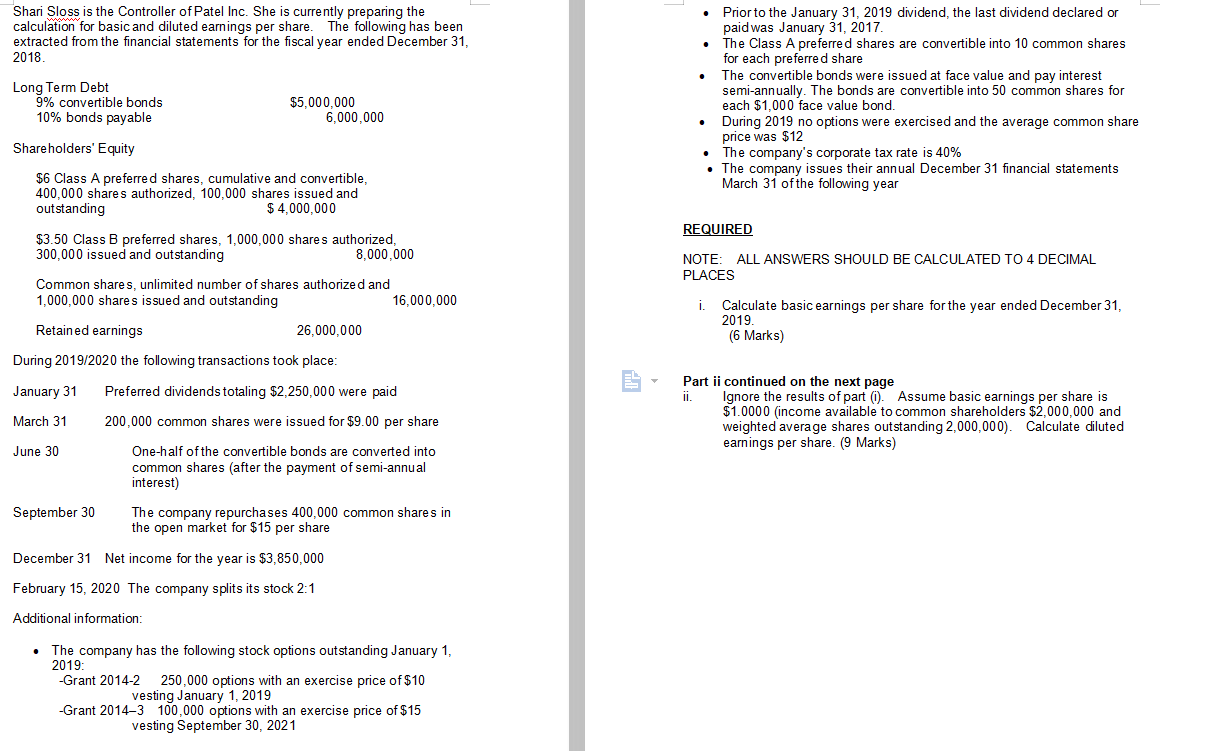

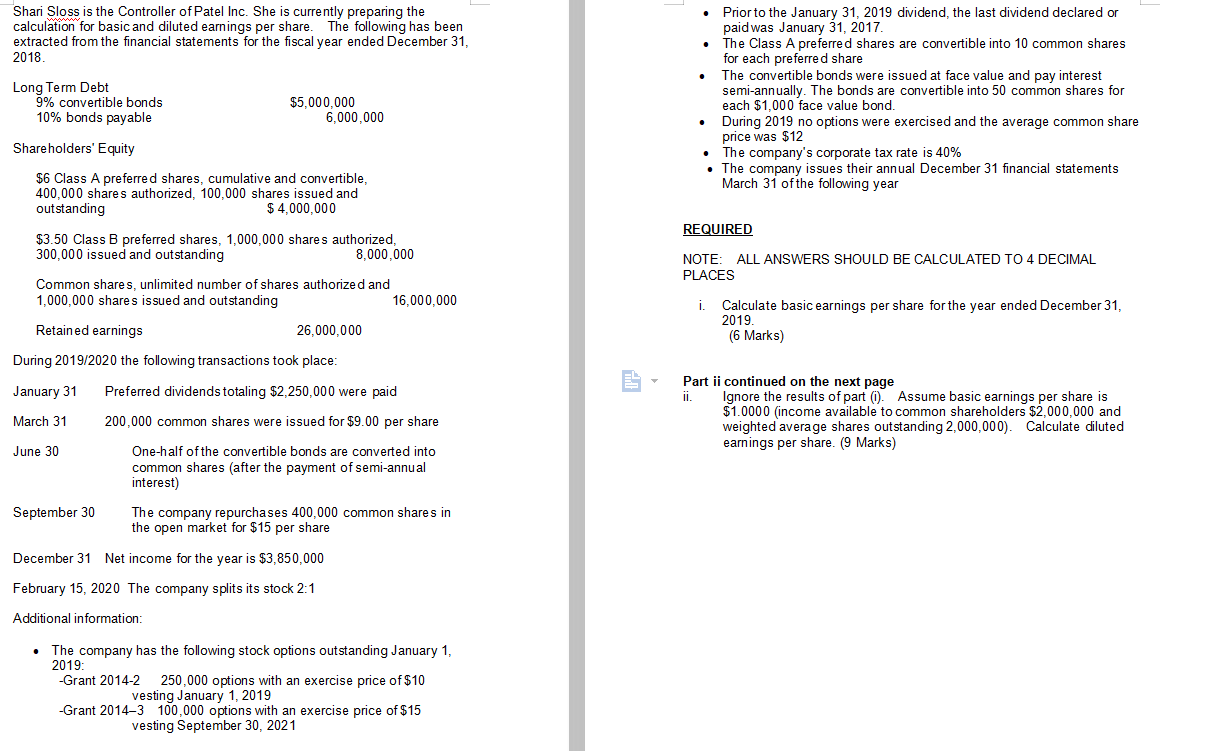

Shari Sloss is the Controller of Patel Inc. She is currently preparing the calculation for basic and diluted earnings per share. The following has been extracted from the financial statements for the fiscal year ended December 31, 2018. Long Term Debt 9% convertible bonds 10% bonds payable $5,000,000 6,000,000 Prior to the January 31, 2019 dividend, the last dividend declared or paid was January 31, 2017 The Class A preferred shares are convertible into 10 common shares for each preferred share The convertible bonds were issued at face value and pay interest semi-annually. The bonds are convertible into 50 common shares for each $1,000 face value bond. During 2019 no options were exercised and the average common share price was $12 The company's corporate tax rate is 40% The company issues their annual December 31 financial statements March 31 of the following year Shareholders' Equity $6 Class A preferred shares, cumulative and convertible, 400,000 shares authorized, 100,000 shares issued and outstanding $ 4,000,000 $3.50 Class B preferred shares, 1,000,000 shares authorized, 300,000 issued and outstanding 8,000,000 REQUIRED NOTE: ALL ANSWERS SHOULD BE CALCULATED TO 4 DECIMAL PLACES Common shares, unlimited number of shares authorized and 1,000,000 shares issued and outstanding 16,000,000 i. Calculate basic earnings per share for the year ended December 31, 2019 (6 Marks) Retained earnings 26.000.000 During 2019/2020 the following transactions took place: January 31 Preferred dividends totaling $2,250,000 were paid Part ii continued on the next page II. Ignore the results of parti). Assume basic earnings per share is $1.0000 (income available to common shareholders $2,000,000 and weighted average shares outstanding 2,000,000). Calculate diluted earnings per share. (9 Marks) March 31 200,000 common shares were issued for $9.00 per share June 30 One-half of the convertible bonds are converted into common shares (after the payment of semi-annual interest) September 30 The company repurchases 400,000 common shares in the open market for $15 per share December 31 Net income for the year is $3,850,000 February 15, 2020 The company splits its stock 2:1 Additional information: The company has the following stock options outstanding January 1, 2019 -Grant 2014-2 250,000 options with an exercise price of $10 vesting January 1, 2019 -Grant 20143 100,000 options with an exercise