Answered step by step

Verified Expert Solution

Question

1 Approved Answer

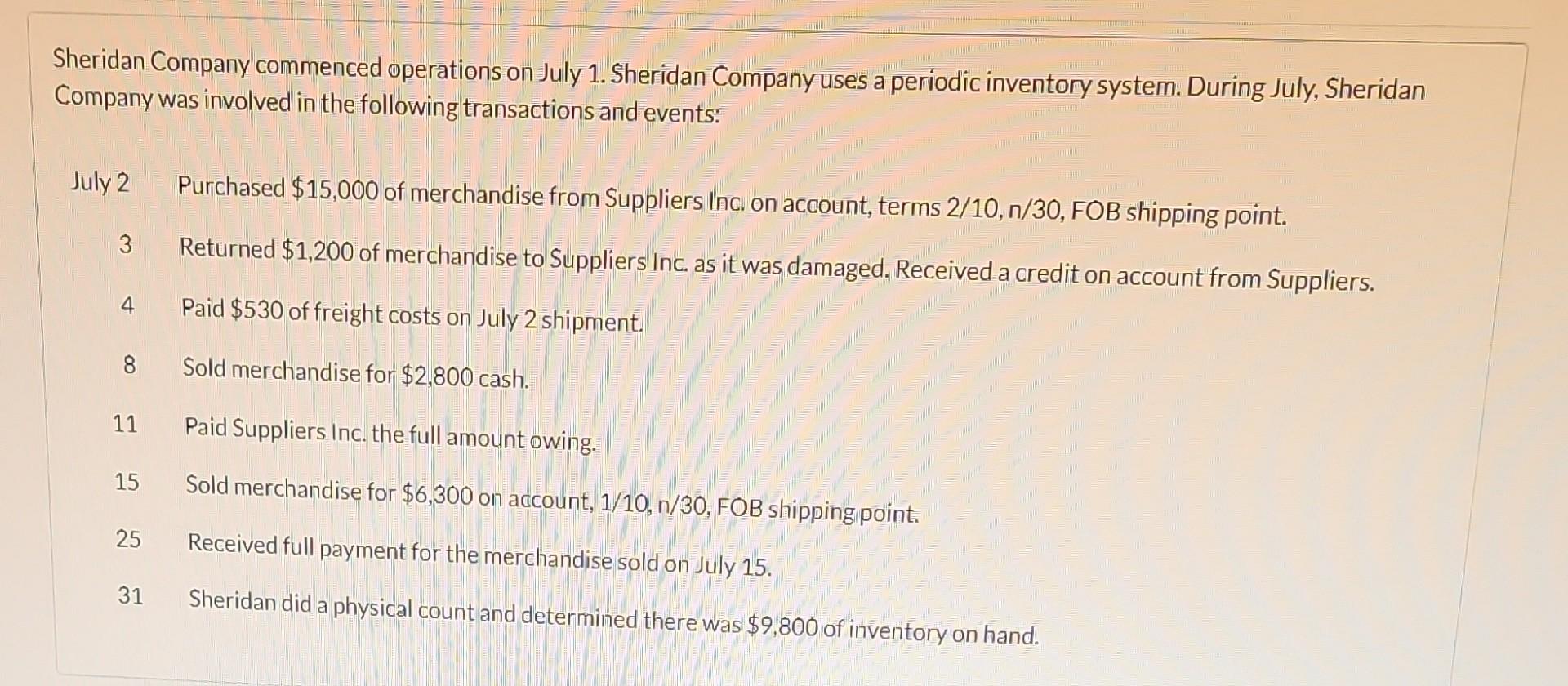

Sheridan Company commenced operations on July 1. Sheridan Company uses a periodic inventory system. During July, Sheridan Company was involved in the following transactions and

