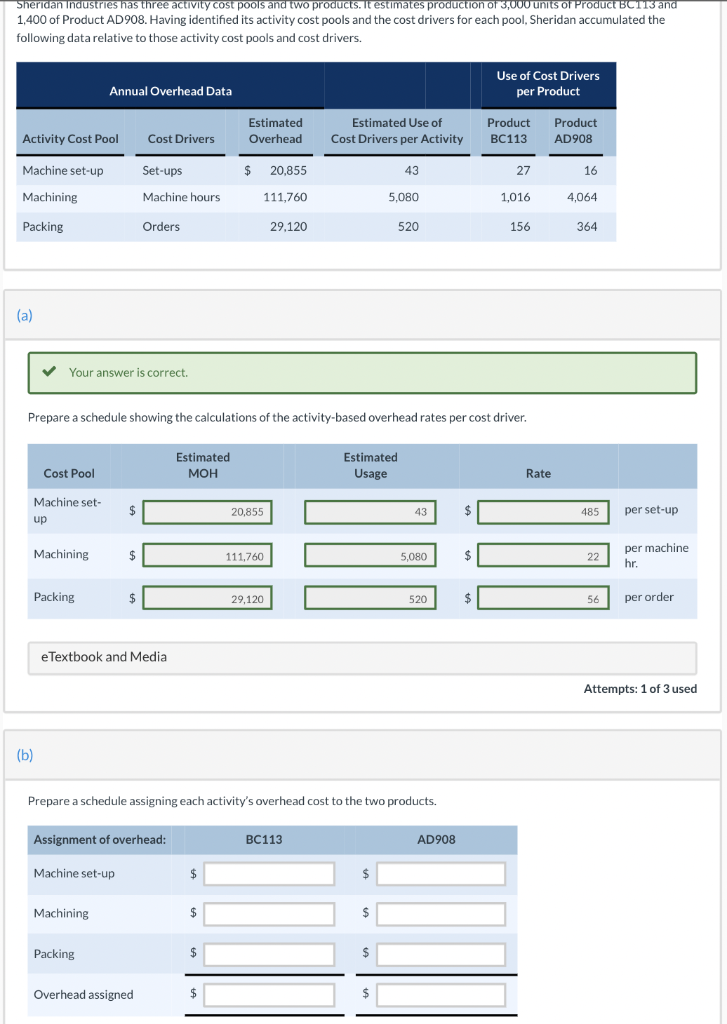

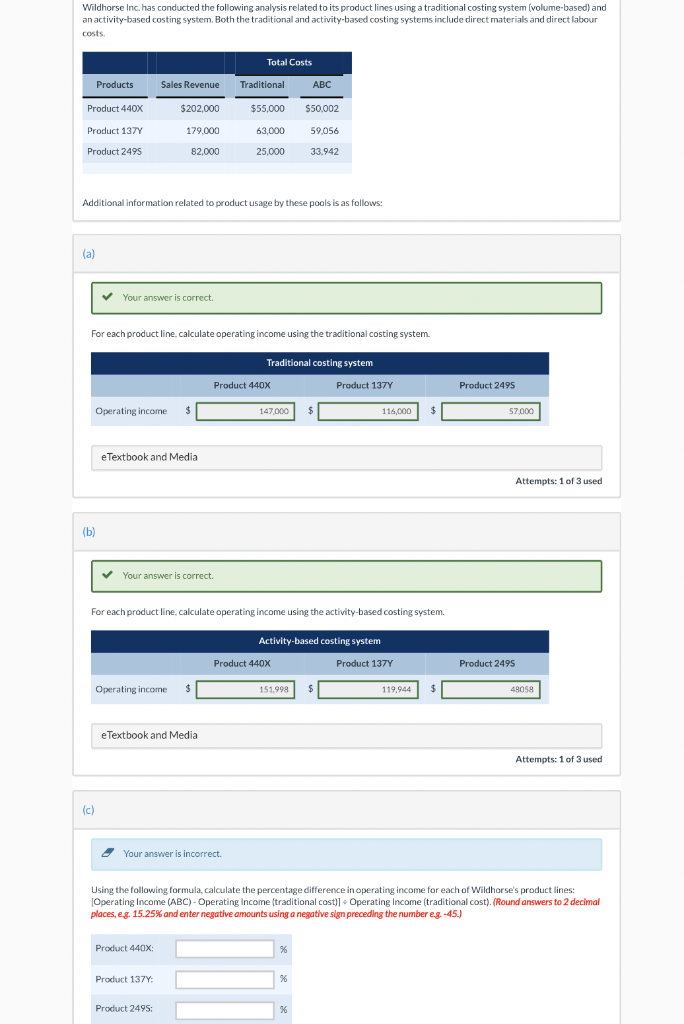

Sheridan Industries has three activity cost pools and two products. It estimates production of 3,000 units of Product BC113 and 1,400 of Product AD908. Having identified its activity cost pools and the cost drivers for each pool, Sheridan accumulated the following data relative to those activity cost pools and cost drivers. Annual Overhead Data Use of Cost Drivers per Product Estimated Overhead Estimated Use of Cost Drivers per Activity Product BC113 Product AD908 Activity Cost Pool Cost Drivers Machine set-up Set-ups $ 20,855 43 27 16 Machining Machine hours 111,760 5.080 1,016 4,064 Packing Orders 29,120 520 156 364 (a) Your answer is correct. Prepare a schedule showing the calculations of the activity-based overhead rates per cost driver. Estimated MOH Estimated Usage Cost Pool Rate Machine set. up $ 20,855 43 485 per set-up Machining $ 111.760 5,080 $ 22 per machine hr. Packing $ 29,120 520 $ 56 per order e Textbook and Media Attempts: 1 of 3 used (b) Prepare a schedule assigning each activity's overhead cost to the two products. Assignment of overhead: BC113 AD908 Machine set-up - $ $ Machining $ $ Packing $ $ Overhead assigned $ Wildhorse Inc. has conducted the following analysis related to its product lines using a traditional costing system (volume-based) and an activity-based costing system. Both the traditional and activity-based costing systems include direct materials and direct labour costs. Total Costs Products Sales Revenue Traditional ABC Product 440X $202,000 $55.000 $50,002 Product 1377 63,000 59,056 179.000 82.000 Product 2495 25,000 33.942 Additional information related to product usage by these pools is as follows: (a) Your answer is correct For each product line, calculate operating income using the traditional costing system , Traditional costing system Product 440X Product 137Y Product 2495 Operating income 147,000 116,000 $ 57.000 e Textbook and Media Attempts: 1 of 3 used (b) Your answer is correct . For each product line, calculate operating income using the activity-based costing system. Activity-based costing system Product 440X Product 137Y Product 2495 Operating income $ 151,998 119,944 $ 48058 e Textbook and Media Attempts: 1 of 3 used : 1 (c) c Your answer is incorrect. Using the following formula, calculate the percentage difference in operating income for each of Wildhorse's product lines: (Operating Income (ABC) - Operating Income (traditional cost)) - Operating Income (traditional cost). (Round answers to 2 decimal places, eg. 15.25% and enter negative amounts using a negative sign preceding the number eg -45.) Product 440x: %6 Product 137Y: Product 2495: 56