Question

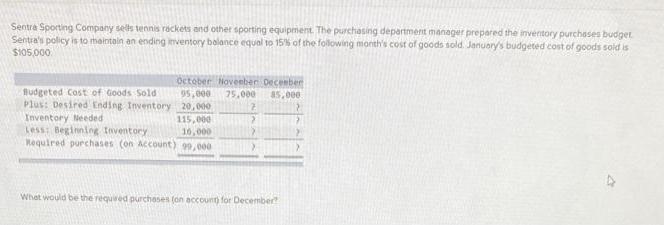

Sentra Sporting Company sells tennis rackets and other sporting equipment. The purchasing department manager prepared the inventory purchases budget Sentra's policy is to maintain

Sentra Sporting Company sells tennis rackets and other sporting equipment. The purchasing department manager prepared the inventory purchases budget Sentra's policy is to maintain an ending inventory balance equal to 15% of the following month's cost of goods sold. January's budgeted cost of goods sold is $105,000 October November December 95,000 25,000 85.000 Budgeted Cost of Goods Sold Plus: Desired Ending Inventory 20,000 Inventory Needed 2 115,000 > Less: Beginning Inventory 10,000 Required purchases (on Account) 99,000 > What would be the required purchases (on account) for December

Step by Step Solution

3.58 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Jan Oct De c Nov 105000 Budgeted cost of Goods sold 95000 Desired Ending inventory 20000 Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Managerial Accounting Concepts

Authors: Thomas Edmonds, Christopher Edmonds, Bor Yi Tsay, Philip Old

7th edition

978-0077632427, 77632427, 78025656, 978-0078025655

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App