Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Set Financial Calculator to Zero Decimal Place Westwood Corporation manufactures and sells drones and provides high-end cinematography services to several major clients. All sales are

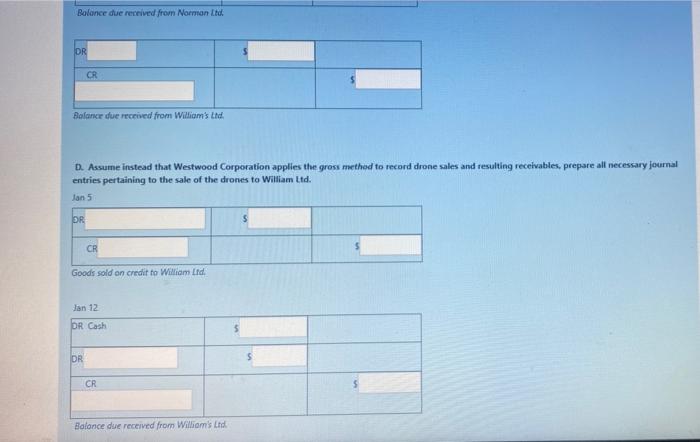

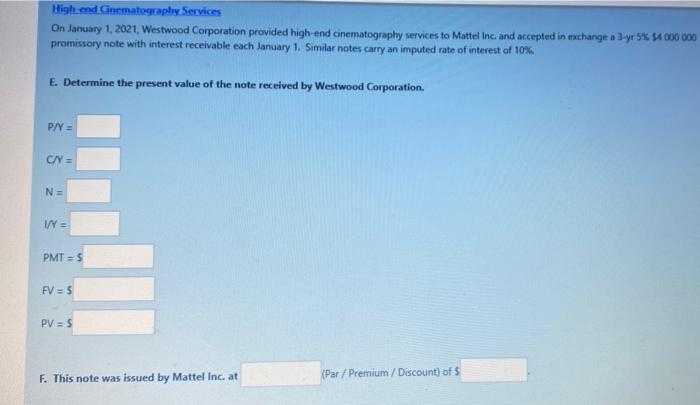

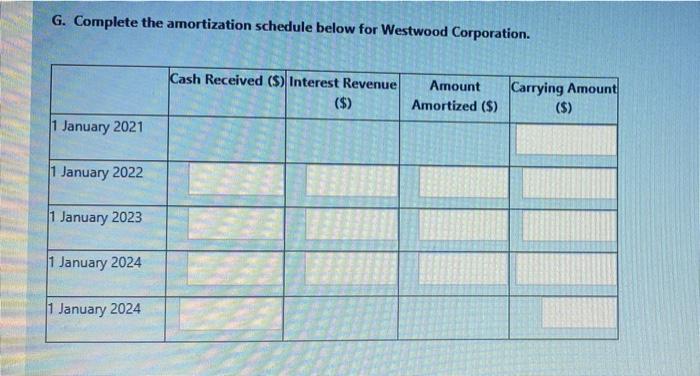

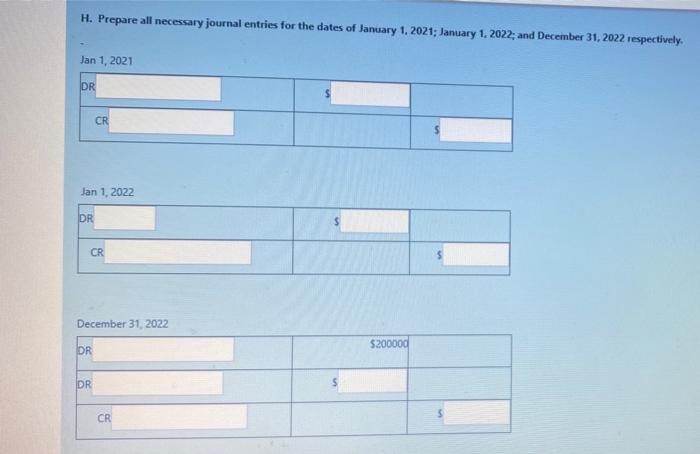

Set Financial Calculator to Zero Decimal Place

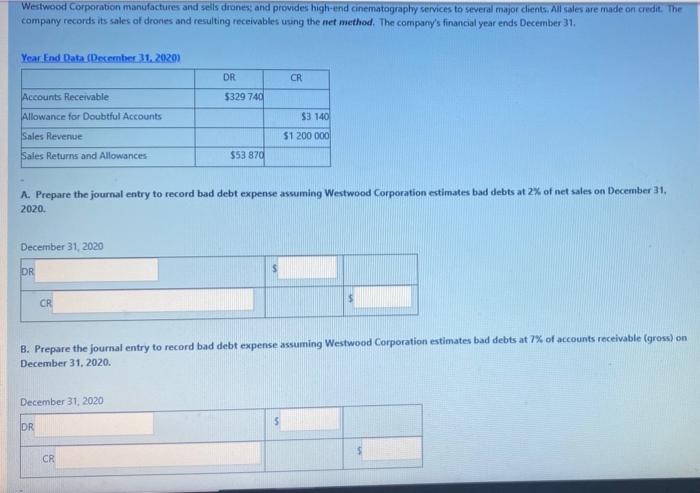

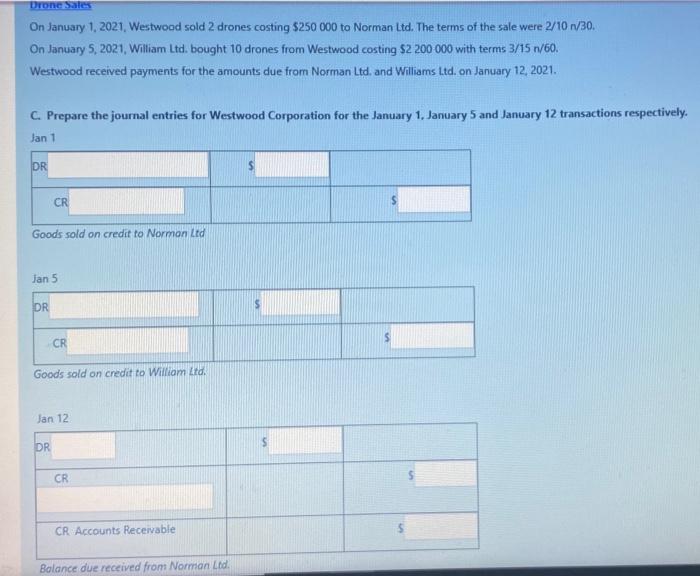

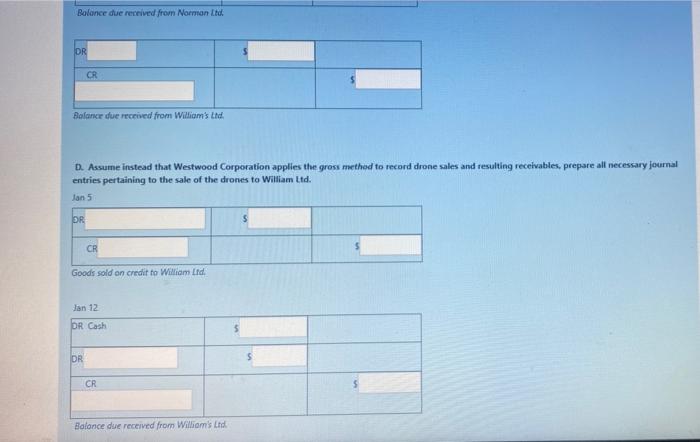

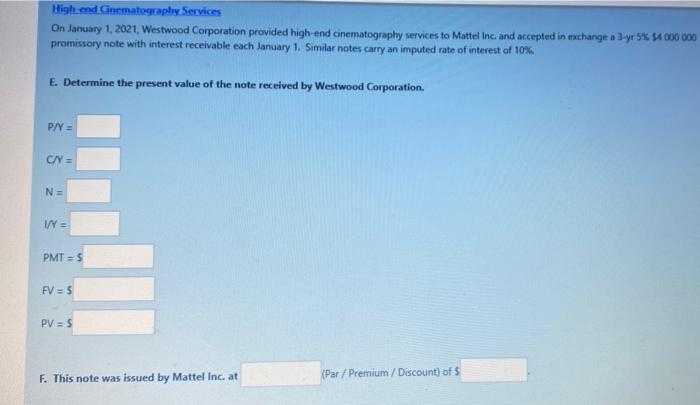

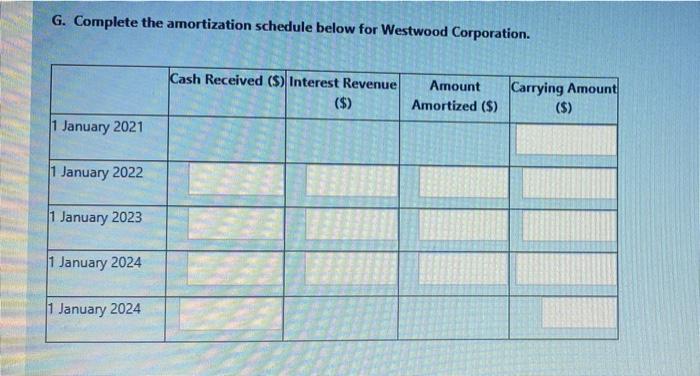

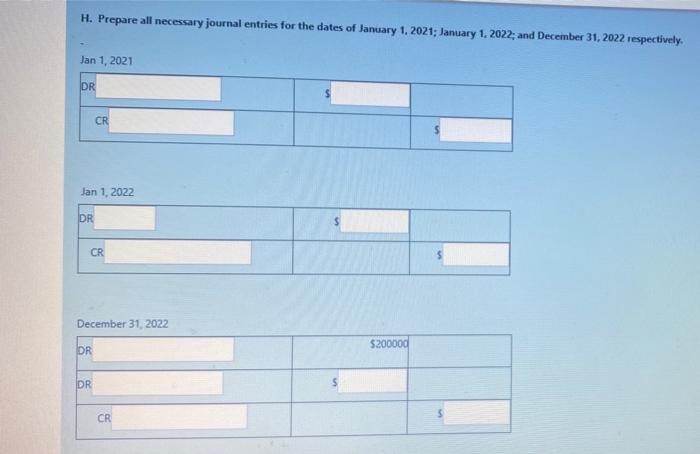

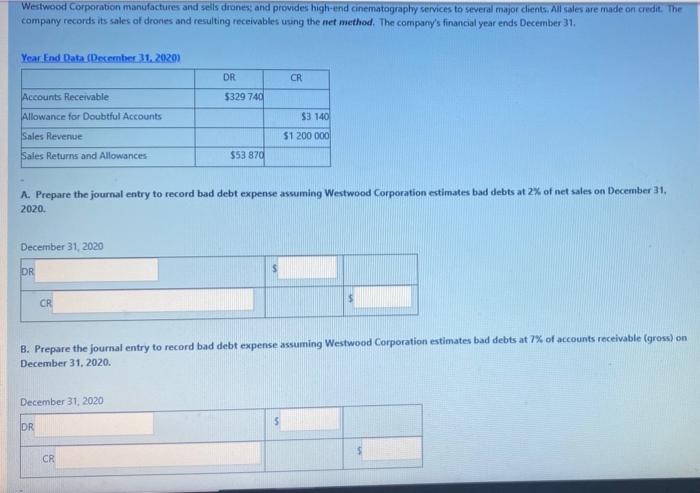

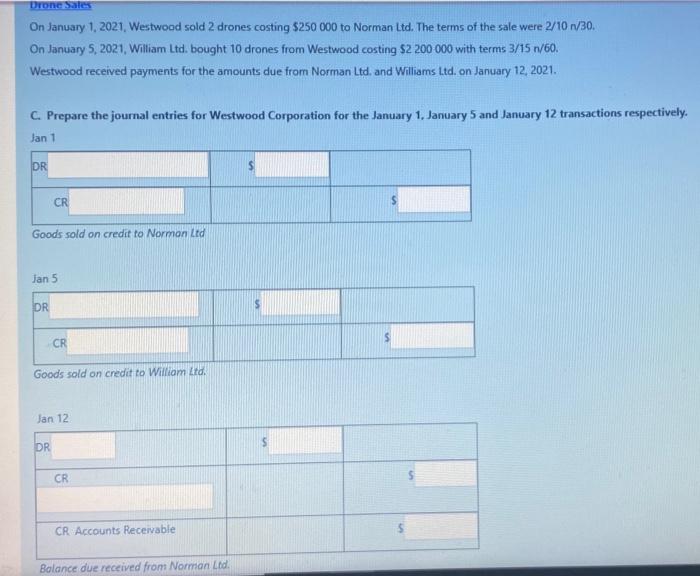

