Answered step by step

Verified Expert Solution

Question

1 Approved Answer

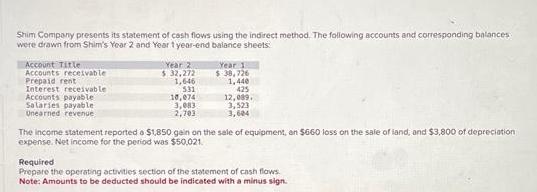

Shim Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Shim's Year 2

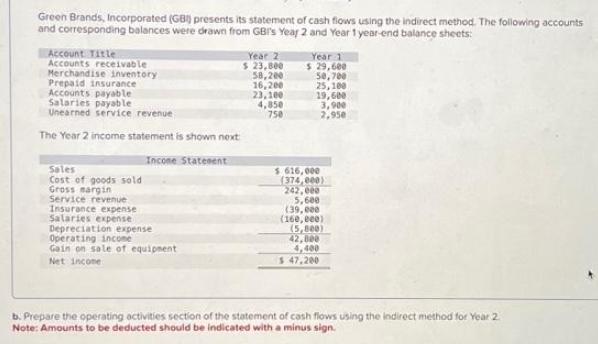

Shim Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Shim's Year 2 and Year 1 year-end balance sheets: Account Title Accounts receivable Prepaid rent Interest receivable Accounts payable Salaries payable Unearned revenue Year 2 $ 32,272 1,646 531 10,074 3,083 2,703 Year 1 $:38,726 1,440 425 12,089. 3,523 3,604 The income statement reported a $1,850 gain on the sale of equipment, an $660 loss on the sale of land, and $3,800 of depreciation expense. Net income for the period was $50,021. Required Prepare the operating activities section of the statement of cash flows. Note: Amounts to be deducted should be indicated with a minus sign. Green Brands, Incorporated (GB) presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from GBI's Year 2 and Year 1 year-end balance sheets: Account Title Accounts receivable Merchandise inventory Prepaid insurance Accounts payable Salaries payable Unearned service revenue The Year 2 income statement is shown next Income Statement Sales Cost of goods sold Gross margin Service revenue Insurance expense Salaries expense Depreciation expense Operating income Gain on sale of equipment Net Income Year 2 $ 23,800 58,200 16,200 23,100 4,850 750 Year 1 $ 29,600 50,700 25,100 19,600 3,900 2,950 $ 616,000 (374,000) 242,000 5,600 (39,000 (160,000) (5,000) 42,000 4,400 $ 47,200 b. Prepare the operating activities section of the statement of cash flows using the indirect method for Year 2 Note: Amounts to be deducted should be indicated with a minus sign.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculations Net Income 50021 Adjustments to reconcile net income to net cash provided by operating activities Add Depreciation Expense 3800 Add Los...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started