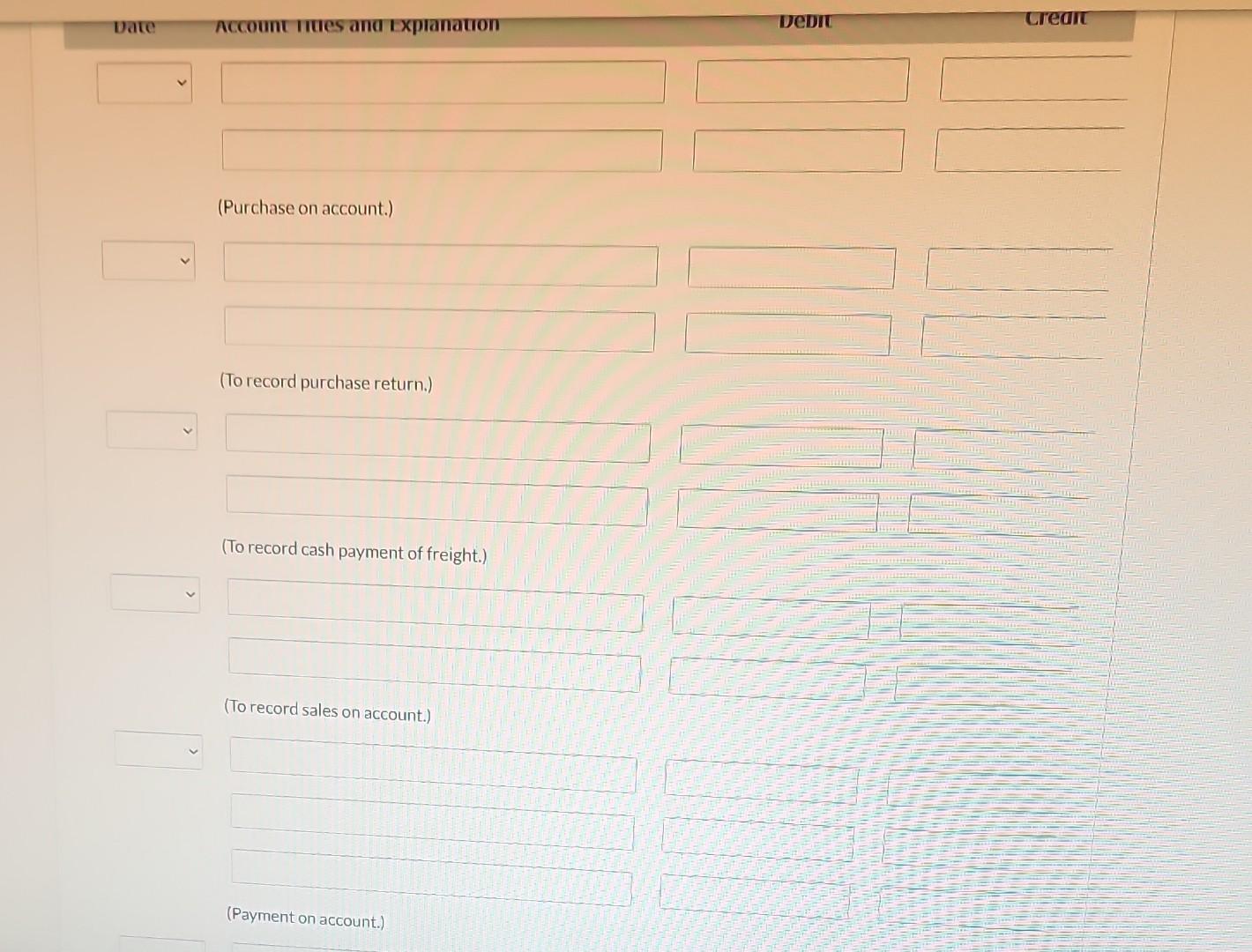

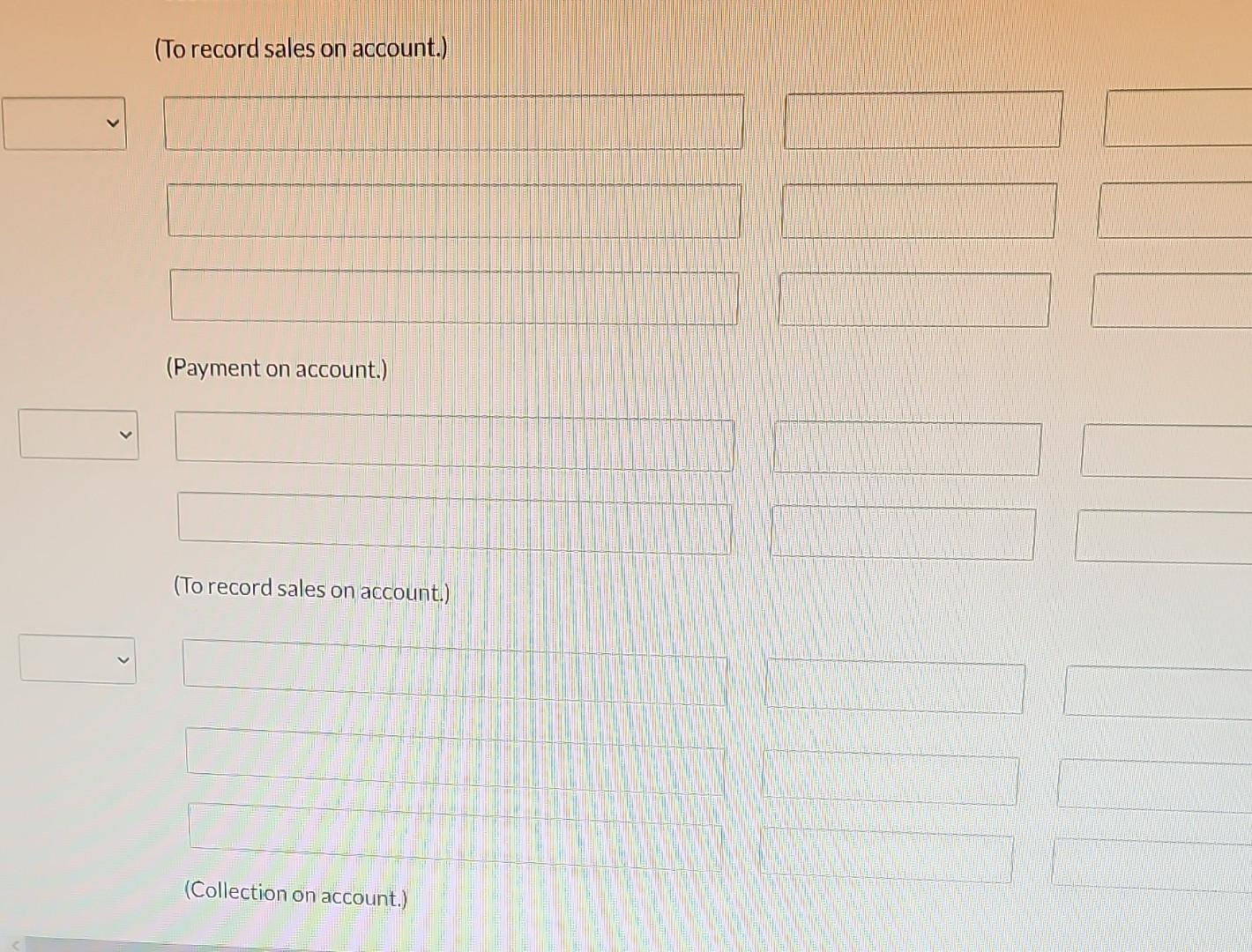

Sheridan Company commenced operations on July 1. Sheridan Company uses a periodic inventory system. During July, Sheridan Company was involved in the following transactions and events: July 2 Purchased $15,000 of merchandise from Suppliers Inc. on account, terms 2/10,n/30,FOB shipping point. 3 Returned $1,200 of merchandise to Suppliers Inc. as it was damaged. Received a credit on account from Suppliers. 4 Paid $530 of freight costs on July 2 shipment. 8 Sold merchandise for $2,800 cash. 11 Paid Suppliers Inc. the full amount owing. 15 Sold merchandise for $6,300 on account, 1/10,n/30, FOB shipping point. 25 Received full payment for the merchandise sold on July 15. 31 Sheridan did a physical count and determined there was $9,800 of inventory on hand. (Purchase on account.) (To record purchase return.) (To record cash payment of freight.) (To record sales on account.) (Payment on account.) (To record sales on account.) (Payment on account.) (To record sales on account.) (Collection on account.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started