Answered step by step

Verified Expert Solution

Question

1 Approved Answer

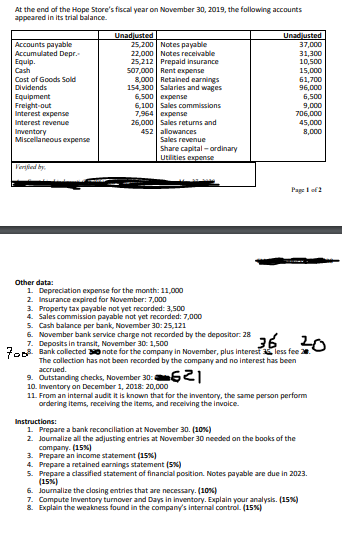

*share capital ordinary is 50.000 * 8. Bank collected 800 note for the company in november , plus interest 36 , less fee 20 At

*share capital ordinary is 50.000

* 8. Bank collected 800 note for the company in november , plus interest 36 , less fee 20

At the end of the Hope Store's fiscal year on November 30, 2019, the following accounts appeared in its trial balance Accounts payable Accumulated Depr Sanies and wages Cost of Goods Sold Dividends Equipment Freight-out Interest expense Interest revenue Inventory Miscellaneous expense 706.000 25.000 Sales returns and 8.000 Pawet Other data 1. Depreciation expense for the month: 11,000 2. Insurance expired for November: 7,000 3. Property tax payable not yet recorded: 3,500 4. Sales commission payable not yet recorded: 7,000 Cash balance per bank, November 30:25, 121 November bank service charge nat recorded by the depositor: 28 2 7. Deposits in transit, November 30: 1,500 70D Bank collected Monote for the company in November, plus intereseless fee The collection has not been recorded by the company and no interest has been 9. Outstanding checks, November 30 -6 2 1 10. inventory on December 1, 2018 20.000 11. From an internal audit it is known that for the inventory, the same person perform ordering items, receiving the items, and receiving the invoice. P20 Instructions 1. Prepare a bank reconciliation at November 30 (10) 2. Journale all the adjusting entries at November 30 needed on the books of the company (15) Prepare an income statement (15%) 4. Prepare a retained earning statements 5. Prepare a classified statement of financial position. Notes payable are due in 2023 6. Journal the closing entries that are necessary. (1094 7. Compute inventory turnover and Days in inventory. Explain your analysis (15) & Explain the weakness found in the company's internal control (15%) At the end of the Hope Store's fiscal year on November 30, 2019, the following accounts appeared in its trial balance Accounts payable Accumulated Depr Sanies and wages Cost of Goods Sold Dividends Equipment Freight-out Interest expense Interest revenue Inventory Miscellaneous expense 706.000 25.000 Sales returns and 8.000 Pawet Other data 1. Depreciation expense for the month: 11,000 2. Insurance expired for November: 7,000 3. Property tax payable not yet recorded: 3,500 4. Sales commission payable not yet recorded: 7,000 Cash balance per bank, November 30:25, 121 November bank service charge nat recorded by the depositor: 28 2 7. Deposits in transit, November 30: 1,500 70D Bank collected Monote for the company in November, plus intereseless fee The collection has not been recorded by the company and no interest has been 9. Outstanding checks, November 30 -6 2 1 10. inventory on December 1, 2018 20.000 11. From an internal audit it is known that for the inventory, the same person perform ordering items, receiving the items, and receiving the invoice. P20 Instructions 1. Prepare a bank reconciliation at November 30 (10) 2. Journale all the adjusting entries at November 30 needed on the books of the company (15) Prepare an income statement (15%) 4. Prepare a retained earning statements 5. Prepare a classified statement of financial position. Notes payable are due in 2023 6. Journal the closing entries that are necessary. (1094 7. Compute inventory turnover and Days in inventory. Explain your analysis (15) & Explain the weakness found in the company's internal control (15%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started