At the end of each month, Fido receives a bank statement from its bank. This bank statement shows the information that the bank has

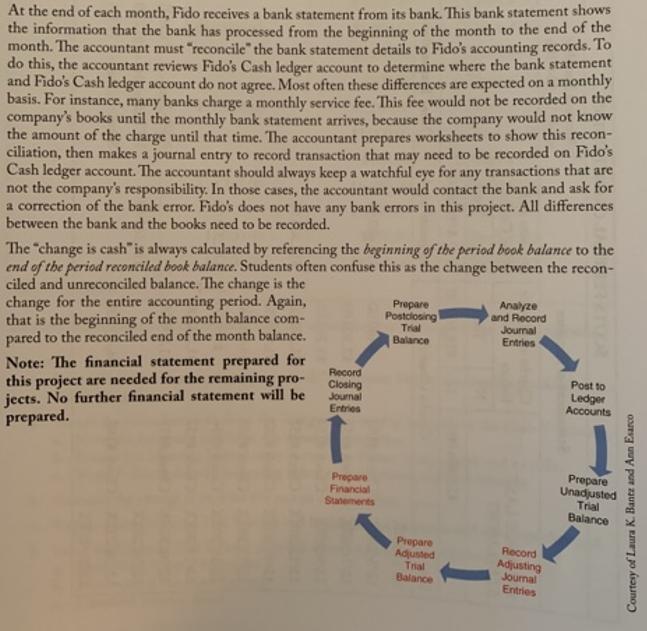

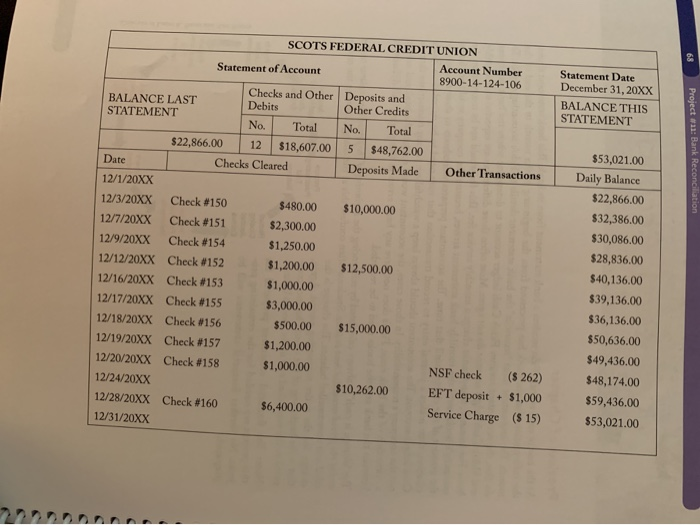

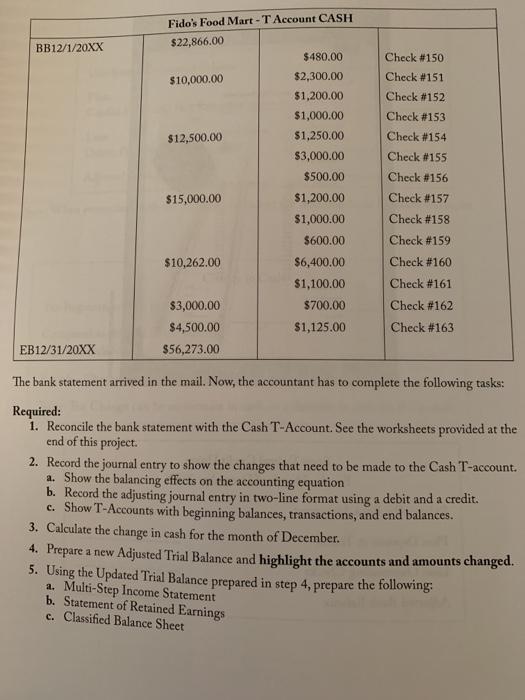

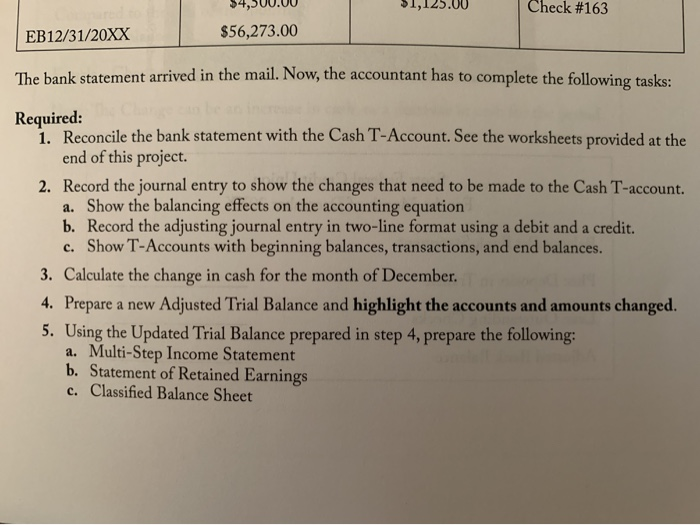

At the end of each month, Fido receives a bank statement from its bank. This bank statement shows the information that the bank has processed from the beginning of the month to the end of the month. The accountant must reconcile the bank statement details to Fido s accounting records. To do this, the accountant reviews Fido s Cash ledger account to determine where the bank statement and Fido s Cash ledger account do not agree. Most often these differences are expected on a monthly basis. For instance, many banks charge a monthly service fee. This fee would not be recorded on the company s books until the monthly bank statement arrives, because the company would not know the amount of the charge until that time. The accountant prepares worksheets to show this recon- ciliation, then makes a journal entry to record transaction that may need to be recorded on Fido s Cash ledger account. The accountant should always keep a watchful eye for any transactions that are not the company s responsibility. In those cases, the accountant would contact the bank and ask for a correction of the bank error. Fido s does not have any bank errors in this project. All differences between the bank and the books need to be recorded. The change is cash is always calculated by referencing the beginning of the period book balance to the end of the period reconciled book balance. Students often confuse this as the change between the recon- ciled and unreconciled balance. The change is the change for the entire accounting period. Again, that is the beginning of the month balance com- pared to the reconciled end of the month balance. Note: The financial statement prepared for this project are needed for the remaining pro- jects. No further financial statement will be prepared. Record Closing Journal Entries Prepare Financial Statements Prepare Postclosing Trial Balance Prepare Adjusted Trial Balance Analyze and Record Journal Entries Record Adjusting Journal Entries Post to Ledger Accounts Prepare Unadjusted Trial Balance Courtesy of Laura K. Bantz and Ann Esarco BALANCE LAST STATEMENT Date Statement of Account $22,866.00 SCOTS FEDERAL CREDIT UNION Checks Cleared 12/1/20XX 12/3/20XX Check #150 12/7/20XX Check #151 12/9/20XX Check #154 12/12/20XX Check #152 12/16/20XX Check #153 12/17/20XX Check #155 12/18/20XX Check #156 12/19/20XX Check #157 12/20/20XX Check #158 12/24/20XX 12/28/20XX