Answered step by step

Verified Expert Solution

Question

1 Approved Answer

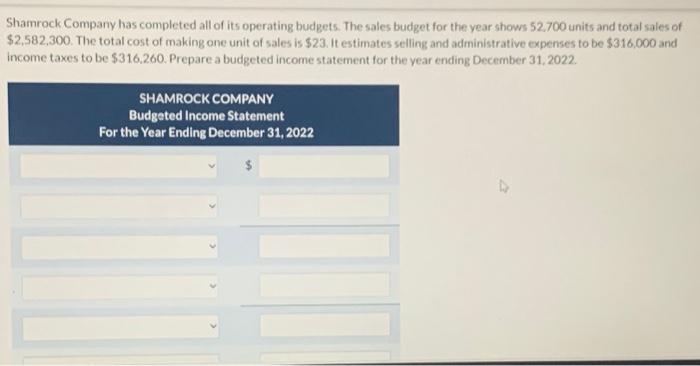

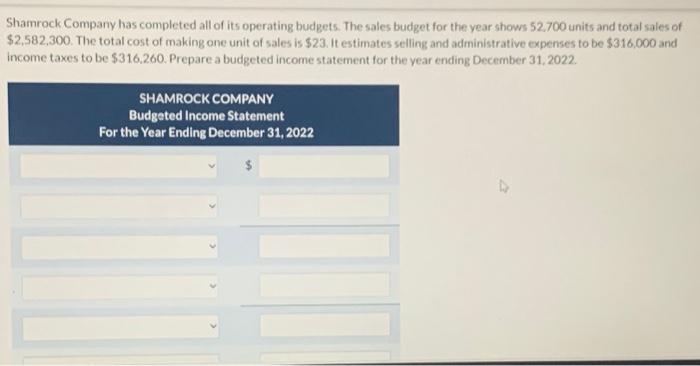

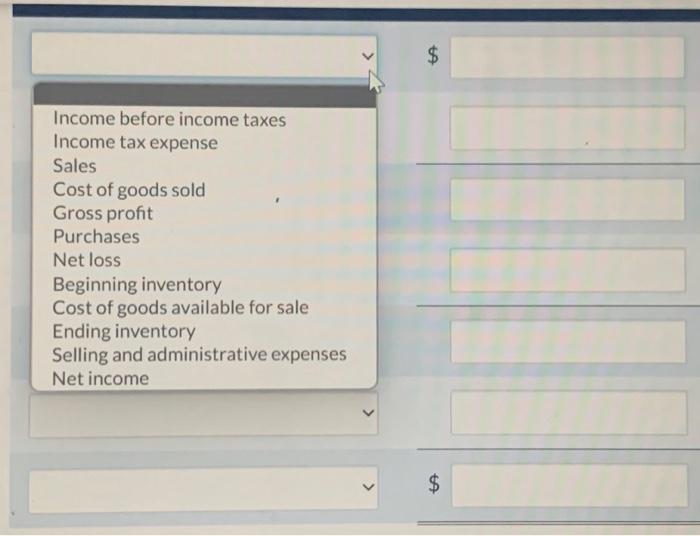

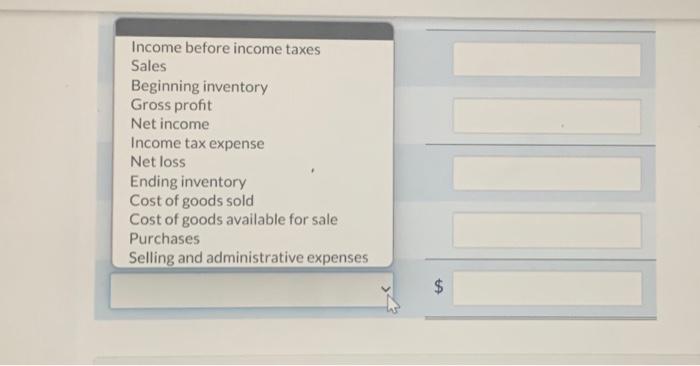

shamroack company has completed all of its operating budgets. the sales budget for the year shows $52700 units and total sales of $2,582,300. the total

