100,000 from his personal savings and raised $500,000 from angel investors for a 25% equity stake of the company in 2017. It broke even in 2019 and made a small profit since then. The company also granted 100,000 shares for employee stock options (ESOP) in 2017 when it raised capita from angel investors. SensorTech does not have any significant liabilities on its balance sheet. Table 1 shows SensorTech's capitalization table. Table 2 shows its income statement. 2020 figures are actual, whereas 2021/2 figures are projected. Table 1: Sensortech's Capitalization Table Table 1: Sensortech's Capitalization Table Ownership % Capitalization Table Tim Smith (CEO) Angel Investors ESOP Inv. Amt. 100,000 500,000 65% # of Shares 650,000 250,000 100,000 1,000,000 25% 10% Total 600,000 100% Table 2: Sensor Tech's Income Statement Income Statement 2020 Revenue COGS Gross margin Salary and benefits Other operating expenses Net income 3,027,343 1,205,356 1,821,987 1,454,221 205,234 162,532 2021 2022 3,250,000 3,500,000 1,250,000 1,300,000 2,000,000 2,200,000 2,500,000 4,000,000 400,000 600,000 (900,000) (2,400,000) Qla. What was implied post-money valuation of SensorTech after the angel financing in 2017? Using that valuation figure, how much is Tim's ownership worth on paper? (Hint: You may review lecture ppt file from Session 11) (2 points) Q1b. Given the projected investment for the next two years (Note: I'm using the word investment loosely here in that salary expenses are not technically "investment in accounting, but in this case, the majority of expenses will be salary expenses for the R&D team), approximately how much funding would you seek in the near future? What are some of the pros/cons of different funding sources that you might consider? How would you structure the deal (in terms of timing, valuation, ownership dilutions, governance/control, and so on.)? What are some of the key considerations in selecting your investors and resources that you seek from them? In short, help Tim develop a fundraising plan for SensorTech. (5 points) Some external market considerations that you might take into account: The external VC and M&A/IPO market has been about average - not too hot, but not too cold either - over the last couple of years. Similar startups raising VC funding has been valued around 10X of their annual revenue. Of course, there has been a high variance in the multiple depending on the growth prospects and quality of the management team. SensorTech makes motion sensors to detect intruders in high-security buildings. It currently has an annual revenue of approximately $3 million and has 14 employees (founder/CEO, two administrative staff members who handle book- keeping, payroll/HR and other miscellaneous tasks, eight R&D engineers, and three sales/marketing/business development professionals). Sensortech is a specialized (fabless semiconductor) design company in that it outsources all the manufacturing to a Taiwanese company. Most of the sales occur directly to property management companies in the US. Tim Smith is the founder and CEO of SensorTech. He had fifteen years of experience fin R&D management from BigTech before founding SensorTech. He has recently learned that sensor technologies will experience a major breakthrough by adopting RedAnt technology, a revolutionary technology invented by the Engineering School at UT-Dallas. It is expected that will increase the accuracy of motion detection by three folds at potentially half the cost. Industry experts believe that such sensor technology will be widely adopted by autonomous vehicles and demand is expected to soar in the next two decades! Unfortunately, he also learned that some of his competitors and other startups have already invested heavily in the RedAnt technology, whereas SensorTech has not. Tim hired you as a consultant and asked you to guide through the opportunities and challenges that SensorTech will face over the next few years. Tim expects that commercializing RedAnt technology will require the hiring of at least ten engineers for the next couple of years, a handful of sales representatives, essentially more than doubling the size of the company to approximately 30 employees during this time. Assume that revenue growth from its existing (building security) business will be modest (5-10%/year) and SensorTech will not expect any revenue from the newly developing RedAnt Technologies for the next two years. Once commercialized, RedAnt Technology has potential to produce $5-10 million in revenue in 2023 (that is excluding the current core business) and the market is expected to grow at least 10-15% per year for the foreseeable future until 2040. SensorTech currently holds about $300,000 in cash from initial investment made by Tim and angel investors. Specifically, Tim initially invested $100,000 from his personal savings and raised $500,000 from angel investors for a 25% equity stake of the company in 2017. It broke even in 2019 and made a small profit since then. The company also granted 100,000 shares for employee stock options (ESOP) in 2017 when it raised capita from angel investors. SensorTech does not have any significant liabilities on its balance sheet. Table 1 shows SensorTech's capitalization table. Table 2 shows its income statement. 2020 figures are actual, whereas 2021/2 figures are projected. Table 1: Sensortech's Capitalization Table Table 1: Sensortech's Capitalization Table Ownership % Capitalization Table Tim Smith (CEO) Angel Investors ESOP Inv. Amt. 100,000 500,000 65% # of Shares 650,000 250,000 100,000 1,000,000 25% 10% Total 600,000 100% Table 2: Sensor Tech's Income Statement Income Statement 2020 Revenue COGS Gross margin Salary and benefits Other operating expenses Net income 3,027,343 1,205,356 1,821,987 1,454,221 205,234 162,532 2021 2022 3,250,000 3,500,000 1,250,000 1,300,000 2,000,000 2,200,000 2,500,000 4,000,000 400,000 600,000 (900,000) (2,400,000) Qla. What was implied post-money valuation of SensorTech after the angel financing in 2017? Using that valuation figure, how much is Tim's ownership worth on paper? (Hint: You may review lecture ppt file from Session 11) (2 points) Q1b. Given the projected investment for the next two years (Note: I'm using the word investment loosely here in that salary expenses are not technically "investment in accounting, but in this case, the majority of expenses will be salary expenses for the R&D team), approximately how much funding would you seek in the near future? What are some of the pros/cons of different funding sources that you might consider? How would you structure the deal (in terms of timing, valuation, ownership dilutions, governance/control, and so on.)? What are some of the key considerations in selecting your investors and resources that you seek from them? In short, help Tim develop a fundraising plan for SensorTech. (5 points) Some external market considerations that you might take into account: The external VC and M&A/IPO market has been about average - not too hot, but not too cold either - over the last couple of years. Similar startups raising VC funding has been valued around 10X of their annual revenue. Of course, there has been a high variance in the multiple depending on the growth prospects and quality of the management team

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started