Answered step by step

Verified Expert Solution

Question

1 Approved Answer

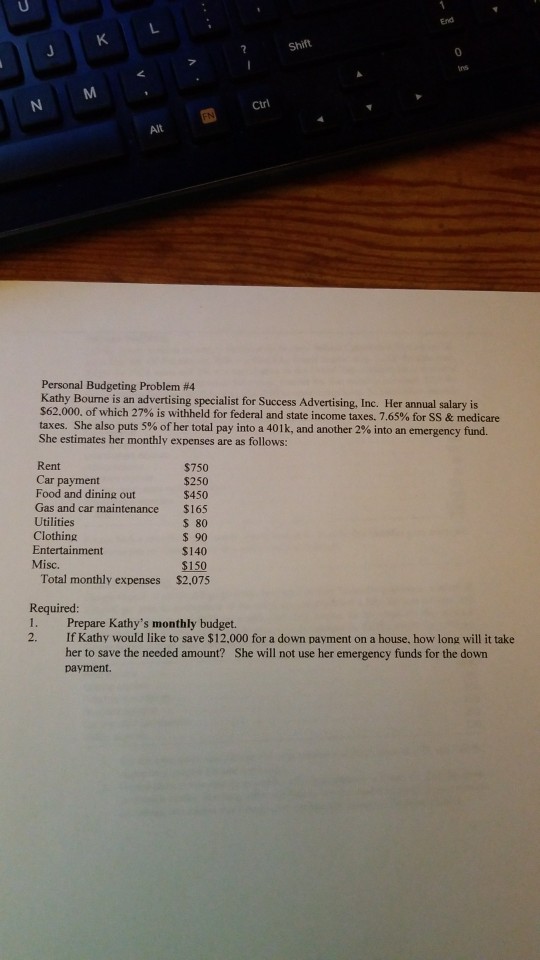

Shift curl Alt Personal Budgeting Problem #4 Kathy Bourne is an advertising specialist for Success Advertising, Inc. Her annual salary is $62,000, of which 27%

Shift curl Alt Personal Budgeting Problem #4 Kathy Bourne is an advertising specialist for Success Advertising, Inc. Her annual salary is $62,000, of which 27% is withheld for federal and state income taxes. 7.65% for SS & medicare taxes. She also puts 5% of her total pay into a 401k, and another 2%into an emergency fund. She estimates her monthly expenses are as follows: Rent Car payment Food and dining out Gas and car maintenance Utilities Clothing Entertainment Misc. $750 $250 $450 $165 S 80 $ 90 $140 150 $2.075 Total monthly expenses Required 1. Prepare Kathy's monthly budget. 2. If Kathy would like to save $12,000 for a down payment on a house, how long will it take her to save the needed amount? payment. She will not use her emergency funds for the down

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started