Westwood Corporation manufactures and sells drones and provides high-end cinematography services to several major clients. All sales are made on credit. The company records its sales of drones and resulting receivables using the net method. The company's financial year ends December 31 Year End Data (December 31, 2020 DR CR 5329 740 Accounts Receivable Allowance for Doubtful Accounts Sales Revenue Sales Returns and Allowances 53 140 $1 200 000 553 870 A. Prepare the journal entry to record bad debt expense assuming Westwood Corporation estimates bad debts at 2% of net sales on December 31. 2020. December 31, 2020 DR CR B. Prepare the journal entry to record bad debt expense assuming Westwood Corporation estimates bad debts at 7% of accounts receivable (gross) on December 31, 2020. December 31, 2020 DR CR Drone Sales On January 1, 2021, Westwood sold 2 drones costing $250 000 to Norman Ltd. The terms of the sale were 2/10 /30. On January 5, 2021. William Ltd. bought 10 drones from Westwood costing $2 200 000 with terms 3/15 n/60. Westwood received payments for the amounts due from Norman Ltd. and Williams Ltd. on January 12, 2021. C. Prepare the journal entries for Westwood Corporation for the January 1, January 5 and January 12 transactions respectively. Jan 1 DR S CR Goods sold on credit to Normon Ltd Jan 5 DR S $ CR Goods sold on credit to William Ltd. Jan 12 DR $ CR CR Accounts Receivable Bolance due received from Norman Led Balance due received from Norman Ltd DR CR Balance due received from William's tid. D. Assume instead that Westwood Corporation applies the gross method to record drone sales and resulting receivables, prepare all necessary journal entries pertaining to the sale of the drones to William Ltd. Jan 5 DR CR Goods sold on credit to William Lid. Jan 12 DR Cash DR CR Balonce due received from William's Ltd High-end Gnematography Services On January 1, 2021, Westwood Corporation provided high-end cinematography services to Mattel Inc. and accepted in exchange a 3 yr 5%, 54 000 000 promissory note with interest receivable each January 1. Similar notes carry an imputed rate of interest of 10%. E. Determine the present value of the note received by Westwood Corporation. P/Y = C/= NE VY PMT=$ FV = 5 PV = 5 F. This note was issued by Mattel Inc. at (Par/Premium/Discount) of $ G. Complete the amortization schedule below for Westwood Corporation. Cash Received ($) Interest Revenue ($) Amount Amortized ($) Carrying Amount ($) 1 January 2021 1 January 2022 1 January 2023 January 2024 1 January 2024 H. Prepare all necessary journal entries for the dates of January 1, 2021; January 1, 2022; and December 31, 2022 respectively. Jan 1, 2021 DR CR Jan 1, 2022 DR CR $ December 31, 2022 DR $200000 DR CR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started