Answered step by step

Verified Expert Solution

Question

1 Approved Answer

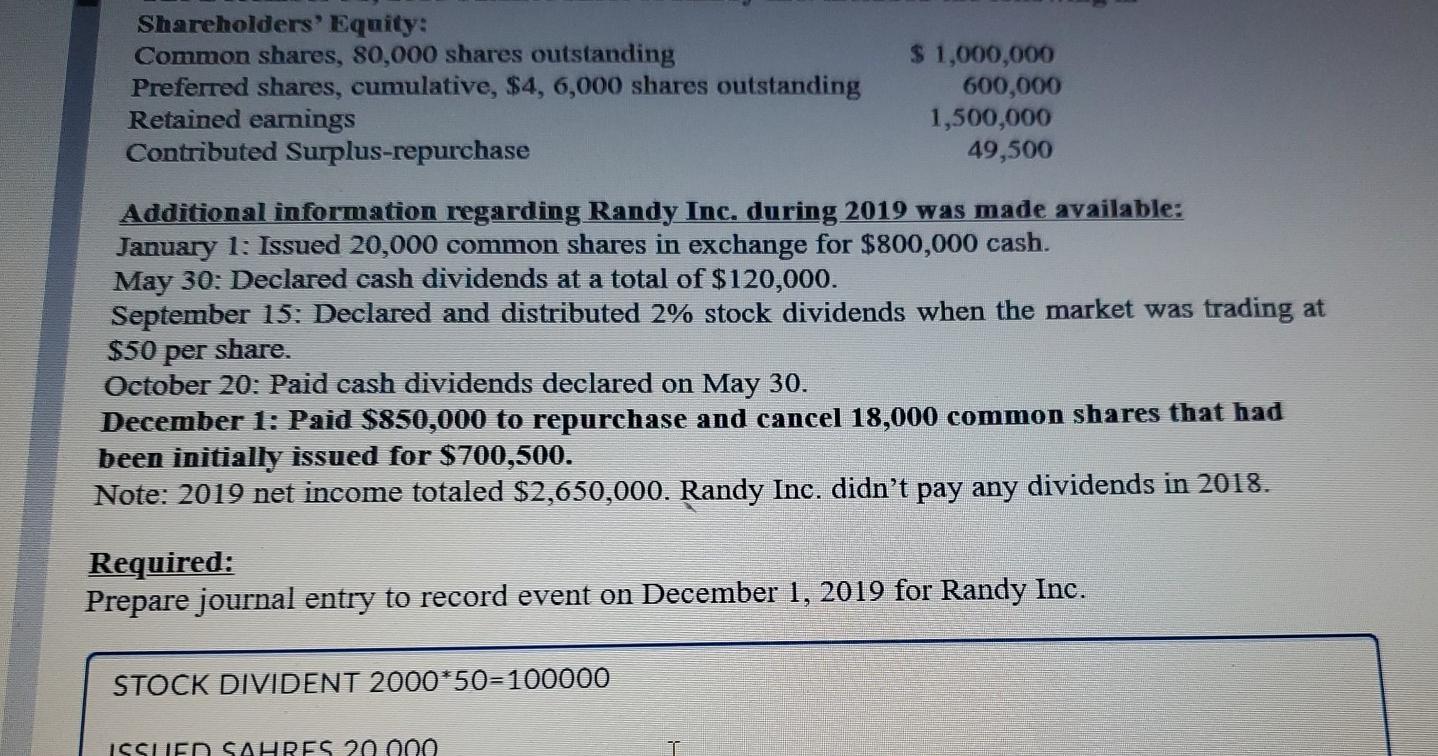

Shareholders' Equity: Common shares, 80,000 shares outstanding Preferred shares, cumulative, $4, 6,000 shares outstanding Retained earnings Contributed Surplus-repurchase $ 1,000,000 600,000 1,500,000 49,500 Additional information

Shareholders' Equity: Common shares, 80,000 shares outstanding Preferred shares, cumulative, $4, 6,000 shares outstanding Retained earnings Contributed Surplus-repurchase $ 1,000,000 600,000 1,500,000 49,500 Additional information regarding Randy Inc, during 2019 was made available: January 1: Issued 20,000 common shares in exchange for $800,000 cash. May 30: Declared cash dividends at a total of $120,000. September 15: Declared and distributed 2% stock dividends when the market was trading at $50 per share. October 20: Paid cash dividends declared on May 30. December 1: Paid $850,000 to repurchase and cancel 18,000 common shares that had been initially issued for $700,500. Note: 2019 net income totaled $2,650,000. Randy Inc. didn't pay any dividends in 2018. Required: Prepare journal entry to record event on December 1, 2019 for Randy Inc. STOCK DIVIDENT 2000*50=100000 ISSLIED SAHRES 20 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started