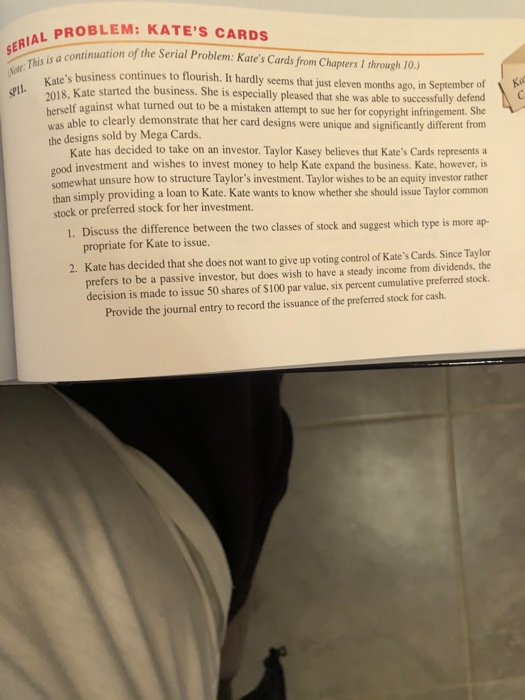

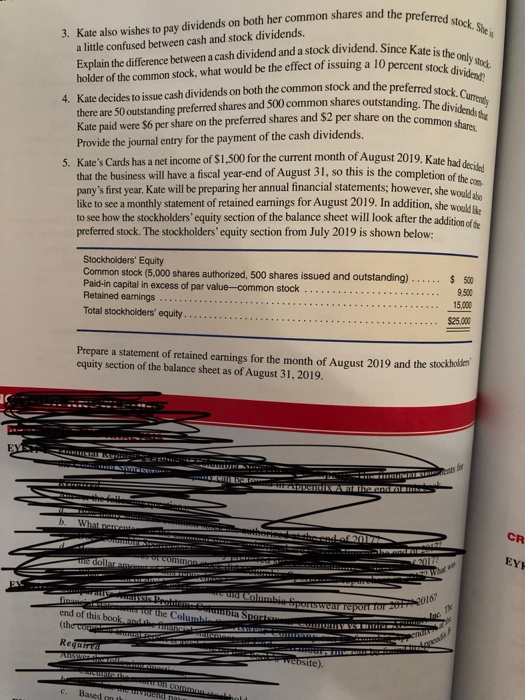

SERIAL PROBLEM: KATE'S CARDS Note: This is a continuation of the Serial Problem: Kate's Cards from Chapters I through 10.) Vete's business continues to flourish. It hardly seems that just eleven months ago, in September of 2018. Kate started the business. She is especially pleased that she was able to successfully defend berself against what turned out to be a mistaken attempt to sue her for copyright infringement. She s able to clearly demonstrate that her card designs were unique and significantly different from SPI. Ka the designs sold by Mega Cards. Kate has decided to take on an investor. Taylor Kasey believes that Kate's Cards represents a good investment and wishes to invest money to help Kate expand the business. Kate, however, is somewhat unsure how to structure Taylor's investment. Taylor wishes to be an equity investor rather than simply providing a loan to Kate. Kate wants to know whether she should issue Taylor common stock or preferred stock for her investment. 1. Discuss the difference between the two classes of stock and suggest which type is more ap- propriate for Kate to issue. 2. Kate has decided that she does not want to give up voting control of Kate's Cards. Since Taylor prefers to be a passive investor, but does wish to have a steady income from dividends, the decision is made to issue 50 shares of $100 par value, six percent cumulative preferred stock. Provide the journal entry to record the issuance of the preferred stock for cash. 3. Kate also wishes to pay dividends on both her common shares and the preferred stock. She is Explain the difference between a cash dividend and a stock dividend. Since Kate is the only stock. holder of the common stock, what would be the effect of issuing a 10 percent stock d 4. Kate decides to issue cash dividends on both the common stock and the preferred stockc there are 50 outstanding preferred shares and 500 common shares outstanding. The dividends th Kate paid were $6 per share on the preferred shares and $2 per share on the common a little confused between cash and stock dividends. Provide the journal entry for the payment of the cash dividends. 5. Kate's Cards has a net income of $1,500 for the current month of August 2019. Kate had decided that the business will have a fiscal year-end of August 31, so this is the completion of pany's first year. Kate will be preparing her annual financial statements; however, she woud like to see a monthly statement of retained earnings for August 2019. In addition, she would to see how the stockholders' equity section of the balance sheet will look after the addition of preferred stock. The stockholders' equity section from July 2019 is shown below: Stockholders' Equity Common stock (5,000 shares authorized, 500 shares issued and outstanding) Paid-in capital in excess of par value-common stock Retained earnings $ 500 9,500 15,000 Total stockholders' equity.. $25,000 Prepare a statement of retained eamings for the month of August 2019 and the stockholden equity section of the balance sheet as of August 31, 2019. ADpentIATIrendma TANMIAIA.... CR b. What percente shennddof 2017 EYF 2017 0 Common e dollar amemt e ud Columbia portswenr report ror 20 2016 raty SISPe tamia Sport finanei the Columbhl end of this book, andatun theco Jac onadi Requirta Website). ICUIRIO Based on th