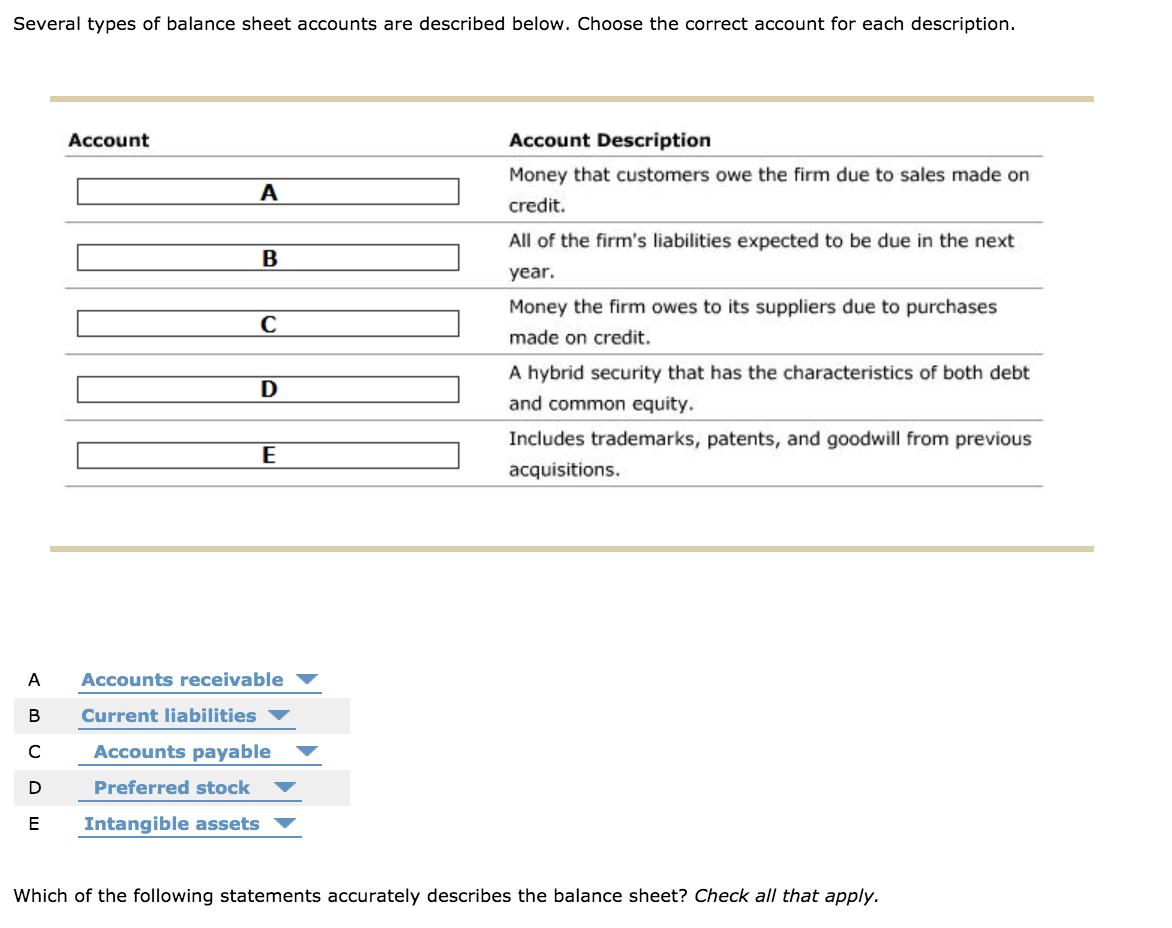

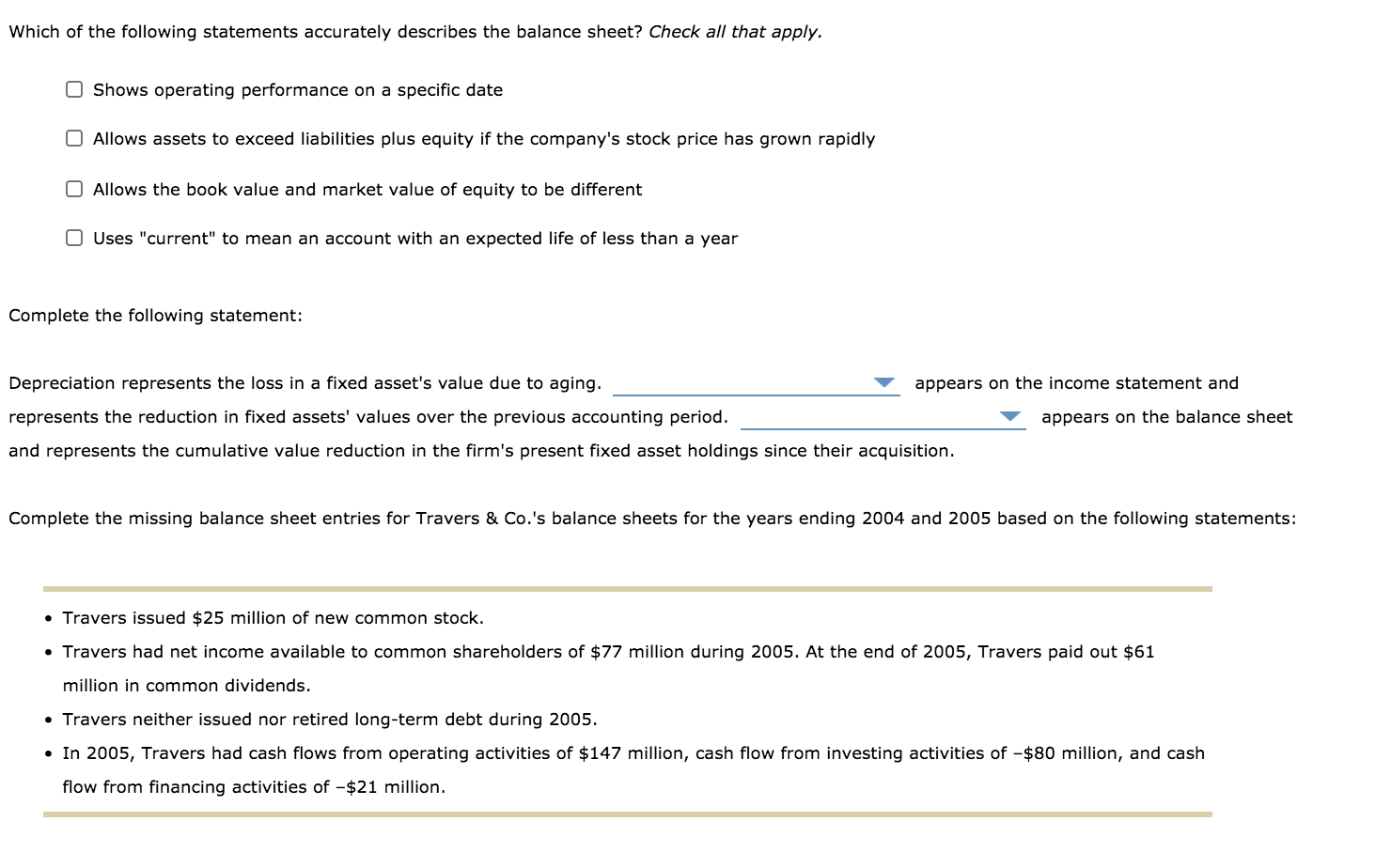

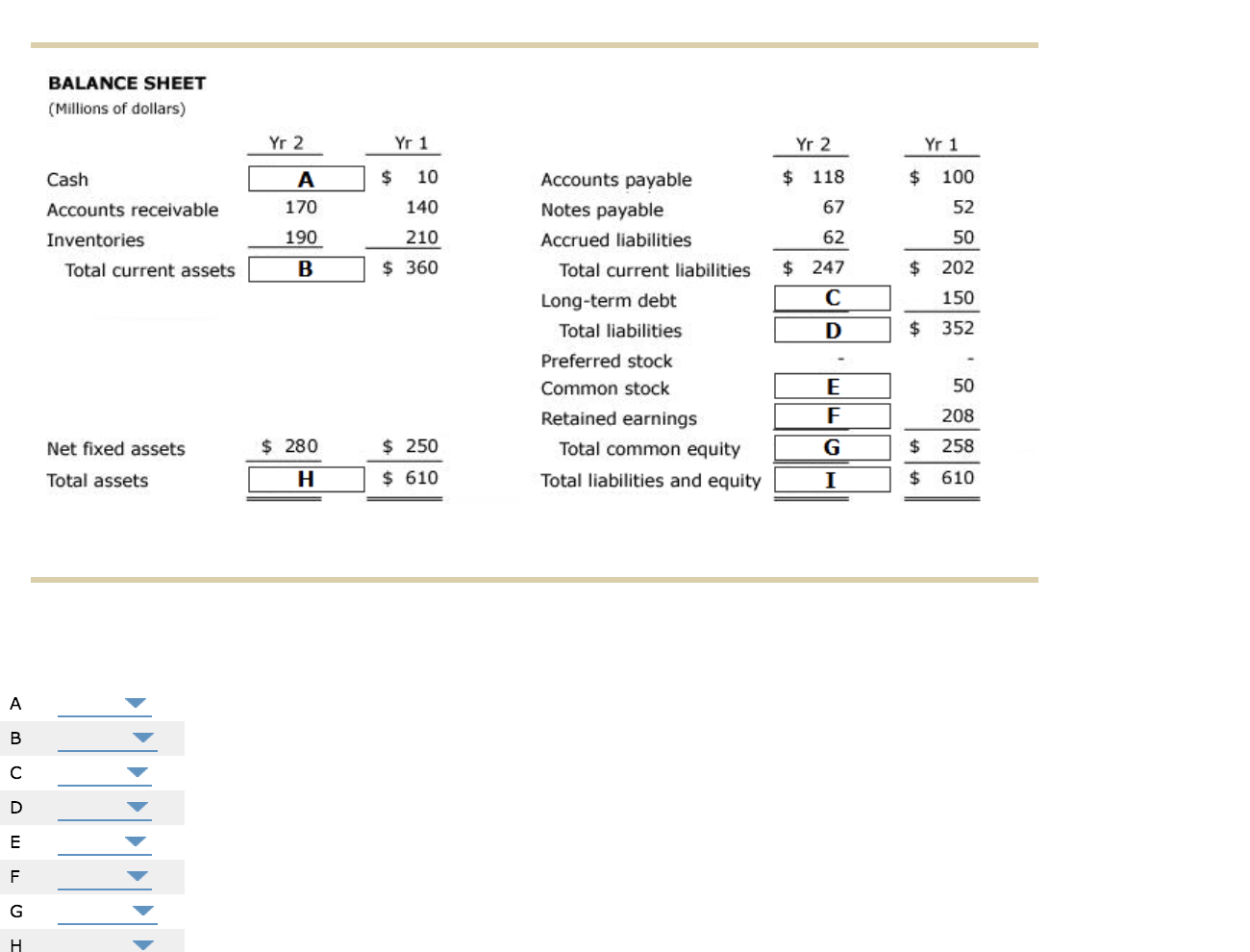

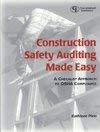

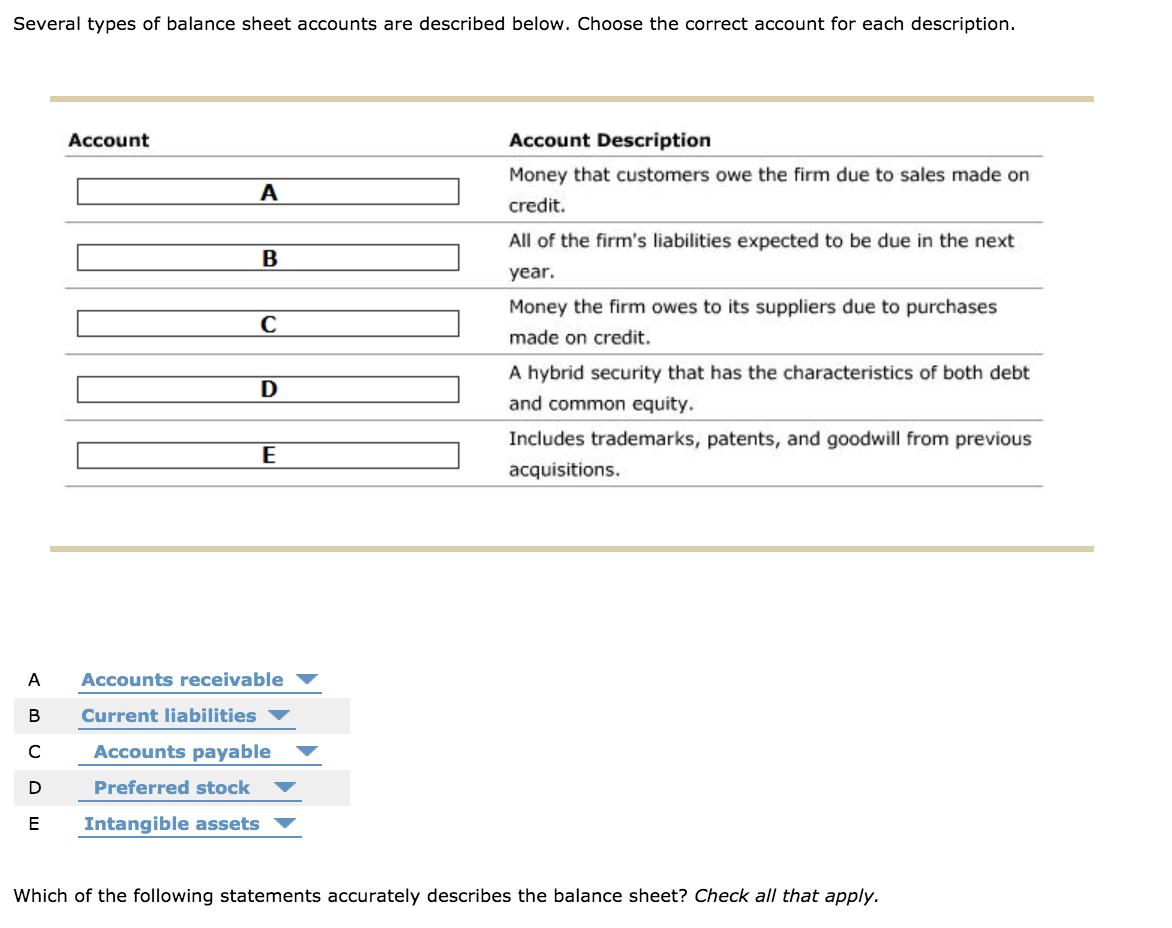

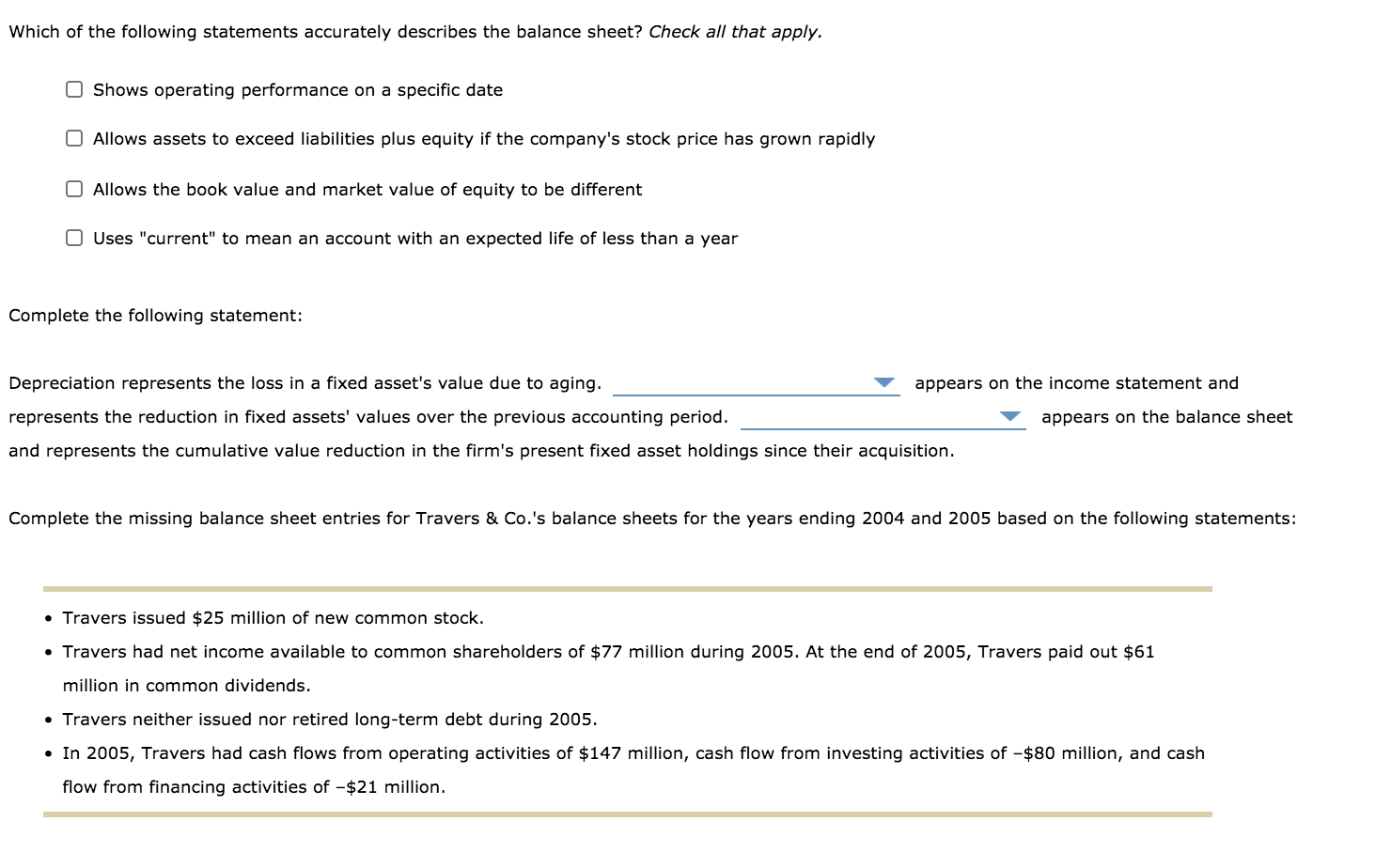

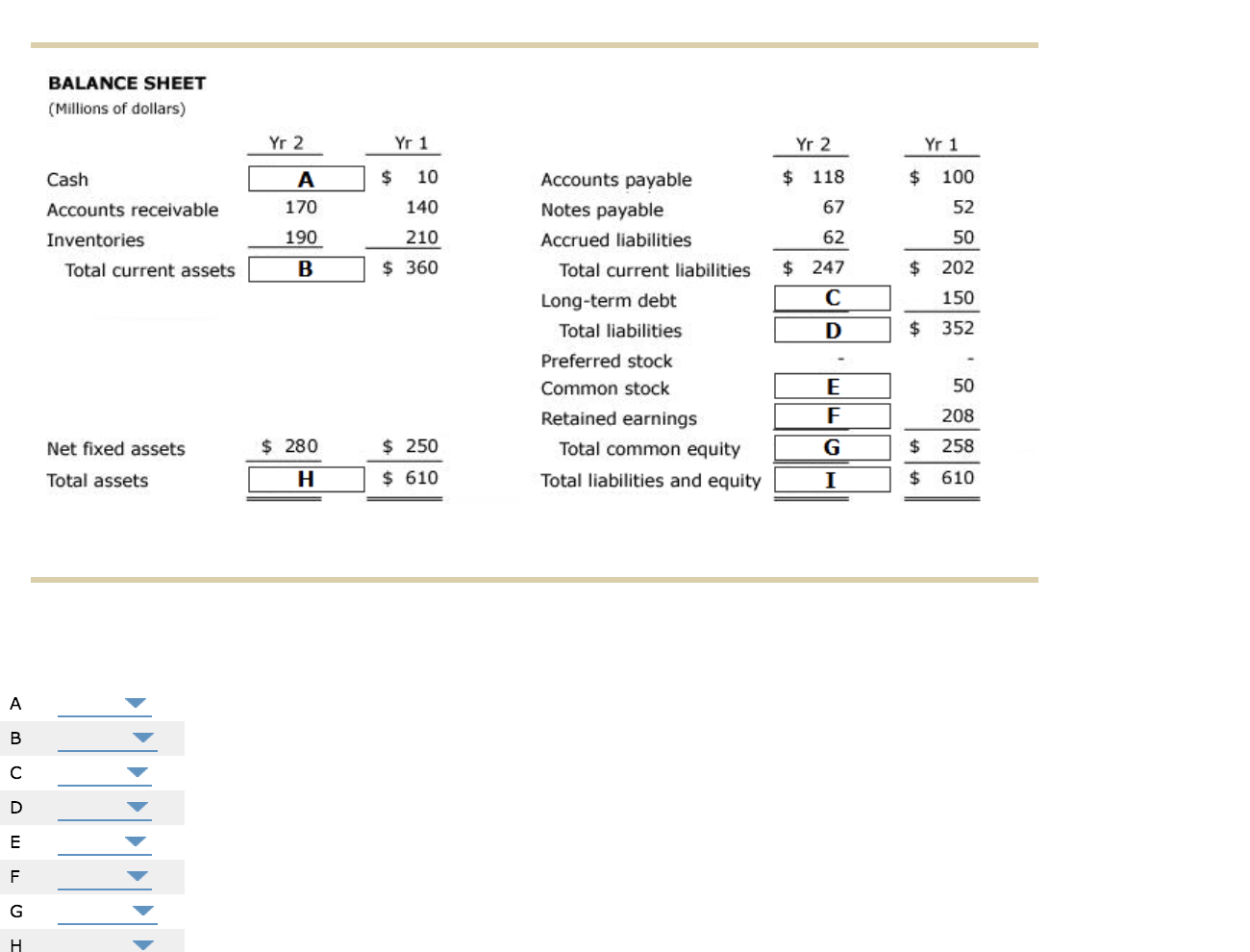

Several types of balance sheet accounts are described below. Choose the correct account for each description. Account A B Account Description Money that customers owe the firm