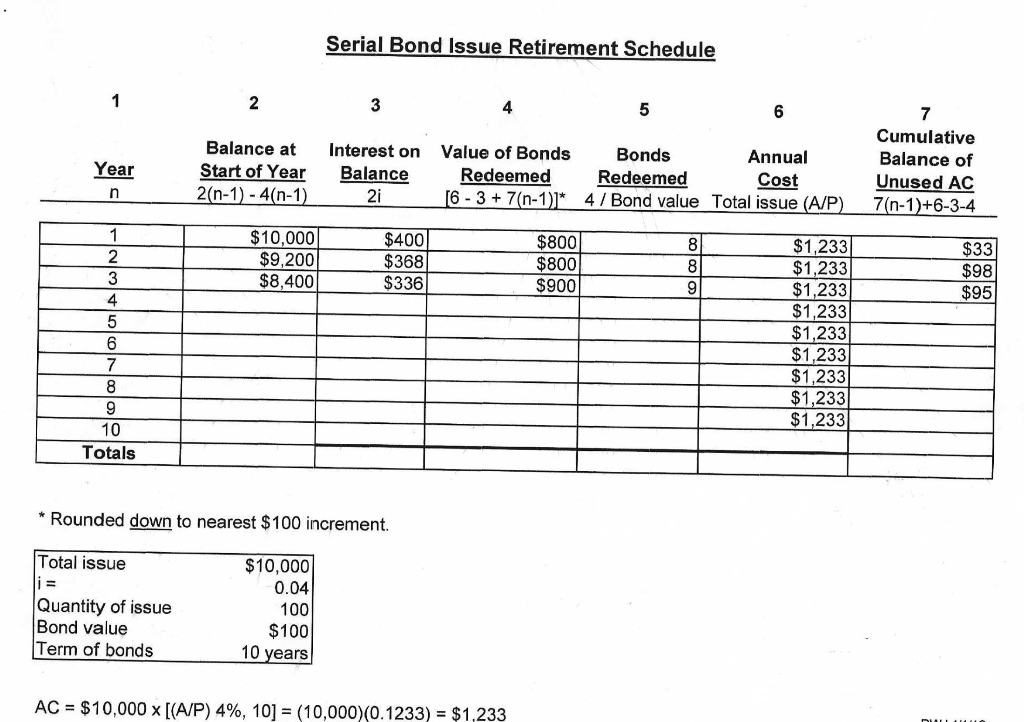

Series Bond Issue Amortization Schedule A $10,000 debt in the form of $100 serial bonds bears 4% interest payable annually. Construct a payment schedule for the repayment (amortization) of this bond issue in 10 equal payments (except for the last payment). Partial bonds may not be retired. A serial bond issue is redeemed in uniform annual amounts, and it is not permitted to redeem a partial bond. This arrangement provides for the maturity of an increasing fraction of the total number of outstanding bonds each year. As progressive uniform annual payments are made, the charge for interest on the unpaid balance becomes progressively less, and a larger part of the remaining unretired principal can be paid off. This is different from redemption by sinking fund, as is done with term bonds, where the entire principal is paid off at the same time, that is, all the bonds mature and are redeemed simultaneously. To construct a schedule for amortization of a serial issue by equal annual payments, it is first necessary to determine the uniform annual payment at the end of each year to cover the cost of the interest on the outstanding bonds, with the balance of the payment going towards principal (retirement of remaining outstanding bonds). Serial Bond Issue Retirement Schedule 1 2 3 5 6 7 Year Balance at Start of Year 2(n-1) - 4(n-1) Interest on Balance 2i Value of Bonds Bonds Annual Redeemed Redeemed Cost [6 - 3 + 7(n-1)]* 4 /Bond value Total issue (A/P) Cumulative Balance of Unused AC 7(n-1)+6-3-4 n $33 $10,000 $9,200 $8,400 $400 $368 $336 $800 $800 $900 8 8 9 $98 $95 1 2 3 4 5 6 7 8 9 10 Totals $1,233 $1,233 $1,233 $1,233 $1,233 $1,233 $1,233 $1,2331 $1,233 * Rounded down to nearest $100 increment. Total issue i = Quantity of issue Bond value Term of bonds $10,000 0.04 100 $100 10 years AC = $10,000 x [(A/P) 4%, 10) = (10,000) (0.1233) = $1,233 Series Bond Issue Amortization Schedule A $10,000 debt in the form of $100 serial bonds bears 4% interest payable annually. Construct a payment schedule for the repayment (amortization) of this bond issue in 10 equal payments (except for the last payment). Partial bonds may not be retired. A serial bond issue is redeemed in uniform annual amounts, and it is not permitted to redeem a partial bond. This arrangement provides for the maturity of an increasing fraction of the total number of outstanding bonds each year. As progressive uniform annual payments are made, the charge for interest on the unpaid balance becomes progressively less, and a larger part of the remaining unretired principal can be paid off. This is different from redemption by sinking fund, as is done with term bonds, where the entire principal is paid off at the same time, that is, all the bonds mature and are redeemed simultaneously. To construct a schedule for amortization of a serial issue by equal annual payments, it is first necessary to determine the uniform annual payment at the end of each year to cover the cost of the interest on the outstanding bonds, with the balance of the payment going towards principal (retirement of remaining outstanding bonds). Serial Bond Issue Retirement Schedule 1 2 3 5 6 7 Year Balance at Start of Year 2(n-1) - 4(n-1) Interest on Balance 2i Value of Bonds Bonds Annual Redeemed Redeemed Cost [6 - 3 + 7(n-1)]* 4 /Bond value Total issue (A/P) Cumulative Balance of Unused AC 7(n-1)+6-3-4 n $33 $10,000 $9,200 $8,400 $400 $368 $336 $800 $800 $900 8 8 9 $98 $95 1 2 3 4 5 6 7 8 9 10 Totals $1,233 $1,233 $1,233 $1,233 $1,233 $1,233 $1,233 $1,2331 $1,233 * Rounded down to nearest $100 increment. Total issue i = Quantity of issue Bond value Term of bonds $10,000 0.04 100 $100 10 years AC = $10,000 x [(A/P) 4%, 10) = (10,000) (0.1233) = $1,233