Answered step by step

Verified Expert Solution

Question

1 Approved Answer

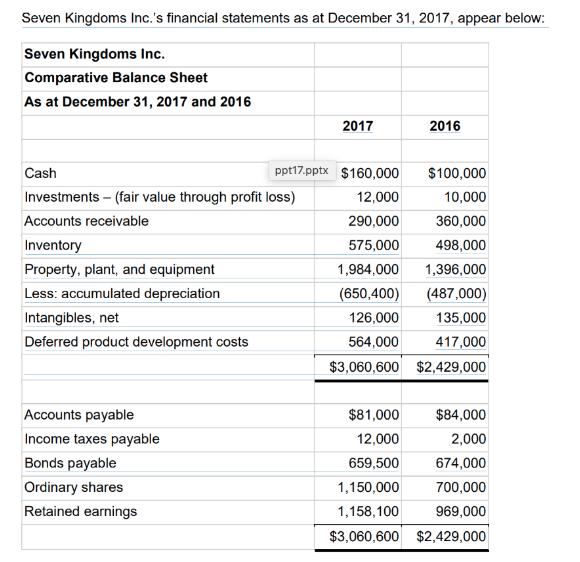

Seven Kingdoms Inc.'s financial statements as at December 31, 2017, appear below: Seven Kingdoms Inc. Comparative Balance Sheet As at December 31, 2017 and

