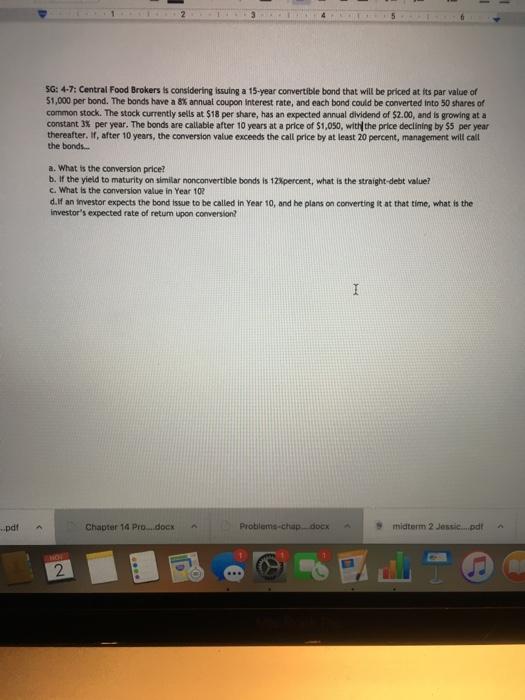

SG: 4-7: Central Food Brokers is considering issuing a 15-year convertible bond that will be priced at its par value of 51,000 per bond. The bonds have a 8% annual coupon Interest rate, and each bond could be converted into 50 shares of common stock. The stock currently sells at $18 per share, has an expected annual dividend of $2.00, and is growing at a constant 3% per year. The bonds are callable after 10 years at a price of $1,050, with the price declining by $5 per year thereafter. If, after 10 years, the conversion value exceeds the call price by at least 20 percent, management will call the bonds. a. What is the conversion price? b. If the yield to maturity on similar nonconvertible bonds is 12Xpercent, what is the straight-debt value? c. What is the conversion value in Year 102 d.If an investor expects the bond issue to be called in Year 10, and he plans on converting it at that time, what is the investor's expected rate of return upon conversion I ..pdf Chapter 14 Pro...docx Problema chapdocx midterm 2 Jessie....odt RO 2 . SG: 4-7: Central Food Brokers is considering issuing a 15-year convertible bond that will be priced at its par value of 51,000 per bond. The bonds have a 8% annual coupon Interest rate, and each bond could be converted into 50 shares of common stock. The stock currently sells at $18 per share, has an expected annual dividend of $2.00, and is growing at a constant 3% per year. The bonds are callable after 10 years at a price of $1,050, with the price declining by $5 per year thereafter. If, after 10 years, the conversion value exceeds the call price by at least 20 percent, management will call the bonds. a. What is the conversion price? b. If the yield to maturity on similar nonconvertible bonds is 12Xpercent, what is the straight-debt value? c. What is the conversion value in Year 102 d.If an investor expects the bond issue to be called in Year 10, and he plans on converting it at that time, what is the investor's expected rate of return upon conversion I ..pdf Chapter 14 Pro...docx Problema chapdocx midterm 2 Jessie....odt RO 2