Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $100,000. John Shell, president of the company, has set

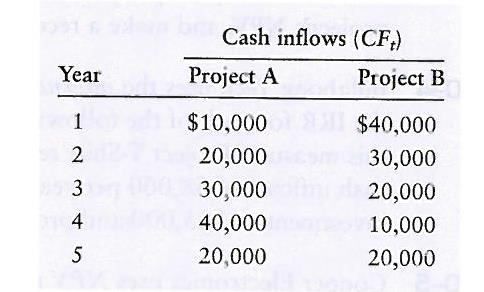

Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $100,000. John Shell, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table:

a. Determine the payback period of each project

b. Because they are mutually exclusive, Shell must choose one. Which should the company invest in?

c. Explain why one of the projects is a better than the other.

**FOR FULL POINTS YOU MUST SHOW YOUR WORK**

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started