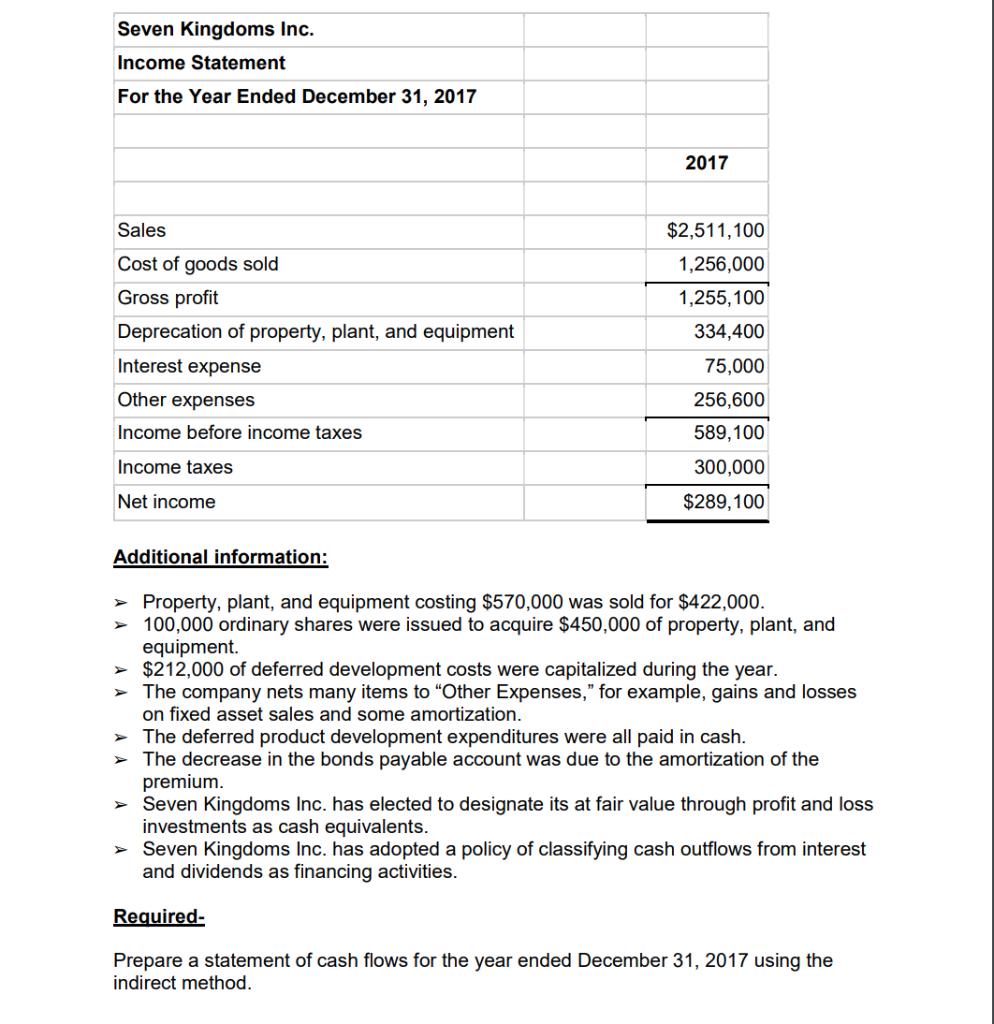

Seven Kingdoms Inc.'s financial statements as at December 31, 2017, appear below: Seven Kingdoms Inc. Comparative Balance Sheet As at December 31, 2017 and 2016 Cash Investments - (fair value through profit loss) Accounts receivable Inventory Property, plant, and equipment Less: accumulated depreciation Intangibles, net Deferred product development costs Accounts payable Income taxes payable Bonds payable Ordinary shares Retained earnings 2017 ppt17.pptx $160,000 12,000 290,000 575,000 2016 $100,000 10,000 360,000 498,000 1,984,000 1,396,000 (650,400) (487,000) 126,000 135,000 564,000 417,000 $3,060,600 $2,429,000 $81,000 12,000 659,500 1,150,000 1,158,100 $3,060,600 $2,429,000 $84,000 2,000 674,000 700,000 969,000 Seven Kingdoms Inc. Income Statement For the Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Deprecation of property, plant, and equipment Interest expense Other expenses Income before income taxes Income taxes Net income Additional information: 2017 $2,511,100 1,256,000 1,255,100 334,400 75,000 256,600 589,100 300,000 $289,100 > Property, plant, and equipment costing $570,000 was sold for $422,000. > 100,000 ordinary shares were issued to acquire $450,000 of property, plant, and equipment. > $212,000 of deferred development costs were capitalized during the year. The company nets many items to "Other Expenses," for example, gains and losses on fixed asset sales and some amortization. The deferred product development expenditures were all paid in cash. > The decrease in the bonds payable account was due to the amortization of the premium. > Seven Kingdoms Inc. has elected to designate its at fair value through profit and loss investments as cash equivalents. > Seven Kingdoms Inc. has adopted a policy of classifying cash outflows from interest and dividends as financing activities. Required- Prepare a statement of cash flows for the year ended December 31, 2017 using the indirect method. Seven Kingdoms Inc.'s financial statements as at December 31, 2017, appear below: Seven Kingdoms Inc. Comparative Balance Sheet As at December 31, 2017 and 2016 Cash Investments - (fair value through profit loss) Accounts receivable Inventory Property, plant, and equipment Less: accumulated depreciation Intangibles, net Deferred product development costs Accounts payable Income taxes payable Bonds payable Ordinary shares Retained earnings 2017 ppt17.pptx $160,000 12,000 290,000 575,000 2016 $100,000 10,000 360,000 498,000 1,984,000 1,396,000 (650,400) (487,000) 126,000 135,000 564,000 417,000 $3,060,600 $2,429,000 $81,000 12,000 659,500 1,150,000 1,158,100 $3,060,600 $2,429,000 $84,000 2,000 674,000 700,000 969,000 Seven Kingdoms Inc. Income Statement For the Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Deprecation of property, plant, and equipment Interest expense Other expenses Income before income taxes Income taxes Net income Additional information: 2017 $2,511,100 1,256,000 1,255,100 334,400 75,000 256,600 589,100 300,000 $289,100 > Property, plant, and equipment costing $570,000 was sold for $422,000. > 100,000 ordinary shares were issued to acquire $450,000 of property, plant, and equipment. > $212,000 of deferred development costs were capitalized during the year. The company nets many items to "Other Expenses," for example, gains and losses on fixed asset sales and some amortization. The deferred product development expenditures were all paid in cash. > The decrease in the bonds payable account was due to the amortization of the premium. > Seven Kingdoms Inc. has elected to designate its at fair value through profit and loss investments as cash equivalents. > Seven Kingdoms Inc. has adopted a policy of classifying cash outflows from interest and dividends as financing activities. Required- Prepare a statement of cash flows for the year ended December 31, 2017 using the indirect method. Seven Kingdoms Inc.'s financial statements as at December 31, 2017, appear below: Seven Kingdoms Inc. Comparative