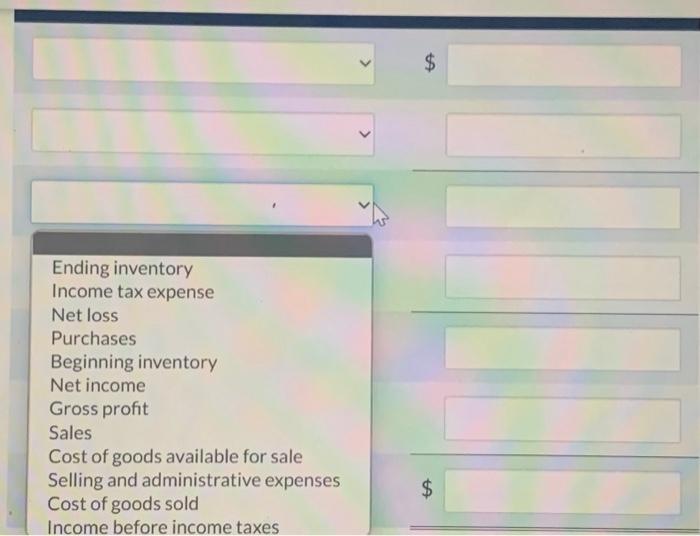

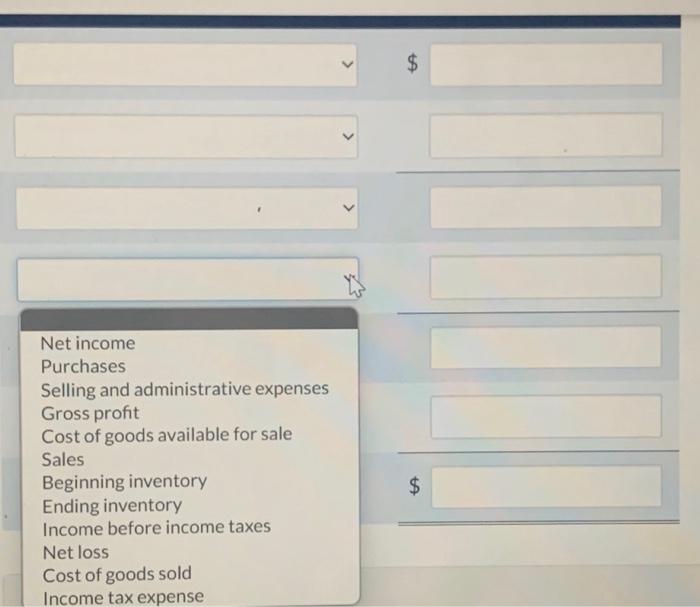

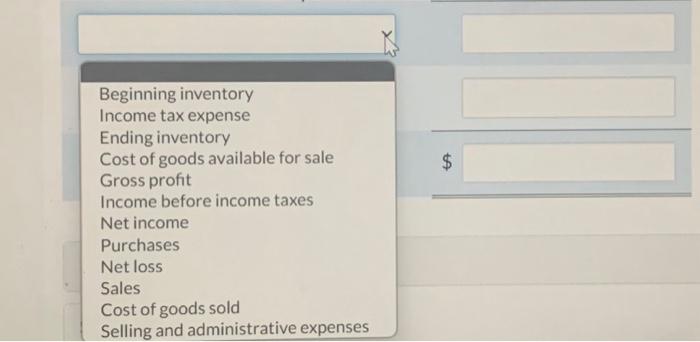

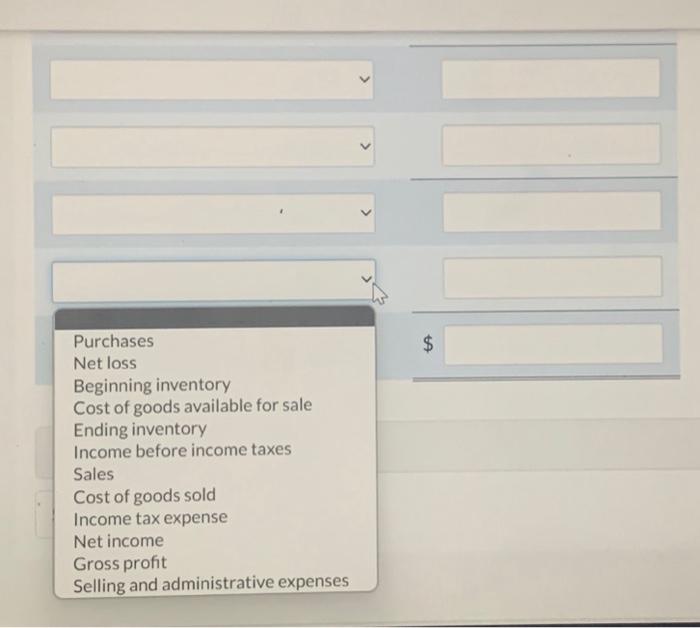

shamroack company has completed all of its operating budgets. the sales budget for the year shows $52700 units and total sales of $2,582,300. the total cost of making one unit of sales is $23. it estimates selling and administrative expenses to be $316,000 and income taxes to be $316,260 . prepare a budgeted income statement for the year ending december 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started