due to sales made on credit. All of the firm's liabilities expected to be due in the next year. Money the firm owes to its suppliers due to purchases made on credit. A hybrid security that has the characteristics of both debt and common equity. Includes trademarks, patents, and goodwill from previous acquisitions. D E A Accounts receivable B Current liabilities Accounts payable Preferred stock D E Intangible assets Which of the following statements accurately describes the balance sheet? Check all that apply. Which of the following statements accurately describes the balance sheet? Check all that apply. Shows operating performance on a specific date Allows assets to exceed liabilities plus equity if the company's stock price has grown rapidly Allows the book value and market value of equity to be different Uses "current" to mean an account with an expected life of less than a year Complete the following statement: Depreciation represents the loss in a fixed asset's value due to aging. appears on the income statement and represents the reduction in fixed assets' values over the previous accounting period. appears on the balance sheet and represents the cumulative value reduction in the firm's present fixed asset holdings since their acquisition. Complete the missing balance sheet entries for Travers & Co.'s balance sheets for the years ending 2004 and 2005 based on the following statements: Travers issued $25 million of new common stock. Travers had net income available to common shareholders of $77 million during 2005. At the end of 2005, Travers paid out $61 million in common dividends. Travers neither issued nor retired long-term debt during 2005. In 2005, Travers had cash flows from operating activities of $147 million, cash flow from investing activities of -$80 million, and cash flow from financing activities of -$21 million. BALANCE SHEET (Millions of dollars) Yr 2 Yr 1 Yr 2 Yr 1 $ 10 $ 118 $ 100 52 170 140 67 Cash Accounts receivable Inventories Total current assets 190 210 62 50 B $ 360 $ 202 $ 247 C 150 Accounts payable Notes payable Accrued liabilities Total current liabilities Long-term debt Total liabilities Preferred stock Common stock Retained earnings Total common equity Total liabilities and equity D $ 352 50 E F 208 Net fixed assets $ 280 $ 250 G $ 258 Total assets H $ 610 I $ 610 Tm oo w > H