price of $15 vesting September 30, 2021 Shari Sloss is the Controller of Patel Inc. She is currently preparing the calculation for basic and diluted earnings per share. The following has been extracted from the financial statements for the fiscal year ended December 31, 2018. Long Term Debt 9% convertible bonds 10% bonds payable $5,000,000 6,000,000 Prior to the January 31, 2019 dividend, the last dividend declared or paid was January 31, 2017 The Class A preferred shares are convertible into 10 common shares for each preferred share The convertible bonds were issued at face value and pay interest semi-annually. The bonds are convertible into 50 common shares for each $1,000 face value bond. During 2019 no options were exercised and the average common share price was $12 The company's corporate tax rate is 40% The company issues their annual December 31 financial statements March 31 of the following year Shareholders' Equity $6 Class A preferred shares, cumulative and convertible, 400,000 shares authorized, 100,000 shares issued and outstanding $ 4,000,000 $3.50 Class B preferred shares, 1,000,000 shares authorized, 300,000 issued and outstanding 8,000,000 REQUIRED NOTE: ALL ANSWERS SHOULD BE CALCULATED TO 4 DECIMAL PLACES Common shares, unlimited number of shares authorized and 1,000,000 shares issued and outstanding 16,000,000 i. Calculate basic earnings per share for the year ended December 31, 2019 (6 Marks) Retained earnings 26.000.000 During 2019/2020 the following transactions took place: January 31 Preferred dividends totaling $2,250,000 were paid Part ii continued on the next page II. Ignore the results of parti). Assume basic earnings per share is $1.0000 (income available to common shareholders $2,000,000 and weighted average shares outstanding 2,000,000). Calculate diluted earnings per share. (9 Marks) March 31 200,000 common shares were issued for $9.00 per share June 30 One-half of the convertible bonds are converted into common shares (after the payment of semi-annual interest) September 30 The company repurchases 400,000 common shares in the open market for $15 per share December 31 Net income for the year is $3,850,000 February 15, 2020 The company splits its stock 2:1 Additional information: The company has the following stock options outstanding January 1, 2019 -Grant 2014-2 250,000 options with an exercise price of $10 vesting January 1, 2019 -Grant 20143 100,000 options with an exercise price of $15 vesting September 30, 2021