Balance Sheet As at December 31, 2017 and 2016 Cash Investments - (fair value through profit loss) Accounts receivable Inventory Property, plant, and equipment Less: accumulated depreciation Intangibles, net Deferred product development costs Accounts payable Income taxes payable Bonds payable Ordinary shares Retained earnings 2017 ppt17.pptx $160,000 12,000 290,000 575,000 2016 $100,000 10,000 360,000 498,000 1,984,000 1,396,000 (650,400) (487,000) 126,000 135,000 564,000 417,000 $3,060,600 $2,429,000 $81,000 12,000 659,500 1,150,000 1,158,100 $3,060,600 $2,429,000 $84,000 2,000 674,000 700,000 969,000 Seven Kingdoms Inc. Income Statement For the Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Deprecation of property, plant, and equipment Interest expense Other expenses Income before income taxes Income taxes Net income Additional information: 2017 $2,511,100 1,256,000 1,255,100 334,400 75,000 256,600 589,100 300,000 $289,100 > Property, plant, and equipment costing $570,000 was sold for $422,000. > 100,000 ordinary shares were issued to acquire $450,000 of property, plant, and equipment. > $212,000 of deferred development costs were capitalized during the year. The company nets many items to "Other Expenses," for example, gains and losses on fixed asset sales and some amortization. The deferred product development expenditures were all paid in cash. > The decrease in the bonds payable account was due to the amortization of the premium. > Seven Kingdoms Inc. has elected to designate its at fair value through profit and loss investments as cash equivalents. > Seven Kingdoms Inc. has adopted a policy of classifying cash outflows from interest and dividends as financing activities. Required- Prepare a statement of cash flows for the year ended December 31, 2017 using the indirect method. Seven Kingdoms Inc.'s financial statements as at December 31, 2017, appear below: Seven Kingdoms Inc. Comparative Balance Sheet As at December 31, 2017 and 2016 Cash Investments - (fair value through profit loss) Accounts receivable Inventory Property, plant, and equipment Less: accumulated depreciation Intangibles, net Deferred product development costs Accounts payable Income taxes payable Bonds payable Ordinary shares Retained earnings 2017 ppt17.pptx $160,000 12,000 290,000 575,000 2016 $100,000 10,000 360,000 498,000 1,984,000 1,396,000 (650,400) (487,000) 126,000 135,000 564,000 417,000 $3,060,600 $2,429,000 $81,000 12,000 659,500 1,150,000 1,158,100 $3,060,600 $2,429,000 $84,000 2,000 674,000 700,000 969,000 Seven Kingdoms Inc. Income Statement For the Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Deprecation of property, plant, and equipment Interest expense Other expenses Income before income taxes Income taxes Net income Additional information: 2017 $2,511,100 1,256,000 1,255,100 334,400 75,000 256,600 589,100 300,000 $289,100 > Property, plant, and equipment costing $570,000 was sold for $422,000. > 100,000 ordinary shares were issued to acquire $450,000 of property, plant, and equipment. > $212,000 of deferred development costs were capitalized during the year. The company nets many items to "Other Expenses," for example, gains and losses on fixed asset sales and some amortization. The deferred product development expenditures were all paid in cash. > The decrease in the bonds payable account was due to the amortization of the premium. > Seven Kingdoms Inc. has elected to designate its at fair value through profit and loss investments as cash equivalents. > Seven Kingdoms Inc. has adopted a policy of classifying cash outflows from interest and dividends as financing activities. Required- Prepare a statement of cash flows for the year ended December 31, 2017 using the indirect method.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow statement For the year ended 31 December 2017 Cash flow from operating activities Net income 289100 Adjustments to reconcile net income to n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started