Question

Shala Inc.'s beta coefficient is 1.2, the risk-free rate is 10 percent, and the market return is 15 percent. Based on the capital asset

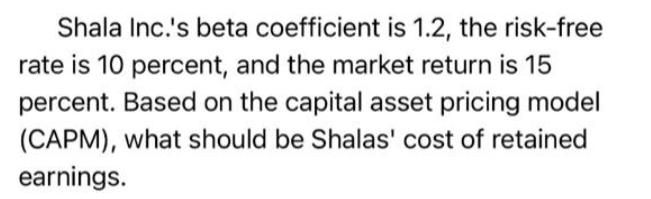

Shala Inc.'s beta coefficient is 1.2, the risk-free rate is 10 percent, and the market return is 15 percent. Based on the capital asset pricing model (CAPM), what should be Shalas' cost of retained earnings.

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER AND EXPLANATION Refer to image 3 Beta coefficient ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments

Authors: Zvi Bodie, Alex Kane, Alan Marcus, Lorne Switzer, Maureen Stapleton, Dana Boyko, Christine Panasian

9th Canadian Edition

1259271935, 9781259271939

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App