Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shang Chi Company is a manufacturer of top-of-the-line fabric made of Hymenoptera silk. The company was established in the middle of 2015 and begun

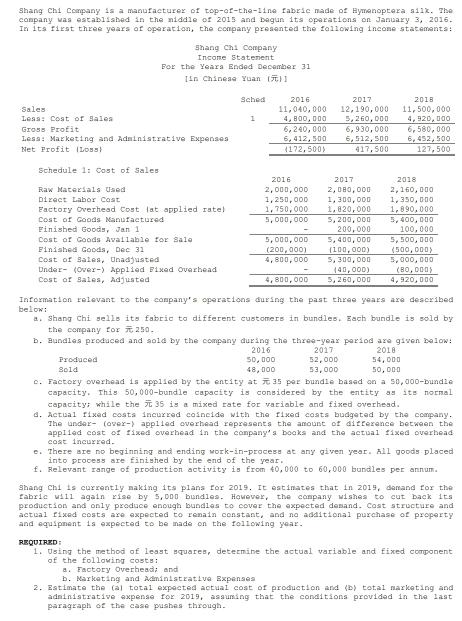

Shang Chi Company is a manufacturer of top-of-the-line fabric made of Hymenoptera silk. The company was established in the middle of 2015 and begun its operations on January 3, 2016. In its first three years of operation, the company presented the following income statements: Sales Less: Cost of Sales Shang Chi Company Income Statement For the Years Ended December 31 [in Chinese Yuan (11 Gross Profit Less: Marketing and Administrative Expenses Net Profit (Loss) Schedule 1: Cost of Sales Raw Materials Used Direct Labor Cost Factory Overhead Cost lat applied ratel Cost of Goods Manufactured Finished Goods, Jan 1 Cost of Goods Available for Sale Finished Goods, Dec 31 Cost of Sales, Unadjusted Under- (Over-) Applied Fixed Overhead Cost of Sales, Adjusted Sched 1 2016 11,040,000 4,800,000 6,240,000 6,412,500 (172,500) 2017 12,190,000 5,260,000 6,930,000 6,512,500 417,500 2016 2017 2,000,000 2,080,000 1,250,000 1,300,000 1,750,000 1.820,000 5,000,000 5,200,000 200,000 2018 2,160,000 1,350,000 1,890,000 5,400,000 100,000 5,500,000 (100,000) (500,000) 5,300,000 5,000,000 (40,000) (80,000) 4,800,000 5,260,000 4,920,000 5,000,000 5,400,000 (200,000) 4,800,000 2018 11,500,000 4,920,000 6,580,000 6,452,500 127,500 Information relevant to the company's operations during the past three years are described below: a. Shang Chi sells its fabric to different customers in bundles. Each bundle is sold by the company for 250.. b. Bundles produced and sold by the company during the three-year period are given below: 2016 2017 2018 50,000 48,000 52,000 53,000 54,000 50,000 Produced Sold c. Factory overhead is applied by the entity at 35 per bundle based on a 50,000-bundle capacity. This 50,000-bundle capacity is considered by the entity as its normal capacity; while the 35 is a mixed rate for variable and fixed overhead. d. Actual fixed costs incurred coincide with the fixed costs budgeted by the company. The under- (over-) applied overhead represents the amount of difference between the applied cost of fixed overhead in the company's books and the actual fixed overhead cost incurred. e. There are no beginning and ending work-in-process at any given year. All goods placed into process are finished by the end of the year. f. Relevant range of production activity is from 40,000 to 60,000 bundles per annum. Shang Chi is currently making its plans for 2019. It estimates that in 2019, demand for the fabric will again rise by 5,000 bundles. However, the company wishes to cut back its production and only produce enough bundles to cover the expected demand. Cost structure and actual fixed costs are expected to remain constant, and no additional purchase of property and equipment is expected to be made on the following year. REQUIRED: 1. Using the method of least squares, determine the actual variable and fixed component of the following costs: a. Factory Overhead; and b. Marketing and Administrative Expenses 2. Estimate the (al total expected actual cost of production and (b) total marketing and administrative expense for 2019, assuming that the conditions provided in the last paragraph of the case pushes through.

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the actual variable and fixed components of the factory overhead and marketing and administrative expenses we can use the method of least squares This method uses historical data ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started