Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharkey's Fun Center is considering building a water slide for its customers and gathered the following information: a . The water slide would cost $

Sharkey's Fun Center is considering building a water slide for its customers and gathered the following information:

a The water slide would cost $ have a year useful life with no salvage value and be depreciated using the straight

line method.

b To make room for the water slide, several rides would be dismantled and sold. These rides are fully depreciated, but they

could be sold for $ to a nearby amusement park.

c The water slide would attract more customers per year who each pay the company's usual admission price of $

per person.

d The water slides' annual incremental operating expenses would be salaries, $; insurance, $; utilities, $; and

maintenance, $

Required:

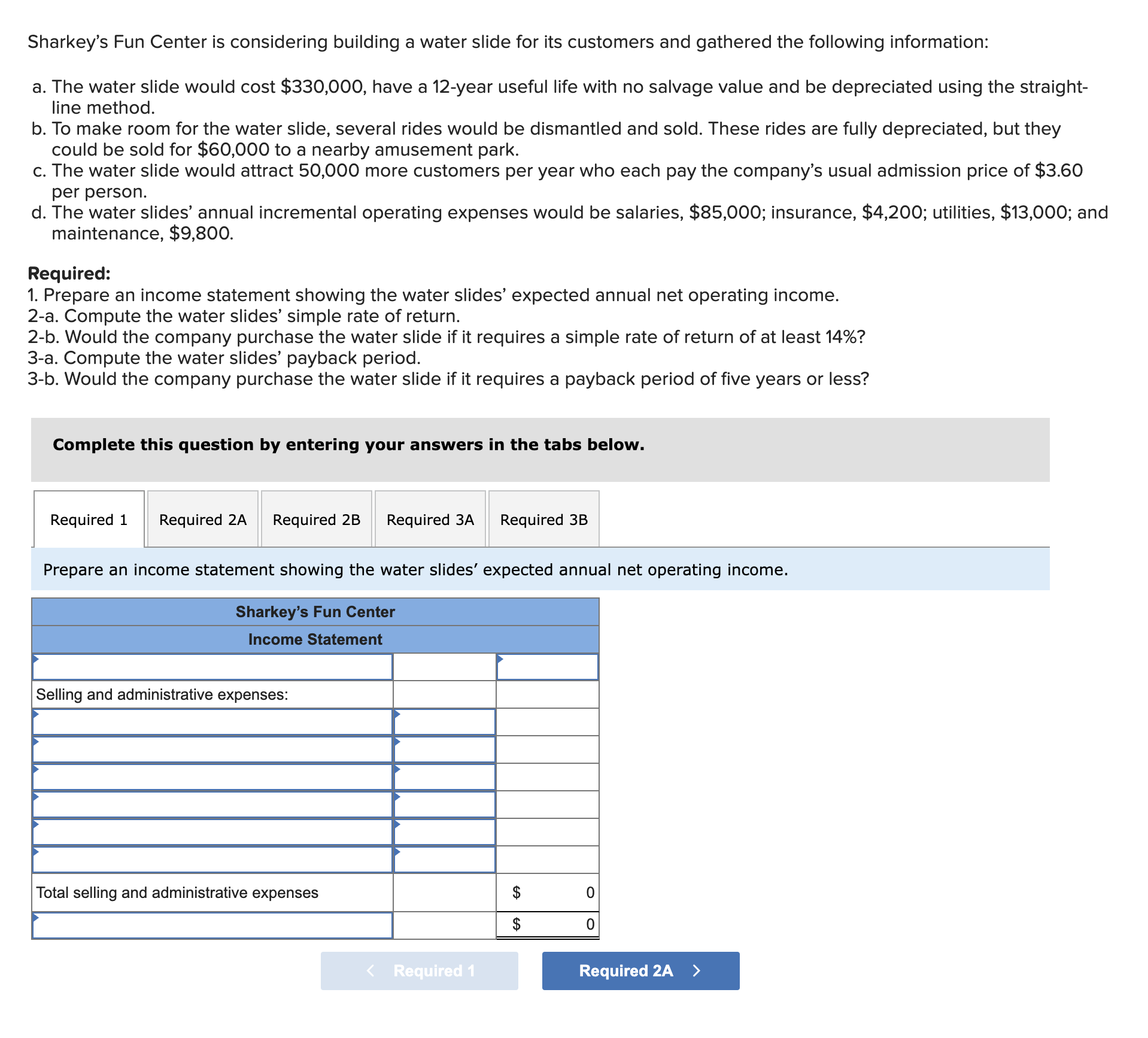

Prepare an income statement showing the water slides' expected annual net operating income.

a Compute the water slides' simple rate of return.

b Would the company purchase the water slide if it requires a simple rate of return of at least

a Compute the water slides' payback period.

b Would the company purchase the water slide if it requires a payback period of five years or less?

Complete this question by entering your answers in the tabs below.

Prepare an income statement showing the water slides' expected annual net operating income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started