Answered step by step

Verified Expert Solution

Question

1 Approved Answer

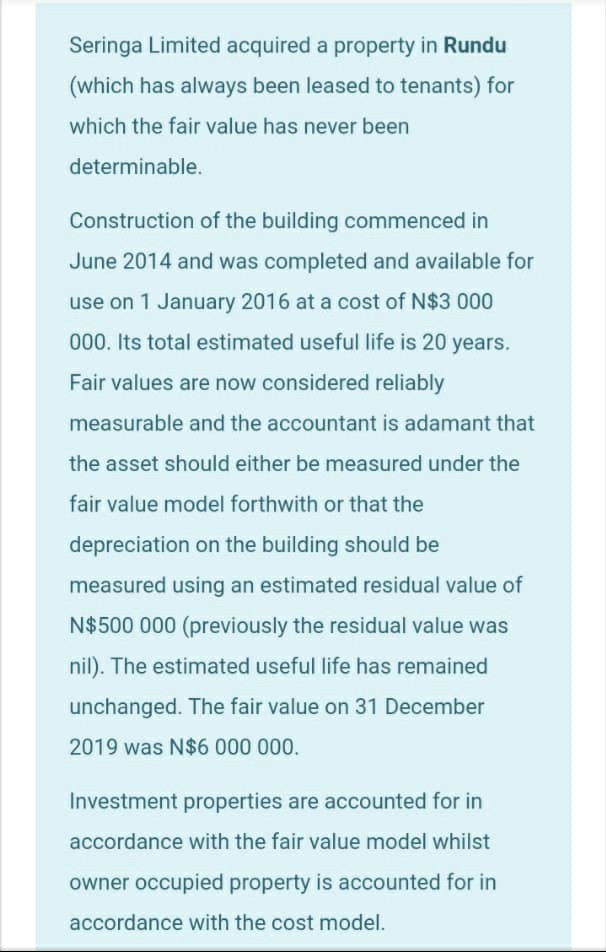

Seringa Limited acquired a property in Rundu (which has always been leased to tenants) for which the fair value has never been determinable. Construction of

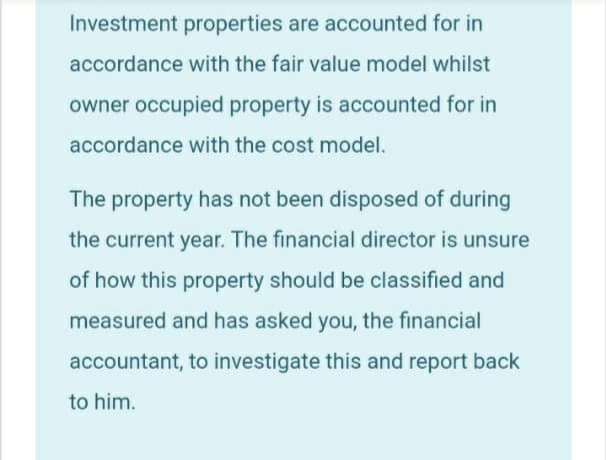

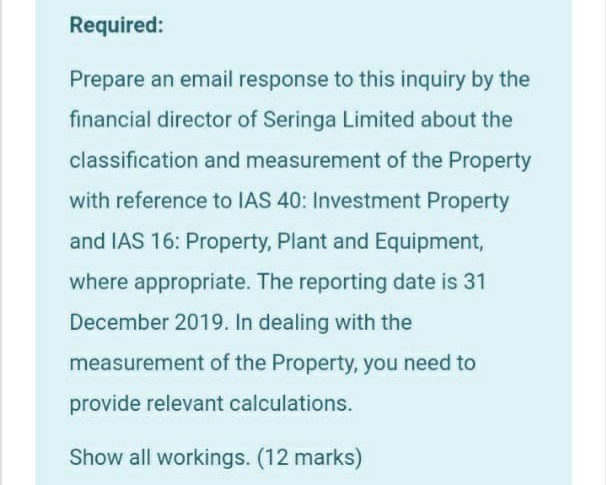

Seringa Limited acquired a property in Rundu (which has always been leased to tenants) for which the fair value has never been determinable. Construction of the building commenced in June 2014 and was completed and available for use on 1 January 2016 at a cost of N$3 000 000. Its total estimated useful life is 20 years. Fair values are now considered reliably measurable and the accountant is adamant that the asset should either be measured under the fair value model forthwith or that the depreciation on the building should be measured using an estimated residual value of N$500 000 (previously the residual value was nil). The estimated useful life has remained unchanged. The fair value on 31 December 2019 was N$6 000 000. Investment properties are accounted for in accordance with the fair value model whilst owner occupied property is accounted for in accordance with the cost model. Investment properties are accounted for in accordance with the fair value model whilst owner occupied property is accounted for in accordance with the cost model. The property has not been disposed of during the current year. The financial director is unsure of how this property should be classified and measured and has asked you, the financial accountant, to investigate this and report back to him. Required: Prepare an email response to this inquiry by the financial director of Seringa Limited about the classification and measurement of the Property with reference to IAS 40: Investment Property and IAS 16: Property, Plant and Equipment, where appropriate. The reporting date is 31 December 2019. In dealing with the measurement of the Property, you need to provide relevant calculations. Show all workings. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started