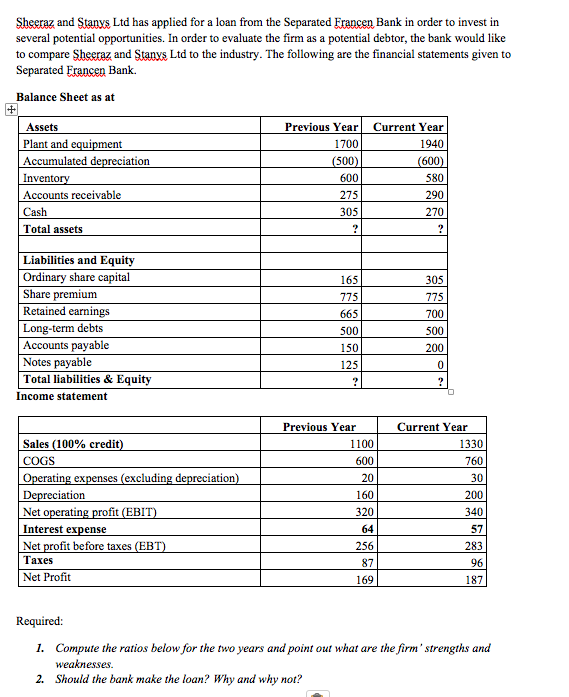

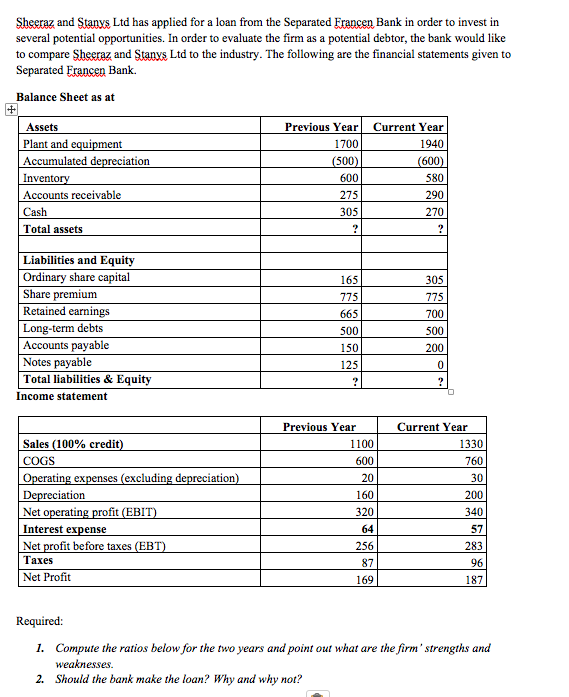

Sheeraz and Stanys Ltd has applied for a loan from the Separated Francen Bank in order to invest in several potential opportunities. In order to evaluate the firm as a potential debtor, the bank would like to compare Sheeraz and Stanys Ltd to the industry. The following are the financial statements given to Separated Exancen Bank. Balance Sheet as at Assets Plant and equipment Accumulated depreciation Inventory Accounts receivable Cash Total assets Previous Year 1700 (500) 600 275 305 ? Current Year 1940 (600) 580 290 270 ? 305 775 700 Liabilities and Equity Ordinary share capital Share premium Retained earnings Long-term debts Accounts payable Notes payable Total liabilities & Equity Income statement 165 775 665 500 150 125 ? 500 200 0 ? O Sales (100% credit) COGS Operating expenses (excluding depreciation) Depreciation Net operating profit (EBIT) Interest expense Net profit before taxes (EBT) Taxes Net Profit Previous Year 1100 600 20 160 320 64 256 87 169 Current Year 1330 760 30 200 340 57 283 96 187 Required: 1. Compute the ratios below for the two years and point out what are the firm' strengths and weaknesses. 2. Should the bank make the loan? Why and why not? Sheeraz and Stanys Ltd has applied for a loan from the Separated Francen Bank in order to invest in several potential opportunities. In order to evaluate the firm as a potential debtor, the bank would like to compare Sheeraz and Stanys Ltd to the industry. The following are the financial statements given to Separated Exancen Bank. Balance Sheet as at Assets Plant and equipment Accumulated depreciation Inventory Accounts receivable Cash Total assets Previous Year 1700 (500) 600 275 305 ? Current Year 1940 (600) 580 290 270 ? 305 775 700 Liabilities and Equity Ordinary share capital Share premium Retained earnings Long-term debts Accounts payable Notes payable Total liabilities & Equity Income statement 165 775 665 500 150 125 ? 500 200 0 ? O Sales (100% credit) COGS Operating expenses (excluding depreciation) Depreciation Net operating profit (EBIT) Interest expense Net profit before taxes (EBT) Taxes Net Profit Previous Year 1100 600 20 160 320 64 256 87 169 Current Year 1330 760 30 200 340 57 283 96 187 Required: 1. Compute the ratios below for the two years and point out what are the firm' strengths and weaknesses. 2. Should the bank make the loan? Why and why not