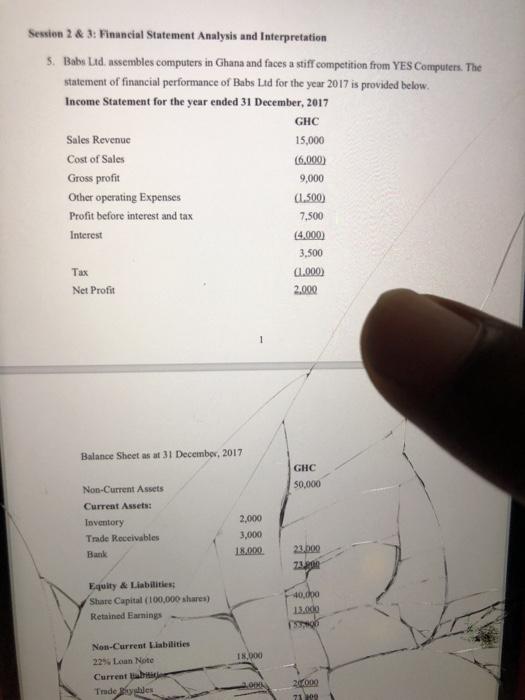

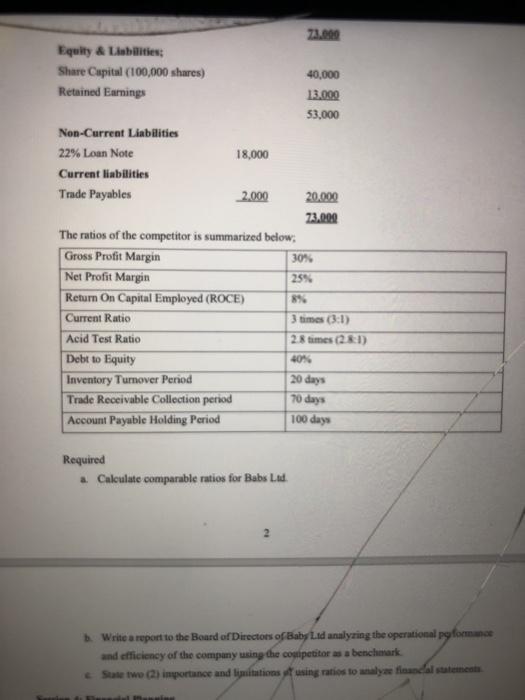

Session 2 & 3: Financial Statement Analysis and Interpretation 5. Babs Ltd. assembles computers in Ghana and faces a stiff competition from YES Computers. The statement of financial performance of Babs Ltd for the year 2017 is provided below. Income Statement for the year ended 31 December, 2017 GHC Sales Revenue 15,000 Cost of Sales (6.000) Gross profit Other operating Expenses 0.500) Profit before interest and tax 7.500 Interest (4.000 3,500 Tax 01.000) Net Profit 9,000 2.000 1 Balance Sheet as at 31 December, 2017 GHC 50,000 Non-Current Assets Current Assets: Toventory Trade Receivables Bank 2,000 3,000 18.000 22.000 7120 Equity & Liabilities Share Capital (100,000 shares) Retained Earnings 40.000 13.do 18.000 Non-Current Liabilities 225 Loan Note Current Trade Boyle LO 71 71.000 Equity & Liabilities: Share Capital (100,000 shares) 40,000 Retained Earings 13.000 53,000 Non-Current Liabilities 22% Loan Note 18,000 Current liabilities Trade Payables 2.000 20.000 73.009 The ratios of the competitor is summarized below; Gross Profit Margin 30% Net Profit Margin 25% Return On Capital Employed (ROCE) 89 Current Ratio 3 times (3:1) Acid Test Ratio 2.8 times (281) Debt to Equity 40% Inventory Turnover Period 20 days Trade Receivable Collection period Account Payable Holding Period 70 days 100 days Required a Calculate comparable ratios for Babs Led Write a report to the Board of Directors of Baby Lad analyzing the operational po formance and efficiency of the company using the competitor as a benchmark Satwo () importance and lipitations using ratios to mye financial statement Session 2 & 3: Financial Statement Analysis and Interpretation 5. Babs Ltd. assembles computers in Ghana and faces a stiff competition from YES Computers. The statement of financial performance of Babs Ltd for the year 2017 is provided below. Income Statement for the year ended 31 December, 2017 GHC Sales Revenue 15,000 Cost of Sales (6.000) Gross profit Other operating Expenses 0.500) Profit before interest and tax 7.500 Interest (4.000 3,500 Tax 01.000) Net Profit 9,000 2.000 1 Balance Sheet as at 31 December, 2017 GHC 50,000 Non-Current Assets Current Assets: Toventory Trade Receivables Bank 2,000 3,000 18.000 22.000 7120 Equity & Liabilities Share Capital (100,000 shares) Retained Earnings 40.000 13.do 18.000 Non-Current Liabilities 225 Loan Note Current Trade Boyle LO 71 71.000 Equity & Liabilities: Share Capital (100,000 shares) 40,000 Retained Earings 13.000 53,000 Non-Current Liabilities 22% Loan Note 18,000 Current liabilities Trade Payables 2.000 20.000 73.009 The ratios of the competitor is summarized below; Gross Profit Margin 30% Net Profit Margin 25% Return On Capital Employed (ROCE) 89 Current Ratio 3 times (3:1) Acid Test Ratio 2.8 times (281) Debt to Equity 40% Inventory Turnover Period 20 days Trade Receivable Collection period Account Payable Holding Period 70 days 100 days Required a Calculate comparable ratios for Babs Led Write a report to the Board of Directors of Baby Lad analyzing the operational po formance and efficiency of the company using the competitor as a benchmark Satwo () importance and lipitations using ratios to mye financial statement