Question

Service versus manufacturing companies Wang Company began operations on January 1, 2018, by issuing common stock for $70,000 cash. During 2018, Wang received $88,000 cash

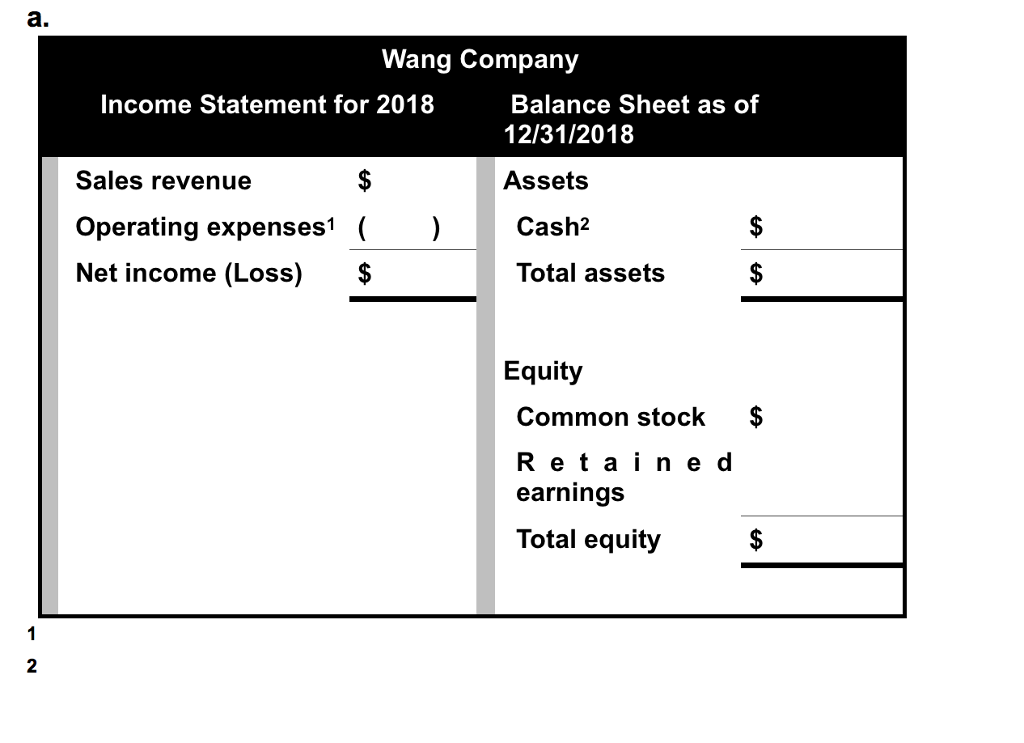

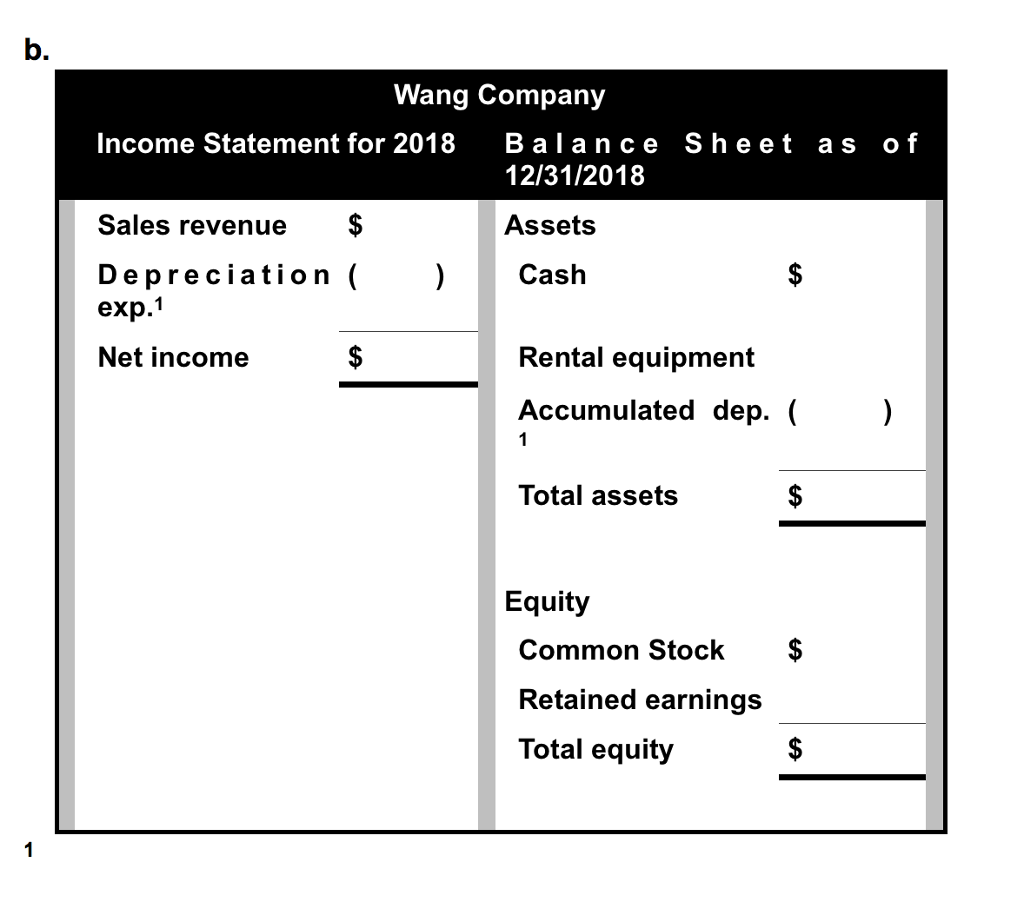

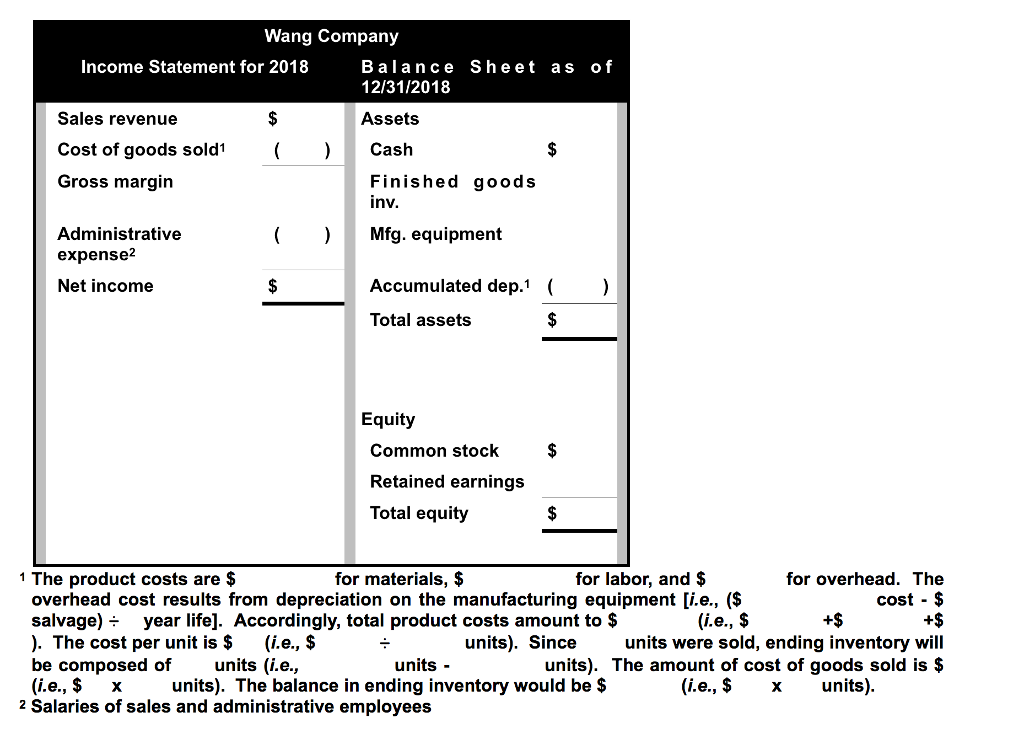

Service versus manufacturing companies Wang Company began operations on January 1, 2018, by issuing common stock for $70,000 cash. During 2018, Wang received $88,000 cash from revenue and incurred costs that required $65,000 of cash payments. Required Prepare a GAAP-based income statement and balance sheet for Wang Company for 2018, under each of the following independent scenarios: a. Wang is a promoter of rock concerts. The $65,000 was paid to provide a rock concert that pro- duced the revenue. b. Wang is in the car rental business. The $65,000 was paid to purchase automobiles. The automobiles were purchased on January 1, 2018, and have five-year useful lives, with no expected salvage value. Wang uses straight-line depreciation. The revenue was generated by leasing the automobiles. c. Wang is a manufacturing company. The $65,000 was paid to purchase the following items:

(1) Paid $10,000 cash to purchase materials that were used to make products during the year.

(2) Paid $20,000 cash for wages of factory workers who made products during the year.

(3) Paid $5,000 cash for salaries of sales and administrative employees. (4) Paid $30,000 cash to purchase manufacturing equipment. The equipment was used solely to make products. It had a three-year life and a $6,000 salvage value. The company uses straight- line depreciation. (5) During 2018, Wang started and completed 2,000 units of product. The revenue was earned when Wang sold 1,500 units of product to its customers.

d. Refer to Requirement c. Could Wang determine the actual cost of making the 500th unit of prod- uct? How likely is it that the actual cost of the 500th unit of product was exactly the same as the cost of producing the 501st unit of product? Explain why management may be more interested in average cost than in actual cost.

PLEASE FILL OUT ANSWERS SIMILAR TO THE BELOW EXAMPLES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started