Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sherrod, Incorporated, reported pretax accounting income of $ 6 4 million for 2 0 2 4 . The following information relates to differences between pretax

Sherrod, Incorporated, reported pretax accounting income of $ million for The following information relates to

differences between pretax accounting income and taxable income:

a Income from installment sales of properties included in pretax accounting income in exceeded that reported for

tax purposes by $ million. The installment receivable account at yearend had a balance of $ million

representing portions of and installment sales expected to be collected equally in and

b Sherrod was assessed a penalty of $ million by the Environmental Protection Agency for violation of a federal law in

The fine is to be paid in equal amounts in and

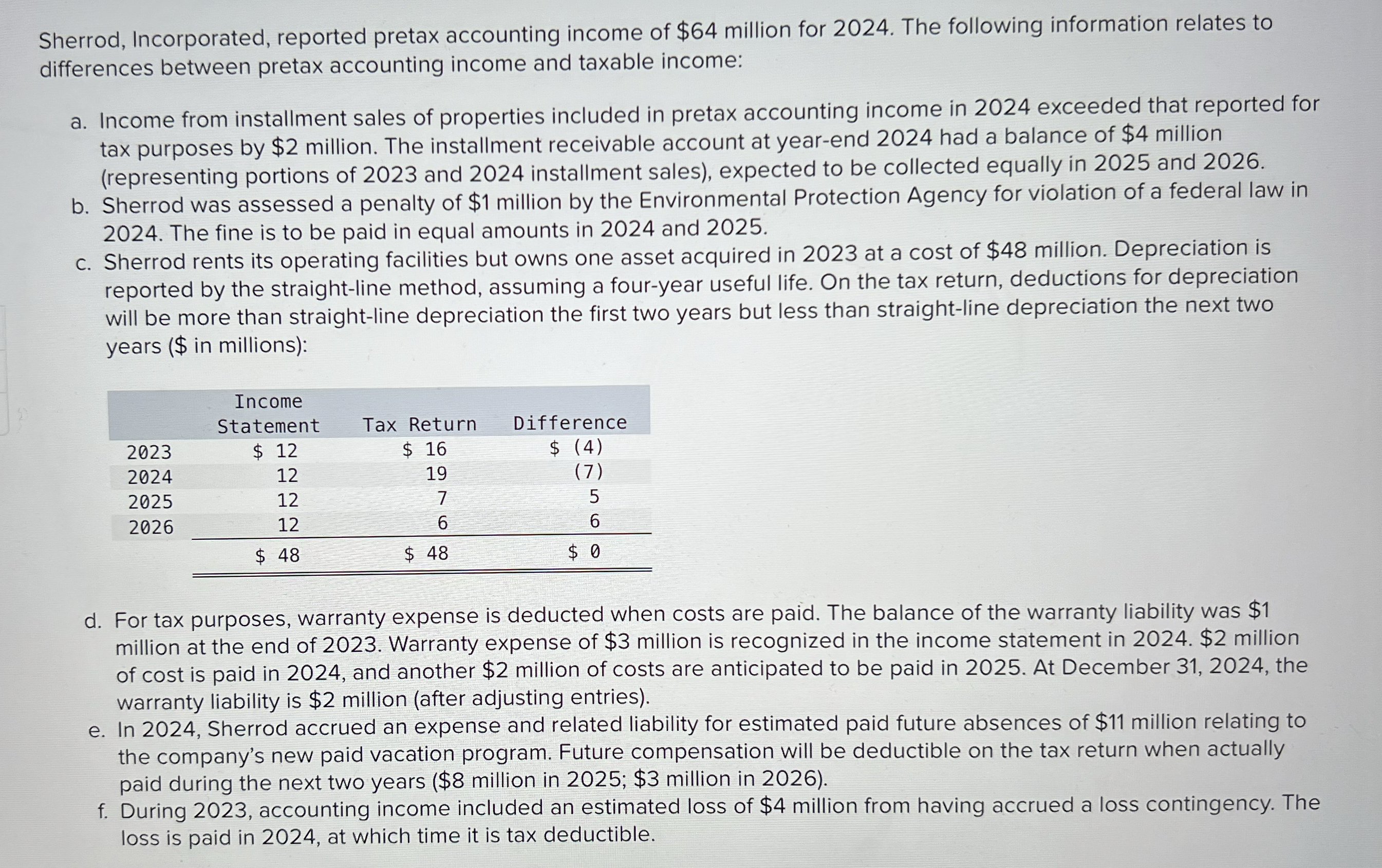

c Sherrod rents its operating facilities but owns one asset acquired in at a cost of $ million. Depreciation is

reported by the straightline method, assuming a fouryear useful life. On the tax return, deductions for depreciation

will be more than straightline depreciation the first two years but less than straightline depreciation the next two

years $ in millions:

d For tax purposes, warranty expense is deducted when costs are paid. The balance of the warranty liability was $

million at the end of Warranty expense of $ million is recognized in the income statement in $ million

of cost is paid in and another $ million of costs are anticipated to be paid in At December the

warranty liability is $ million after adjusting entries

e In Sherrod accrued an expense and related liability for estimated paid future absences of $ million relating to

the company's new paid vacation program. Future compensation will be deductible on the tax return when actually

paid during the next two years $ million in ; $ million in

f During accounting income included an estimated loss of $ million from having accrued a loss contingency. The

loss is paid in at which time it is tax deductible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started