Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shell Oil Refinery expects to pay for 100,000 barrel of crude oil at close of day on Friday, January 3 They want to hedge their

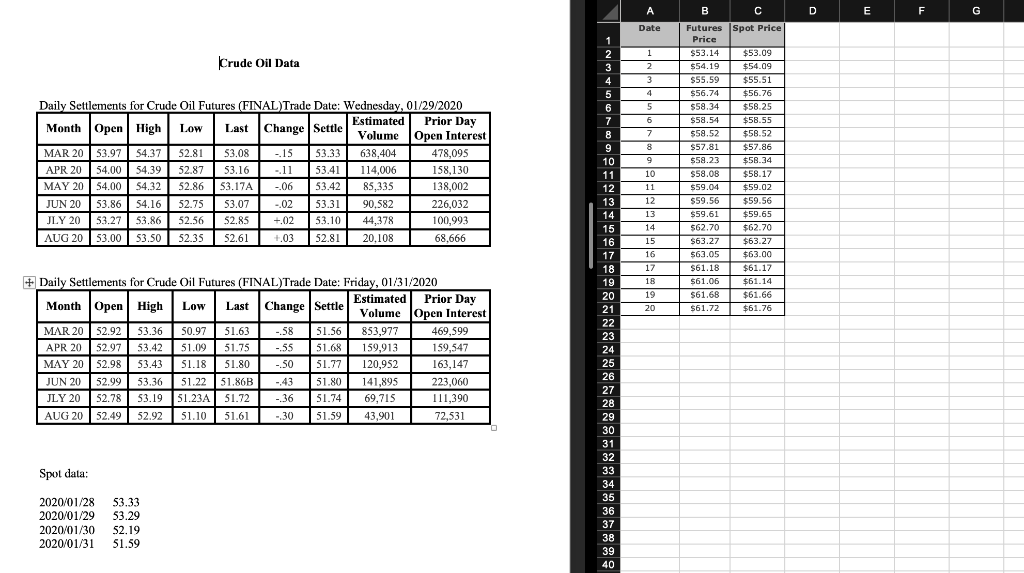

- Shell Oil Refinery expects to pay for 100,000 barrel of crude oil at close of day on Friday, January 3 They want to hedge their position with crude oil futures.Assume that they enter into the position at close of day on Tuesday, January 28. The size of one crude oil futures is 1,000 barrel. Futures and spot data is provided in the file HW2_data.doc.

- Describe the position they should enter (long or short, contract month).

- Compute the hedge ratio using data from HW2_data.xls file.

- How many contracts do they need to buy or sell?

- Document the price gain or loss every day that their position is open

everything is in the picture

E F G Date Crude Oil Data Daily Settlements for Crude Oil Futures (FINAL) Trade Date: Wednesday, 01/29/2020 Month Open High Low Last Change Settle Estimated Prior Day Volume Open Interest MAR 20 53.97 54.37 52.8153.08 -15 53.33 638,404 478,095 APR 20 54.00 54.39 52.87 53.16 -11 53.41 114,006 158,130 MAY 20 54.00 54.32 52.8653.17A -.06 53.42 85,335 138,002 JUN 20 53.8654.16 52.75 53.07 -02 53.31 90.582 226,032 JLY 20 53.27 53.8652.56 52.85 +.0253.10 44,378 100,993 AUG 20 53.00 53.50 52.3552.61 4.0352.81 20,108 68,666 Futures Spot Price Price $53.14 $53.09 $54.19 $54.09 $55.59 $55.51 $56.74 $56.76 $58.34 $58.25 $58.54 $58.55 $59.52 $58.52 $57.81 $57.86 $59.23 $58.34 $58.08 $58.17 $59.04 $59.02 $59.56 $59.56 $59.61 $59.65 $62.70 $62.70 563.27 $63.27 S63.05 $63.00 $61.18 $61.06 $61.14 $61.68 $61.66 $61.72 $61.76 10 12 13 14 16 18 18 19 20 + Daily Settlements for Crude Oil Futures (FINAL)Trade Date: Friday, 01/31/2020 Month Open High Low Last Change Settle Estimated Prior Day Volume Open Interest MAR 20 52.92 53.36 50.9751.63 -58 51.56 853,977| 469,599 APR 20 52.97 53.42 51.09 51.75 -55 51.68 159,913 159,547 MAY 20 52.98 53.43 51.1851.80 .50 51.77 120,952 163,147 JUN 20 52.99 53.36 51.2251.86B -43 51.80 141,895 223,060 JLY 20 52.78 53.19 51.23A 51.72 -36 51.74 69,715 111,390 AUG 20 52.49 52.92 51.10 51.61 -30 51.59 43,901 72,531 Spol dala: 2020/01/28 53.33 2020/01/29 53.29 2020/01/30 52.19 2020/01/3151.59 E F G Date Crude Oil Data Daily Settlements for Crude Oil Futures (FINAL) Trade Date: Wednesday, 01/29/2020 Month Open High Low Last Change Settle Estimated Prior Day Volume Open Interest MAR 20 53.97 54.37 52.8153.08 -15 53.33 638,404 478,095 APR 20 54.00 54.39 52.87 53.16 -11 53.41 114,006 158,130 MAY 20 54.00 54.32 52.8653.17A -.06 53.42 85,335 138,002 JUN 20 53.8654.16 52.75 53.07 -02 53.31 90.582 226,032 JLY 20 53.27 53.8652.56 52.85 +.0253.10 44,378 100,993 AUG 20 53.00 53.50 52.3552.61 4.0352.81 20,108 68,666 Futures Spot Price Price $53.14 $53.09 $54.19 $54.09 $55.59 $55.51 $56.74 $56.76 $58.34 $58.25 $58.54 $58.55 $59.52 $58.52 $57.81 $57.86 $59.23 $58.34 $58.08 $58.17 $59.04 $59.02 $59.56 $59.56 $59.61 $59.65 $62.70 $62.70 563.27 $63.27 S63.05 $63.00 $61.18 $61.06 $61.14 $61.68 $61.66 $61.72 $61.76 10 12 13 14 16 18 18 19 20 + Daily Settlements for Crude Oil Futures (FINAL)Trade Date: Friday, 01/31/2020 Month Open High Low Last Change Settle Estimated Prior Day Volume Open Interest MAR 20 52.92 53.36 50.9751.63 -58 51.56 853,977| 469,599 APR 20 52.97 53.42 51.09 51.75 -55 51.68 159,913 159,547 MAY 20 52.98 53.43 51.1851.80 .50 51.77 120,952 163,147 JUN 20 52.99 53.36 51.2251.86B -43 51.80 141,895 223,060 JLY 20 52.78 53.19 51.23A 51.72 -36 51.74 69,715 111,390 AUG 20 52.49 52.92 51.10 51.61 -30 51.59 43,901 72,531 Spol dala: 2020/01/28 53.33 2020/01/29 53.29 2020/01/30 52.19 2020/01/3151.59 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started