Check #160 12/31/20XX Checks and Other Deposits and Debits Other Credits No. Total No. Total 12 $18,607.00 5 $48,762.00 Deposits Made $480.00 $2,300.00 $1,250.00 $1,200.00 $1,000.00 $3,000.00 $500.00 $1,200.00 $1,000.00 $6,400.00 $10,000.00 $12,500.00 $15,000.00 $10,262.00 Account Number 8900-14-124-106 Other Transactions NSF check ($ 262) EFT deposit + $1,000 Service Charge ($15) Statement Date December 31, 20XX THIS BALANCE STATEMENT $53,021.00 Daily Balance $22,866.00 $32,386.00 $30,086.00 $28,836.00 $40,136.00 $39,136.00 $36,136.00 $50,636.00 $49,436.00 $48,174.00 $59,436.00 $53,021.00 68 Project #11: Bank Reconciliation BB12/1/20XX EB12/31/20XX Fido s Food Mart-T Account CASH $22,866.00 $10,000.00 $12,500.00 $15,000.00 $10,262.00 $3,000.00 $4,500.00 $56,273.00 $480.00 $2,300.00 $1,200.00 $1,000.00 $1,250.00 $3,000.00 $500.00 $1,200.00 $1,000.00 $600.00 $6,400.00 $1,100.00 $700.00 $1,125.00 Check #150 Check #151 Check #152 Check #153 Check #154 Check #155 Check #156 Check #157 Check #158 Check # 159 Check #160 Check # 161 Check #162 Check #163 The bank statement arrived in the mail. Now, the accountant has to complete the following tasks: Required: 1. Reconcile the bank statement with the Cash T-Account. See the worksheets provided at the end of this project. 2. Record the journal entry to show the changes that need to be made to the Cash T-account. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions, and end balances. 3. Calculate the change in cash for the month of December. 4. Prepare a new Adjusted Trial Balance and highlight the accounts and amounts changed. 5. Using the Updated Trial Balance prepared in step 4, prepare the following: a. Multi-Step Income Statement b. Statement of Retained Earnings c. Classified Balance Sheet Check #163 EB12/31/20XX $56,273.00 The bank statement arrived in the mail. Now, the accountant has to complete the following tasks: Required: 1. Reconcile the bank statement with the Cash T-Account. See the worksheets provided at the end of this project. 2. Record the journal entry to show the changes that need to be made to the Cash T-account. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions, and end balances. 3. Calculate the change in cash for the month of December. 4. Prepare a new Adjusted Trial Balance and highlight the accounts and amounts changed. 5. Using the Updated Trial Balance prepared in step 4, prepare the following: a. Multi-Step Income Statement b. Statement of Retained Earnings c. Classified Balance Sheet

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Reconcilation Balance as per Cash T Account 56273 Uncleared checks 3525 Dep...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started